Bitcoin (BTC) slipped to around $86,000 on Sunday as global markets shifted into a risk-off mode, despite the U.S. dollar weakening amid fears of Japanese currency intervention and stress in the bond market. This move is challenging the long-held belief that a falling dollar automatically lifts Bitcoin, as capital is instead rotating into gold and silver.

The divergence highlights where investors are currently seeking protection and why Bitcoin is trading more like a risk asset than a hedge while confidence in fiat currencies wavers.

Weak Dollar Fails to Lift Bitcoin

Market observers note that the recent decline in the dollar has not pushed Bitcoin higher. Instead, capital is flowing decisively into traditional safe-haven assets.

In a January 26 analysis, CryptoQuant contributor GugaOnChain said dollar weakness only supports Bitcoin in specific environments, such as high inflation or easy liquidity. When fear dominates and investors prioritize preserving capital, they tend to favor assets with long-established store-of-value roles, especially gold.

He explained that if a currency’s devaluation comes from a crisis of confidence and extreme risk aversion — as seen now with rumors of yen intervention and broader geopolitical stress — cryptocurrencies often fall alongside equities.

“Investors are not chasing returns; they are protecting purchasing power as confidence in other areas deteriorates rapidly,” market observer Daniel Tschinkel noted.

He also pointed out that physical gold is trading at elevated premiums in parts of Asia, signaling strong real demand beyond paper markets.

Gold and Silver Capital While Bitcoin Lags

Capital inflows into precious metals have surged. According to The Kobeissi Letter, gold’s market capitalization has reached a record $35 trillion, while silver’s stands near $6 trillion.

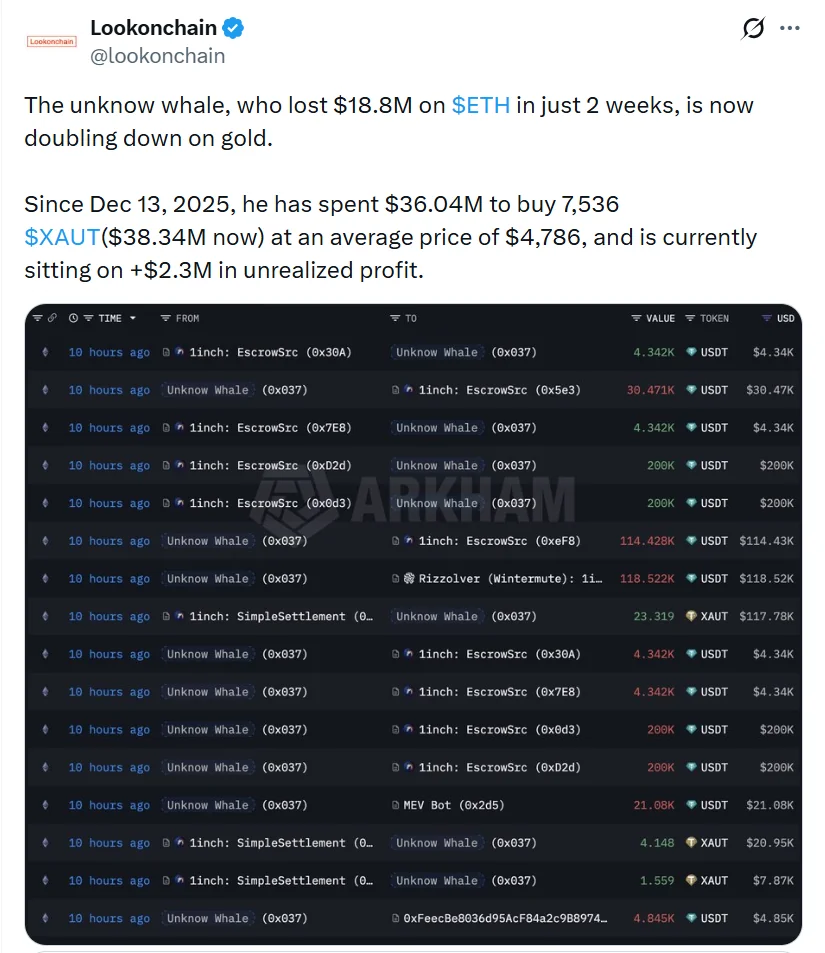

At the same time, funds are rotating away from crypto. On-chain analytics firm Lookonchain reported that an investor who lost $18.8 million on Ethereum in two weeks later spent more than $36 million buying a gold-backed token since December and is now sitting on over $2 million in unrealized profit.

The performance gap is also striking. Analyst Ash Crypto showed that a $100,000 investment one year ago would now be worth:

-

$180,000 in gold

-

$342,000 in silver

-

Only $85,900 in Bitcoin

Trader Ted Pillows added that Bitcoin is down about 56% versus gold since December 2024, with the monthly RSI for the BTC/gold pair at its lowest level on record.

Overall, the current landscape suggests that as long as macroeconomic fear continues to drive investors into physical metals, Bitcoin’s narrative as a “digital safe haven” faces a serious test.

As GugaOnChain concluded:

“For BTC to thrive, U.S. dollar weakness must come from risk appetite — not from fear.”