In the latest trading session, Bitcoin slipped below $113,000 — its lowest level in more than two weeks — triggering $113 million in leveraged long positions to be liquidated. Notably, this plunge came just days after BTC set a new all-time high of $124,176, raising doubts over whether the bull cycle has ended amid a worsening macroeconomic backdrop.

SEC Investigation and AI “Letdowns”

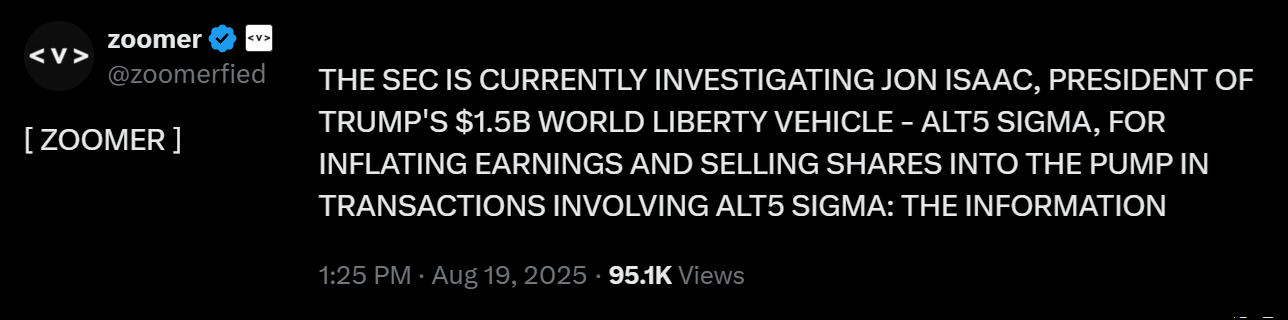

Selling pressure intensified following reports that the U.S. Securities and Exchange Commission (SEC) is investigating fraud and stock manipulation at Alt5 Sigma — a company that recently signed a $1.5 billion partnership with World Liberty Financial, a financial venture closely linked to former U.S. President Donald Trump.

World Liberty raised around $550 million through two public token offerings, branding itself as a DeFi and stablecoin platform. Trump disclosed earnings of $57.4 million from his stake in the project, while his son, Eric Trump, is set to join Alt5 Sigma’s board.

Investor sentiment was further dampened after the Nasdaq 100 slid 1.5%, following an MIT NANDA study. Based on 150 corporate interviews and 300 public AI deployments, the report revealed that 95% of companies failed to generate rapid revenue growth from artificial intelligence pilot programs.

Import Tariffs, Rising Gold, and Fed Skepticism

Another factor fueling risk aversion was the U.S. decision to impose new 50% tariffs on 407 aluminum- and steel-related products — including car parts, plastics, and specialty chemicals. Economists warned that such measures could disrupt supply chains and drive consumer prices higher.

Meanwhile, UBS raised its gold price forecast to $3,700 per ounce by September 2026. The bank expects gold to benefit from below-trend economic growth, Federal Reserve easing, and a weaker dollar. Mounting U.S. fiscal deficit concerns and questions over the Fed’s independence further reinforce this bullish outlook for gold.

Derivatives Market Signals Fear

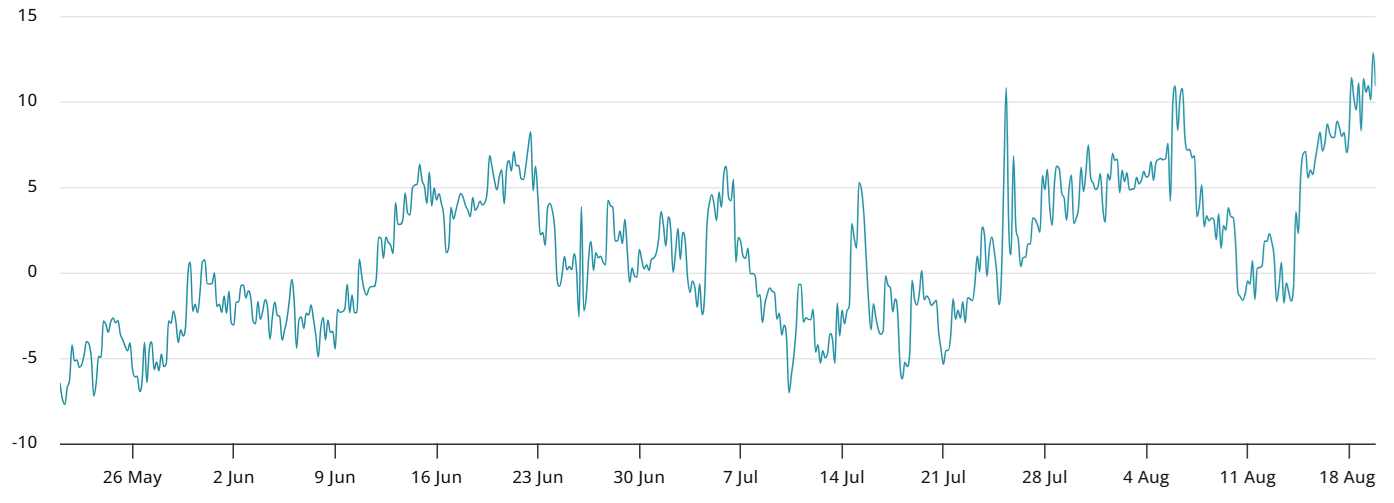

Demand for downside protection in Bitcoin derivatives surged as the 30-day options delta skew (put-call spread) jumped to 12% — its highest level in more than four months. Normally, this indicator fluctuates between -6% and +6%. A reading above 10% signals extreme fear.

A similar situation occurred on April 7, when Bitcoin fell below $74,500. Yet within just one month, BTC rebounded by 40%, reaching $104,150 on May 8.

Despite the cloud of fear, there is no solid evidence suggesting that Bitcoin’s bull run has ended. Panic often overshoots reality. In fact, Bitcoin could even benefit from potential capital outflows from equities, reinforcing the cryptocurrency’s long-term bullish outlook.