Meme Coins Reclaim the Spotlight: $2 Billion Trading Volume Spike

After a period of decline, meme coins are once again capturing investor attention. This resurgence comes as the broader market recovers and optimism grows, especially following political buzz — like former President Donald Trump’s hint at the approval of the GENIUS Act.

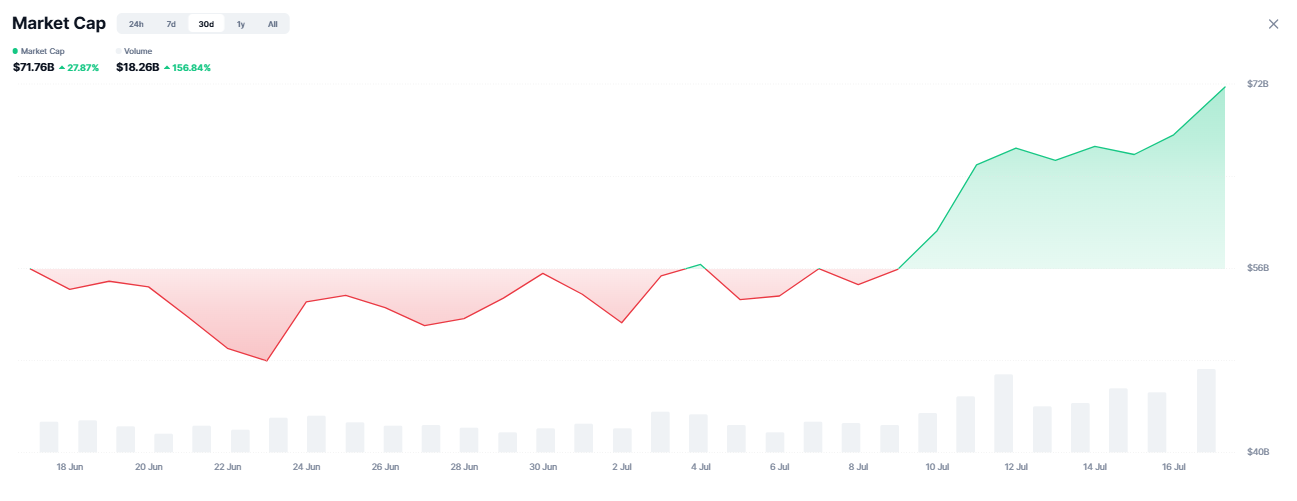

According to CoinMarketCap, the Fear and Greed Index has reached 70 — clearly reflecting a greedy investor sentiment. The total market capitalization of meme-themed coins has now surpassed $71.27 billion, while trading volume surged over 42% in just 24 hours, hitting $17.58 billion.

Major players like DOGE, SHIB, and PEPE are in the green, but it’s FLOKI, BONK, and SPX6900 that are truly making waves with double-digit gains today.

What’s Behind FLOKI, BONK, and SPX6900’s Explosive Growth?

FLOKI is today’s top performer, with a massive 402% surge in trading volume. This spike reflects renewed interest in meme coins as the AltSeason Index rises — a signal that an altcoin season may be underway. FLOKI is currently trading at $0.0001320, with a market cap of $1.25 billion.

BONK has also been on a steady upward trend for weeks. It has gained 171% over the past month and another 27% today alone. The rally is supported by the expanding Solana meme coin ecosystem, rising open interest (OI), growing trading volume, and a strong technical setup. Analysts also note that 100 BONK tokens were sold this week, easing sell pressure. Meanwhile, BONK’s launchpad has seen high demand, generating fees used for buybacks — helping drive the price even higher. BONK is now trading at $0.00003937, with a 24-hour trading volume of $2.54 billion, up 77%.

SPX6900, although less well-known, is also making a strong bullish move. The token hit a new all-time high (ATH) just hours ago and is up 10% in 24 hours, with trading volume up 90% to $191.48 million. It’s currently priced at $1.77, with a market cap of $1.65 billion.

Like other meme coins, SPX6900’s rally is driven by improved market conditions and macroeconomic factors such as US CPI and PPI data.