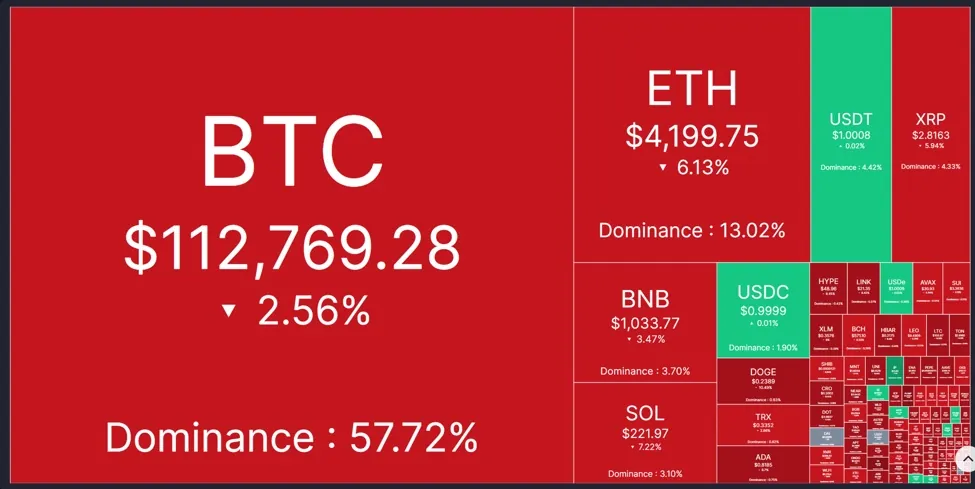

The cryptocurrency market kicked off the new week deep in the red as major coins tumbled simultaneously. Bitcoin (BTC) and Ethereum (ETH) spearheaded the decline, dragging the entire market down to multi-week lows. The collapse of key technical levels, coupled with aggressive profit-taking, has left investor sentiment extremely cautious.

Data shows that the total market capitalization wiped out $77 billion in Monday’s trading session, while more than 400,000 traders were liquidated, with combined losses exceeding $1.7 billion. Fear now dominates the market as investors begin to restructure their portfolios ahead of month-end.

Why Is Crypto Falling?

Analysts point to several macroeconomic factors behind the latest selloff. Although the U.S. Federal Reserve cut interest rates to 4.00 – 4.25% last week, Fed Chair Jerome Powell’s cautious stance on inflation has dampened hopes for an aggressive easing cycle.

Joel Kruger, FX and crypto strategist at LMAX Group, explained:

“The market tone has turned more cautious. Investors appear to be shifting into Bitcoin as a safer asset, while Ethereum and altcoins face heavy selling pressure. At the same time, September’s impressive rally has triggered profit-taking, given that the month is historically one of Bitcoin’s weakest.”

Upcoming economic data is also in focus. Investors are closely watching the PCE inflation report and a slew of Fed commentary this week, both of which could reshape interest rate expectations and liquidity conditions.

Short-Term Outlook Remains Gloomy

The current downturn has dragged many coins to their lowest levels in over a month, extending losses for four and, in some cases, five consecutive sessions. The entire market is painted in red on CoinMarketCap’s heatmap, underscoring widespread panic.

Without fresh macro catalysts, analysts warn that the crypto market may remain under pressure in the short term before finding a stable footing.