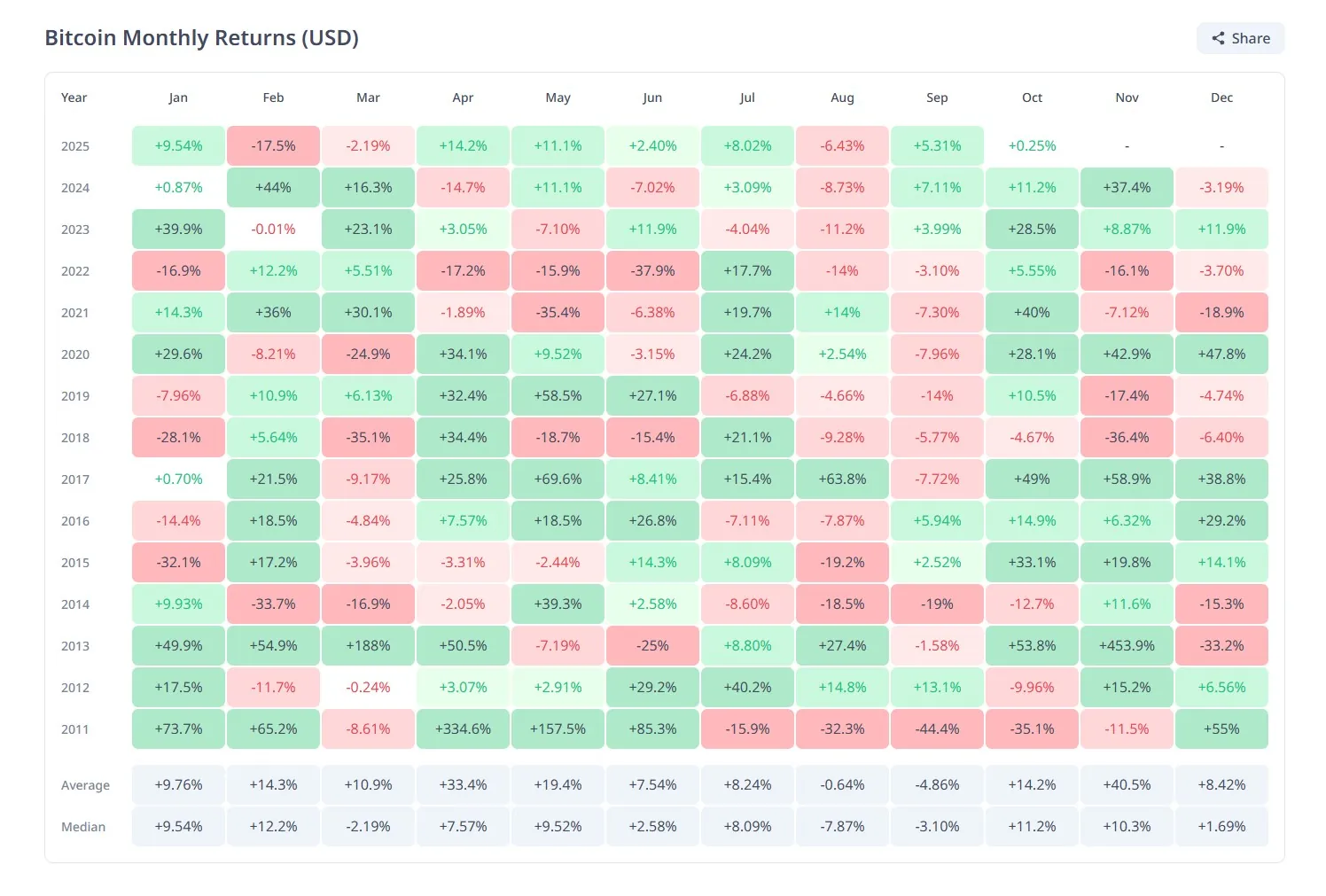

Historical data shows that Bitcoin has posted gains in nine out of the past ten Octobers. In standout years like 2017 and 2021, BTC surged 50% and 40%, respectively. Iliya Kalchev, an analyst at Nexo, said this record underpins the legend of Uptober.

Analysts at Compass Point added that such rallies are often amplified by September’s weakness, making the rebound look even stronger. Yet, this year’s “Red September” failed to appear. Instead, Bitcoin rose nearly 5% in September, boosting optimism for October.

The Uptober phenomenon reflects how seasonal cycles shape financial markets, much like the “Santa Claus rally” in equities. Partly driven by seasonal flows as funds rebalance in Q4, Uptober has also become a cultural meme within crypto circles. Across social media, traders rally around the idea, with many declaring, “We need Uptober after months of pain.”

Still, not everyone buys into the hype. Jake Kennis, senior analyst at Nansen, warned that Uptober is “more community psychology than trading strategy.” While retail traders may be influenced by memes, professional investors typically anchor decisions in macro factors, liquidity, and technicals.

That said, upbeat sentiment can still have a real impact. KuCoin Ventures noted that while Uptober doesn’t form the basis of its investment thesis, investor optimism can trigger self-fulfilling momentum as capital flows into the market.

Other experts see tangible tailwinds this year. A Bitfinex analyst highlighted that October brings unique support: the Federal Reserve has shifted toward easing, U.S. spot Bitcoin ETFs are absorbing more than $150 million in daily inflows, and BTC has held above the key $110,000 support despite record-sized options expiries.

Even so, macro risks remain unpredictable. Fed policy shifts, geopolitical tensions, and developments in the Middle East could all disrupt any bullish momentum.

In the end, history favors Uptober, but crypto markets are inherently volatile. “Whether October turns green or red will depend less on superstition and more on how economic and political forces play out,” Kalchev at Nexo remarked. “Still, betting against Bitcoin in October has rarely been wise.”