Institutional Giants Embrace Ethereum Opportunities

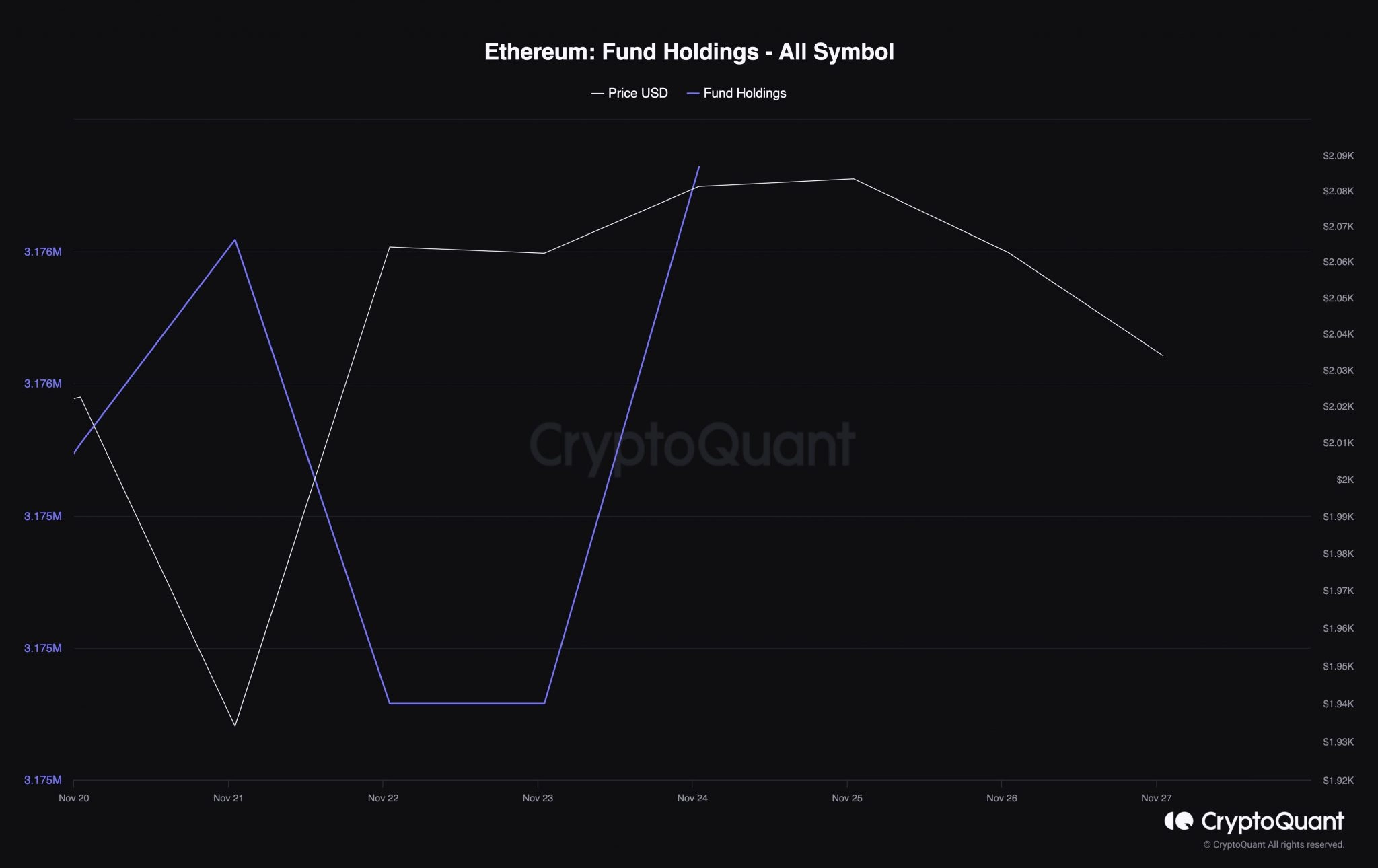

The sentiment among Ethereum’s institutional investors has shifted from cautious optimism to robust confidence, with funds pouring into Ethereum trusts and ETFs steadily rising since November 23rd. As of the latest data from CryptoQuant, Ethereum Funds Holdings have surged to 3.17 million.

This metric upswing underscores the escalating demand from institutional investors seeking exposure to the altcoin. Notably, influential figures in the crypto space, such as Woominkyu, a verified author on CryptoQuant, have also echoed this market sentiment.

Going beyond surface-level analysis, Woominkyu delved into the impact of this influx on Ethereum’s price dynamics. The analyst observed, “This surge coincides with Ethereum’s price stabilization between $1.8K and $1.9K USD, signaling a heightened interest from institutional investors. It reflects their unwavering confidence in Ethereum’s long-term value and the market’s growth potential.”

Moreover, the sustained bullish outlook may also be tied to the optimism surrounding the potential approval of a spot ETF. However, this optimism is not solely driven by regulatory expectations; other factors come into play. One key factor is Ethereum’s notable transition to Proof-of-Stake (PoS), commonly referred to as the Merge. Consensys, in a blog post from the previous year, foresaw the potential impact of the Merge on institutional inflows, contributing to the ongoing positive sentiment.

Several factors contribute to the renewed confidence among institutional investors in Ethereum. One such factor is the enhanced security protocols, instilling greater trust in investors regarding the safeguarding of their funds.

Related: Ethereum Whales Strong Buy, Exchange Supply Continuously Diminishing

Another noteworthy element is the implementation of a deflationary supply mechanism, which mitigates the risk of ETH plummeting to zero. A prominent Ethereum-powered software company emphasized the potential attractiveness of ETH to institutions, citing that the reduced supply could lead to an increase in its overall value.

Belief is Back

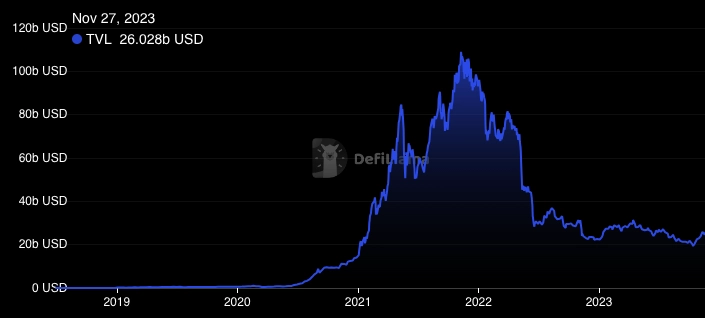

The Shapella upgrade, activated in April, further solidified the faith of major investors in Ethereum. This sentiment aligns with the increasing Total Value Locked (TVL) in Ethereum, reaching $26.02 billion at present—a substantial 19.31% surge over the last 30 days. A continued rise in this metric could attract both retail and institutional investors, seeking potential long-term gains.

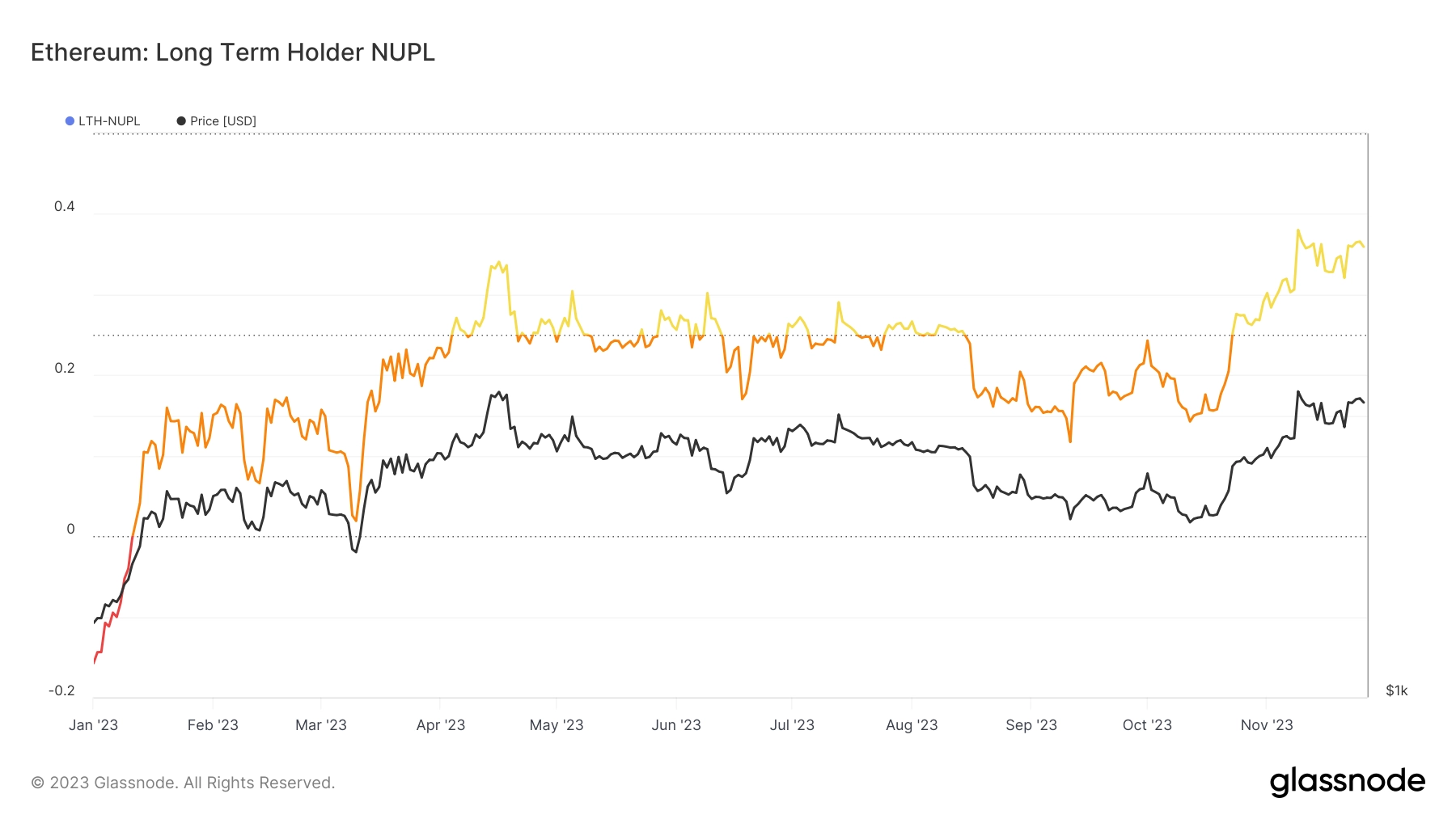

Examining the Long-Term Holder Net Unrealized Profit and Loss (LTH-NUPL) reveals a positive shift in market sentiment from hope (depicted in orange) to optimism (depicted in yellow). This indicator reflects the behavior of long-term holders, indicating that holders are no longer gripped by fear. Instead, a prevailing belief in the significant future potential of ETH has taken hold.

A close watch on the market dynamics suggests that if the ETH price surpasses $2,000 in the upcoming weeks, the LTH-NUPL may transition to the belief stage. This transition could trigger substantial accumulation, potentially fueling an extended rally for Ethereum.