Why Chainlink’s (LINK) Path to $20 Hinges on Sustaining Crucial Support Levels

Chainlink (LINK) has undergone a 7.6% retracement from its yearly peak of $16.7 on November 11. Despite finding robust support around $15, there are indications that momentum is gathering for another upward surge.

The Chainlink network is in the midst of a substantial expansion, with prominent investors demonstrating a steadfast commitment to retaining their LINK tokens.

Sustained Interest in LINK

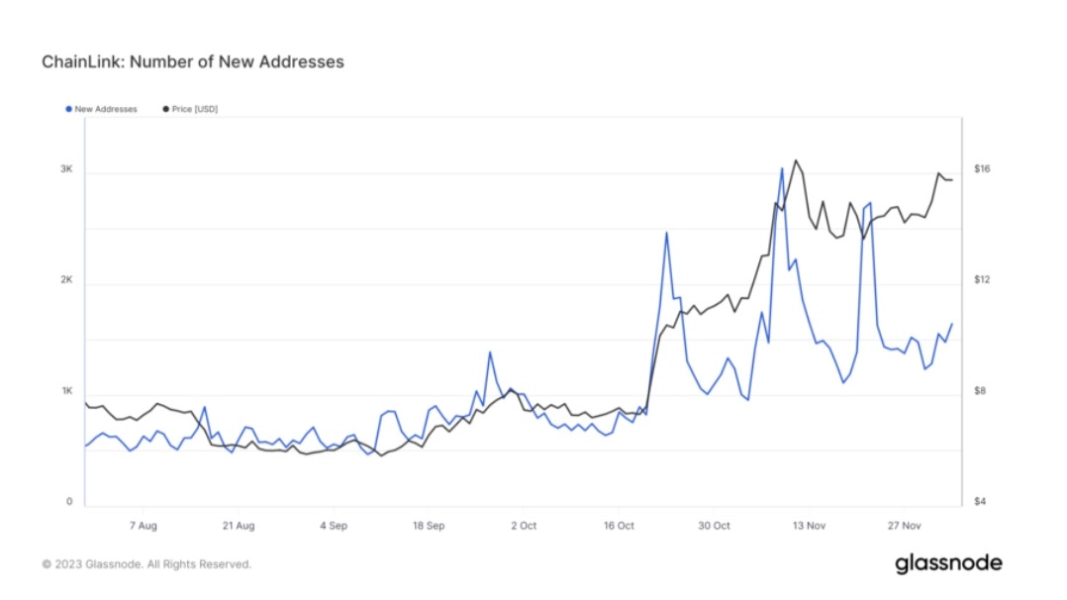

The growth of the Chainlink network has been remarkable. Since early September, the daily influx of new and unique addresses engaging in transactions has consistently shown an upward trajectory, marking both higher highs and higher lows.

This figure has surged from a low of 467 new addresses per day to an impressive 3,044, reflecting a remarkable 650% increase over three months. Such consistent and substantial user adoption suggests the potential for future price escalations.

This heightened demand is further underscored by the activities of crypto whales. Between November 28 and November 29, these significant players acquired over 9.6 million LINK, equivalent to approximately $143.3 million in value.

Despite a subsequent sale of about 2.5 million LINK, contributing to the recent corrective price movement, the whales still retain a substantial holding of around 186.2 million LINK.

The sustained vibrancy in network activity and the unwavering commitment of major players in the crypto space underpin the impressive bullish trend that Chainlink has experienced in recent months. As the cryptocurrency strives to break through the $20 mark, maintaining crucial support levels becomes paramount in navigating the evolving market dynamics.

Chainlink Price Analysis: Robust Support Amidst Limited Resistance

Utilizing IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, we gain insights into the key support and resistance dynamics shaping Chainlink’s price movement. The IOMAP model leverages on-chain data to categorize addresses based on their average token purchase prices, identifying crucial buying zones that may function as support or resistance levels.

As per the IOMAP analysis, Chainlink encounters a notable resistance barrier standing between $15.8 and $16.3. Within this range, 9,140 addresses have historically acquired over 11.4 million LINK. To pave the way for a potential climb to $20, Chainlink must successfully close a daily candlestick above this resistance level.

On the supportive side, a vital demand zone fortifies Chainlink’s position. Approximately 18,000 addresses have accumulated a substantial 40.4 million LINK within the price range of $14.4 and $14.9.

Related: What Exactly does Chainlink Do? Is Chainlink the Same as Ethereum?

It’s imperative to highlight the significance of preserving this support level in the face of potential profit-taking maneuvers by large investors. The maintenance of this level is crucial to sustaining Chainlink’s bullish trajectory. A failure to uphold this support zone could trigger a correction, with potential downside targets at $13.2 or even $12. As Chainlink navigates these critical levels, the balance between support and resistance becomes a pivotal factor in shaping its near-term price action.