Investors are hopeful that Bitcoin will rally following the U.S. Senate’s approval of a $5 trillion debt ceiling hike. However, historical data paints a more cautious picture.

On July 2, former President Donald Trump’s “Big Beautiful Bill” passed a key vote in the Senate, moving closer to becoming law. A major highlight of the bill is the proposed $5 trillion increase in the national debt ceiling — a controversial move that some believe could boost risk assets like Bitcoin.

But history suggests otherwise. Previous instances of debt ceiling hikes or suspensions in the U.S. have often been followed by Bitcoin price declines, typically within the six months that follow. One rare exception was in June 2023, when BTC posted a significant gain. Currently, despite widespread optimism, Bitcoin remains stagnant around $105,000 — a level it has held for nearly five months.

Some analysts argue that markets have already priced in the news. Yet, Bitcoin’s modest price movement suggests otherwise, especially given the political backing for the bill in recent weeks.

Adding to the mix, Trump also announced a new trade agreement between the U.S. and Vietnam on the same night. Under the deal, Vietnamese goods will face a 20% tariff when entering the U.S., while transshipped goods from China passing through Vietnam will be taxed at 40%. In return, Vietnam will fully open its market to U.S. goods with zero tariffs. Trump emphasized, “They’ve never done this before.”

The announcement comes just days ahead of the July 9 deadline, when Trump could reimpose retaliatory tariffs. The move poses a serious risk to Vietnam, where exports to the U.S. accounted for nearly 30% of GDP last year. In 2024 alone, the U.S. trade deficit with Vietnam reached $123.5 billion — a figure Trump cites as proof of an unfair trade relationship.

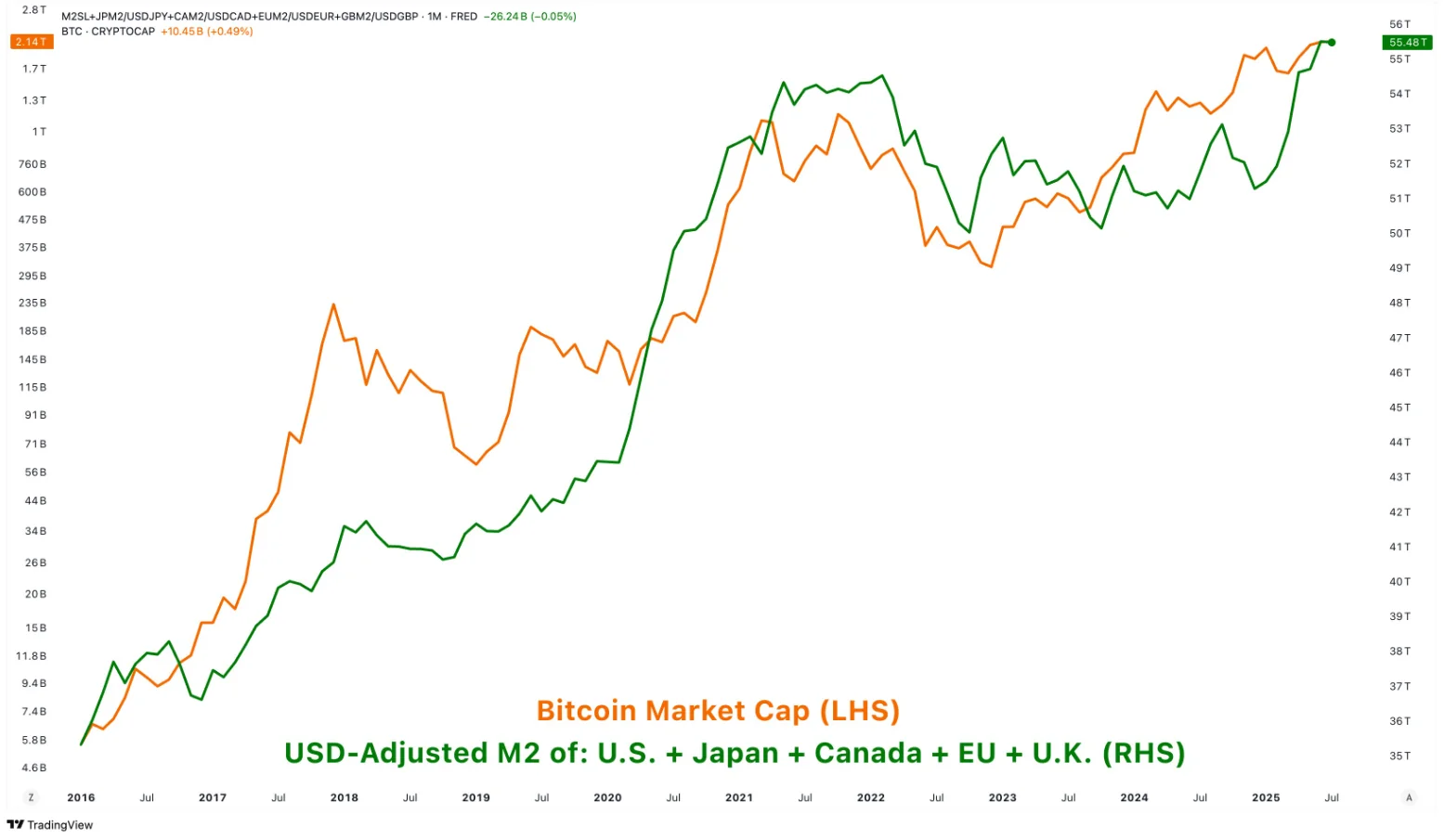

Meanwhile, global macroeconomic conditions are offering new tailwinds for Bitcoin. As of July 2, the global M2 money supply — covering the U.S., Eurozone, Japan, the U.K., and Canada — hit a record high of $55.48 trillion. At the same time, the U.S. dollar is experiencing its weakest first half of the year in over 50 years.

Bitcoin typically reacts positively to increases in M2, with a lag of three to six months. However, the breakout above $100,000 in April 2025 happened within just one to two weeks, suggesting the current rally may be fueled more by real liquidity than by short-term speculation. This strengthens the belief that Bitcoin’s recent momentum is supported by clear macroeconomic factors rather than hype alone.