The notable upswing in SOL’s value seems to be intricately linked to the recent spike in gas fees on Ethereum and the distribution of Solana’s airdrops, including the much-discussed Bonk.

During the week ending December 24, the price of Solana catapulted by over 60%, reaching a milestone of $118 – a level not seen in the past eighteen months.

What’s behind the uptick in SOL’s price this week?

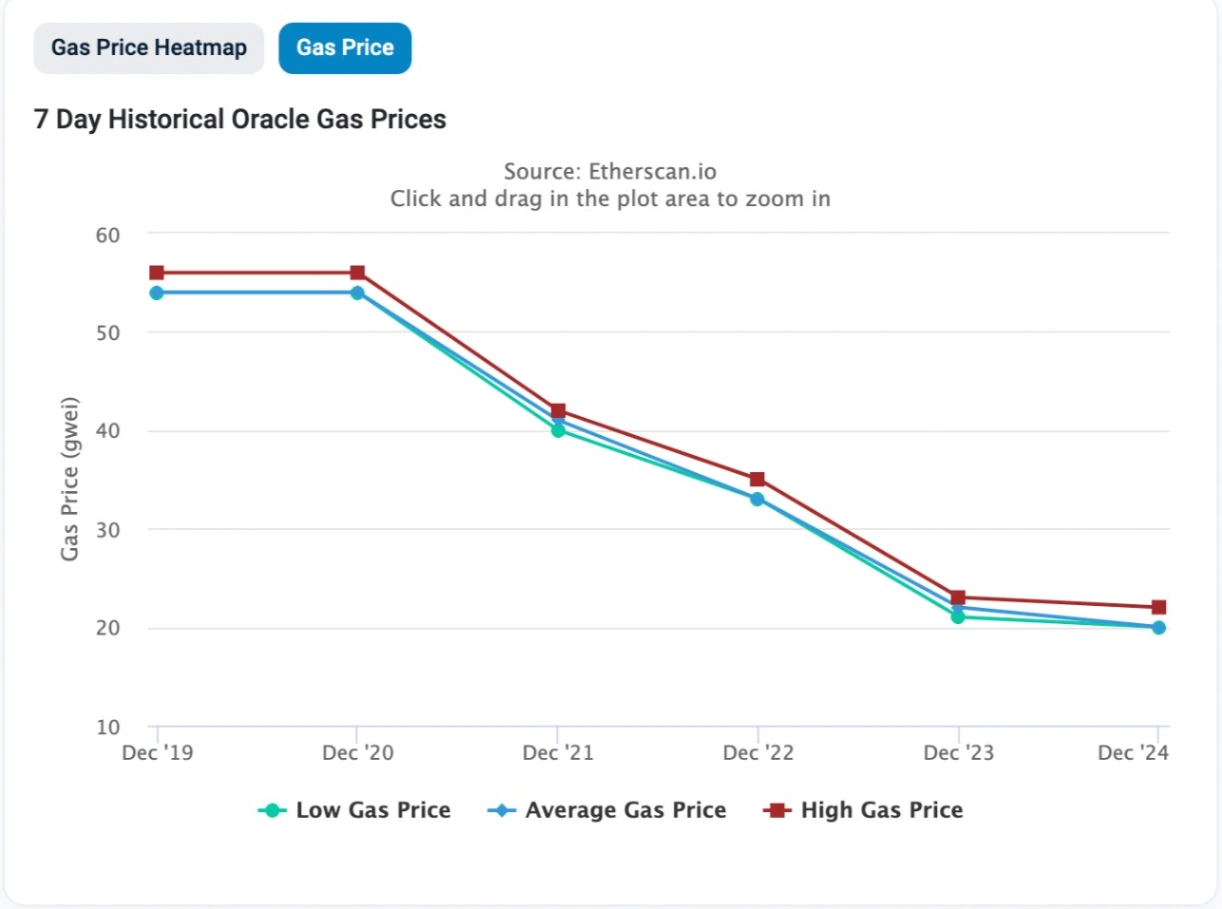

The surge in Solana’s valuation aligns with a concurrent escalation in gas fees within the ecosystem of its primary blockchain rival, Ethereum. Notably, the cost of executing a transaction on the Ethereum network briefly surpassed $10 earlier in the week, with some users reporting exorbitant fees of up to $150 for transactions valued at $50.

Although Ethereum’s gas fees have receded by more than 50% from their week-to-date peak, the brief escalation prompted users to explore alternative blockchain platforms boasting lower transaction costs. This increased user activity likely played a pivotal role in bolstering Solana’s price in recent months.

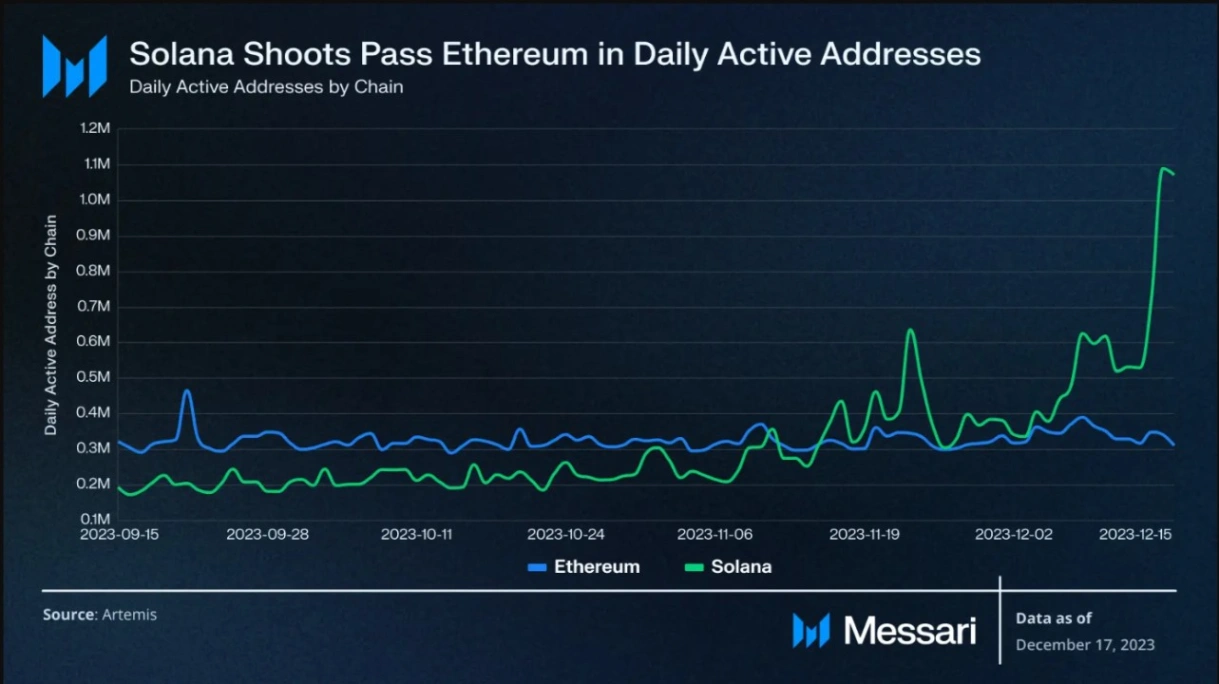

For instance, data from Messari reveals a substantial surge in active addresses on Solana, marking a nearly 400% increase over the last three months, compared to a mere 3% uptick on Ethereum.

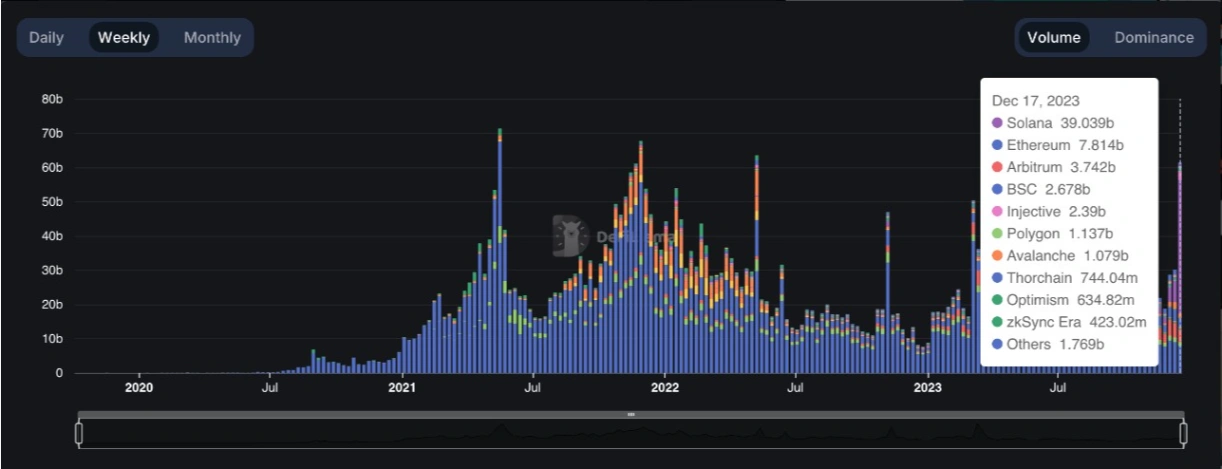

Solana’s price surge also finds support in recent airdrops on its blockchain, particularly the Bonk memecoin, contributing significantly to the upswing in daily active addresses and overall price. Concurrently, the decentralized exchange volume on Solana has taken the lead this week.

The appeal of Solana lies in its lower transaction costs, facilitating the creation of new addresses and proving advantageous for airdrop enthusiasts. Notably, Solana’s transaction fees have consistently remained below $0.01, as reported by CoinCodex. However, this affordability is not without its critics, who have voiced concerns on social media regarding potential drawbacks associated with these lower fees.

Institutional Capital Flows into Solana

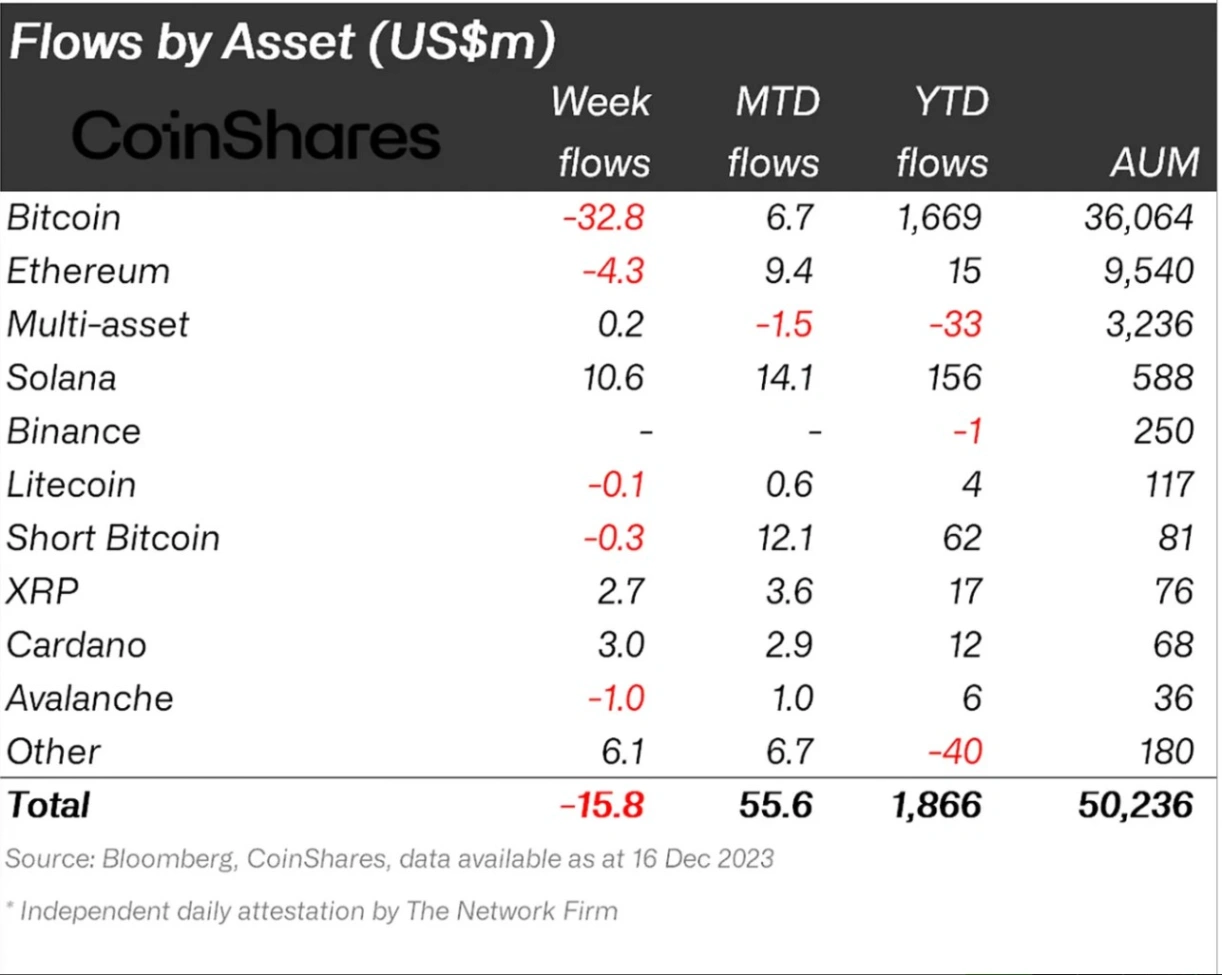

This week’s surge in Solana’s value is underpinned by a robust influx of institutional capital, marking another triumphant period for fund flows.

🚨 Solana fanboys don’t know they are actually paying $100 mil in fees / month to use the network.

SOL runs on subsidies & inflation = price crashes = subsidies crash = validators leave = chain halts.

Now you know why SOL has INFINITE supply = death spiral to zero?

It costs… pic.twitter.com/BZTkkV4xGa

— Duo Nine ⚡ YCC (@DU09BTC) December 23, 2023

Solana-focused investment funds notably attracted $10.6 million in the week concluding on December 16, outpacing inflows into leading competitors such as Bitcoin and Ethereum. December witnessed an impressive $14.1 million in inflows into Solana funds, establishing it as the highest-received capital among cryptocurrencies.

Solana Price Analysis

While the ascent of Solana’s price this week has been noteworthy, indications from technical analyses suggest a potential slowdown.

Examining the three-day chart, SOL’s price trajectory has formed higher highs. However, a closer look at the relative strength indicator (RSI) and volumes reveals lower highs. This technical discrepancy implies an emerging bearish divergence, signaling the possibility of an impending selloff.

If bearish sentiment prevails, SOL’s price is at risk of retracing towards its 0.382 Fibonacci line, situated near $100 by New Year’s. A decisive close below $100 could pave the way for a further decline towards the 0.236 Fibonacci line, approximately at $66.

Related: Paxos’s USDP is Allowed to Expand Operations on Solana

Conversely, a conclusive break above the 0.5 Fibonacci line, around $130, might propel the price towards a rally targeting the 0.618 Fibonacci line near $157.50. The coming days will likely offer insights into whether Solana can sustain its upward momentum or faces corrective measures based on these technical indicators.