Canada’s launch of the first-ever spot XRP ETF in North America may serve as a major catalyst for the US Securities and Exchange Commission (SEC) to consider approving a similar product. Here are the key reasons why this scenario is becoming increasingly likely.

Canada Takes the Lead with North America’s First Spot XRP ETF

Asset management firm Purpose Investments — overseeing more than $24 billion in assets under management — is set to list the first spot XRP ETF on the Toronto Stock Exchange (TSX) on June 18. The ETF will be traded under three ticker symbols: XRPP (CAD-hedged), CRPP.B (CAD non-hedged), and XRPP.U (USD-denominated).

This product allows Canadian investors to hold XRP within registered accounts such as Tax-Free Savings Accounts (TFSAs) and Registered Retirement Savings Plans (RRSPs).

With this move, Canada is asserting itself as a leader in regulated crypto investment products, challenging the US and former President Donald Trump’s ambitions to make “crypto made in America.” While delays in the SEC’s regulatory process are causing the US to lag behind, experts believe it won’t be long before it catches up.

Could the US Be Next to Approve a Spot XRP ETF?

Several major US ETF issuers, including Franklin Templeton and Bitwise, are currently awaiting SEC decisions on their spot XRP ETF applications. Despite recent delays, analysts remain optimistic about potential approval by 2025.

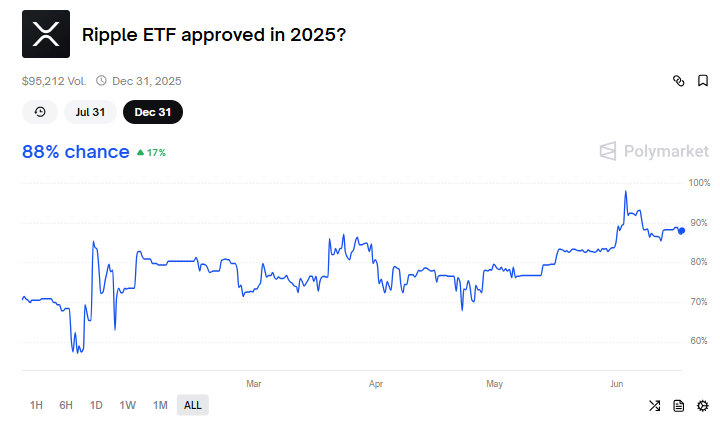

According to Bloomberg analysts, there’s an 85% chance that the SEC will approve a Ripple ETF in Q4 of this year. Polymarket — a decentralized prediction platform — shows even higher odds, with an 88% chance of approval. At one point, this number reached 98%, though it has since dipped slightly due to rising interest in a potential spot Solana ETF.

The approval of Purpose Investments’ XRP ETF in Canada could put additional pressure on the SEC to follow suit. Furthermore, several leveraged ETF products based on XRP are already trading, adding to the momentum.

The biggest remaining hurdle is the ongoing Ripple vs. SEC lawsuit, but that case appears to be nearing its conclusion. This adds further confidence to the outlook, though the exact timeline for a final SEC decision remains uncertain.