What is Tokenomics?

Tokenomics is a portmanteau of “token” and “economics,” referring to the economic factors and mechanisms related to the use and valuation of a token.

Tokenomics describes the factors influencing the use and value of a token, including the token’s creation and distribution mechanisms, market supply and demand, as well as incentive mechanisms and token burning plans.

For cryptocurrency projects, designing Tokenomics effectively is a key factor in ensuring the success of the token. Investors and stakeholders often carefully consider a project’s Tokenomics before deciding to participate, as it directly impacts the prospects and value of the token.

The Importance of Tokenomics

To understand the importance of Tokenomics, imagine the cryptocurrency market as a game with multiple participants:

- Developers: Those who build projects and tokens such as Andre Cronje, Vitalik Buterin, etc.

- Market Makers: Entities like CZ (Binance), Sam (FTX) controlling trading activities.

- Large Investment Funds: a16z, Multicoin, ParaFi, etc., are major investors.

- Retail Investors: The majority of users, including readers like you.

Thus, the main players controlling the game are not small retail investors like us, but rather Market Makers, Developers, and large investment funds. And they control the game through the most important tool – the token.

Therefore, to understand what is happening in the crypto market, users need to have a deep understanding of Tokenomics – how tokens operate and are valued. This is the key for users to grasp the actions of the big players and participate in the game more wisely.

Related: How Do I Create a Binance Account? The Step-by-Step Guide

Components of Tokenomics

Token Supply

One of the crucial factors in Tokenomics is token supply, including:

- Circulating Supply: The number of tokens currently circulating in the market.

- Total Supply: The total number of tokens expected to exist but not yet fixed.

- Max Supply: The maximum number of tokens, already determined and unchangeable.

Checking these metrics helps users understand how many tokens a project currently has in circulation compared to the expected total supply. However, not all projects disclose all three of these metrics.

Market Cap and Fully Diluted Valuation

- Market Cap: Represents the value of a crypto asset based on the circulating supply and current price.

- Fully Diluted Valuation (FDV): Represents the value of the project based on the total token supply, including unreleased tokens.

The calculation of FDV varies depending on whether the project has a Max Supply or not. For projects without a Max Supply, FDV is calculated based on Total Supply. Whereas if there is a Max Supply, FDV will be based on that.

Token Utility

This component helps users understand the use cases of the token. There are two main types of tokens:

- Utility token: Used for accessing services, features within the ecosystem.

- Governance token: Allows owners to participate in project governance and decision-making.

Some projects like BNB have both utility and governance functions, allowing users to participate in the project’s decision-making process.

Token Allocation

Tokenomics is a concept related to how a token is issued, allocated, and managed in a blockchain project. By examining how tokens are allocated to different entities, we can assess the tokenomics of a project.

In a blockchain project, tokens are typically allocated to the following groups:

- Development team

- Investors (seed, private, public sale rounds)

- Early contributors Marketing activities

- Airdrops and retroactive allocations

Taking BNB as an example, the initial total supply is 200 million BNB, allocated as follows:

- ICO: 50% – 100 million BNB

- Binance Team: 40% – 80 million

- BNB Angel investors: 10% – 20 million BNB

Analyzing this token allocation helps users understand more about the tokenomics of the project.

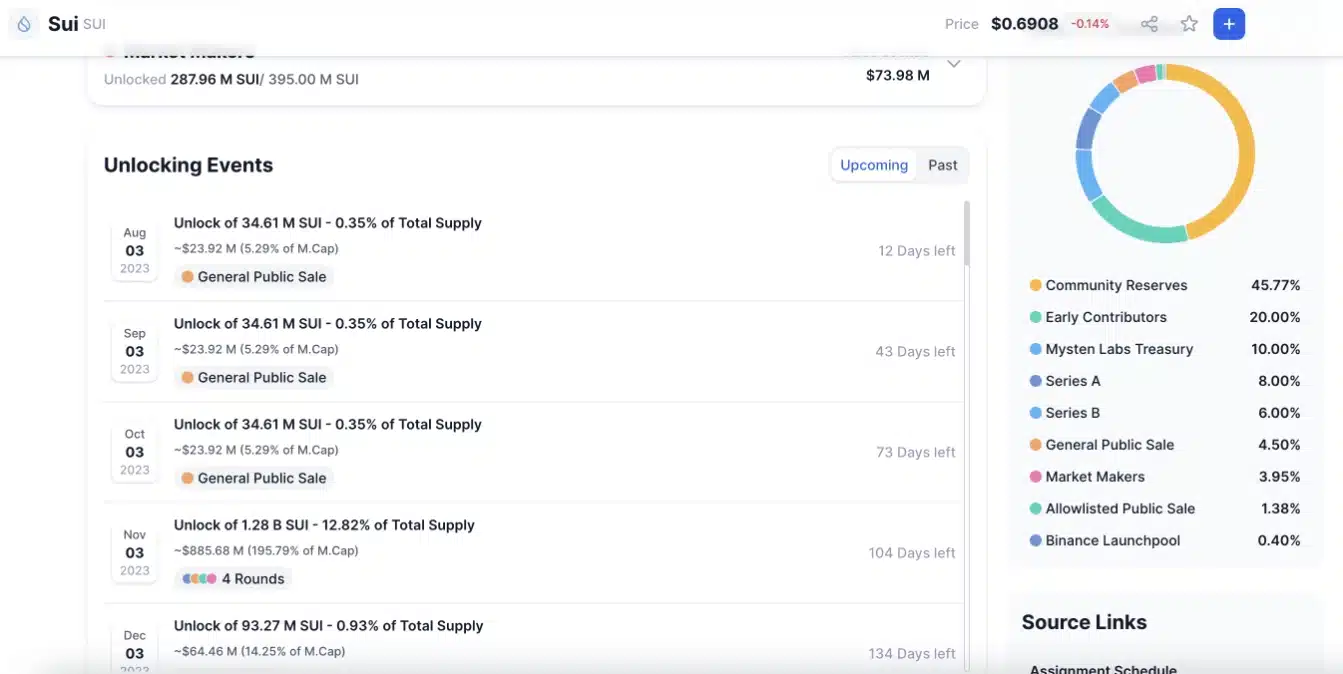

Token Unlock Schedule

The token unlock schedule is an important factor affecting the price of a token. When users invest in a project, they are usually allocated tokens at specific time intervals.

Usually, tokens are not distributed all at once but gradually unlocked according to a schedule. Tokens with unlock schedules nearing completion are often seen as positive signals, as there will be less selling pressure afterward.

For example, the unlock schedule of the SUI token is illustrated in the figure. In the short term, unlocking events often impact price decreases due to many investors tending to sell. However, in the long run, the unlock schedule is still an important factor for investors to track the project’s development.

Users can refer to websites like Dropstab, Token Unlocks, Vest Lab, Cryptorank to check unlock schedule information. However, not all projects are fully updated on these platforms, so further research through the project’s official channels is necessary.

Token Burn Schedule

Token burn is a process of permanently removing a certain amount of tokens from circulation to reduce the total supply and create deflationary characteristics for the token.

Not all projects apply this mechanism, but it is often used in platform blockchain projects (Layer 1). Recently, other projects like BendDAO, Shiba Inu have also implemented token burn.

Binance is a typical example of a token burn mechanism. With an initial total supply of 200 million BNB, Binance uses a portion of quarterly profits to buy back and burn BNB. The goal is to reduce the total supply of BNB to 100 million in the future, thereby creating deflationary characteristics.

Most recently, Binance completed its 24th BNB burn round, with 1,991,106.82 BNB burned. Reducing the token supply will support the long-term value of BNB.

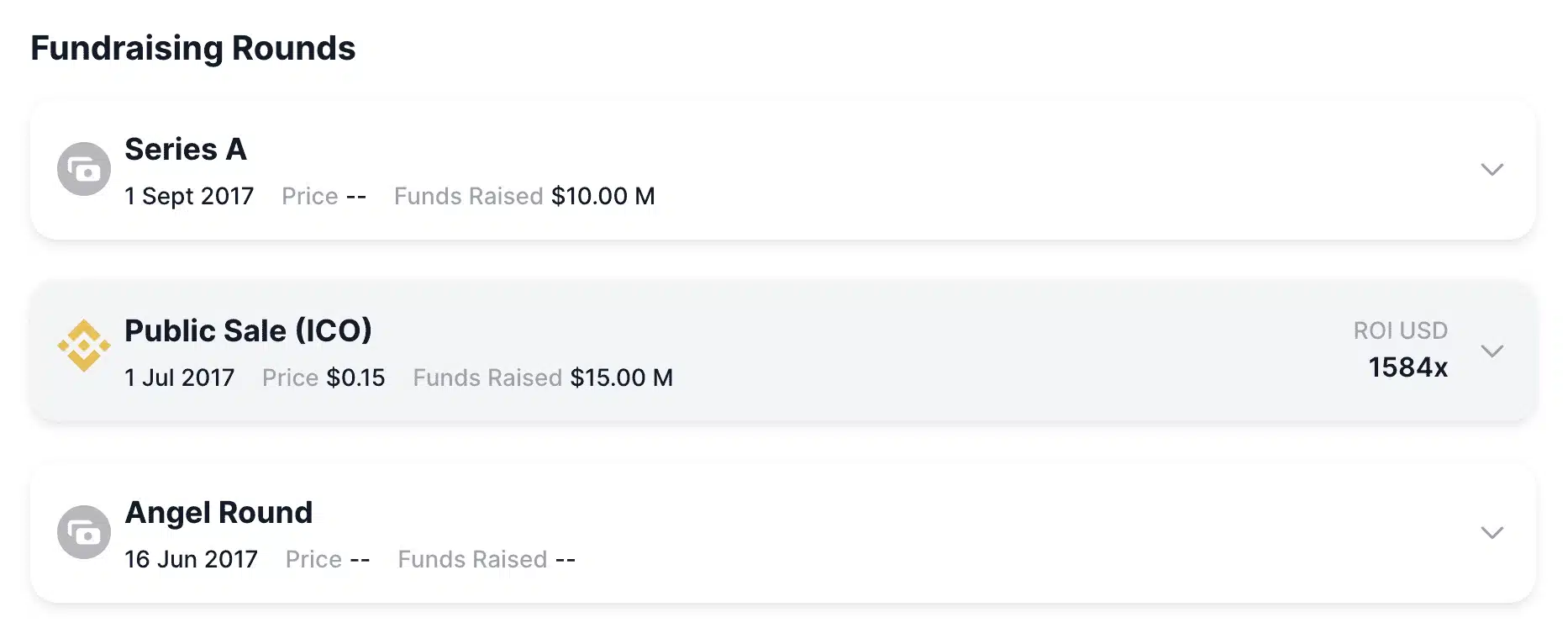

Token Sale

Token sale rounds typically include:

- Seed sale: The first token sale round when the project has not yet completed the product. Investors in this round are usually high-risk venture capital funds.

- Private sale: Fundraising round when the project has achieved certain milestones. Investors here are usually large and reputable funds.

- Public sale: Token sale round for the community.

The opening price is usually lowest in the Seed round and increases gradually to the Public round. However, investors in the Public round often have their tokens unlocked faster (usually 100% upon listing), while Seed and Private rounds have to wait longer.

This is to maintain a good price for the token in the long term because Seed and Private round investors are usually long-term investors.

For example, Binance raised a total of $25 million through 2 rounds, including Public Sale and Series A.

Conclusion

After reading the article “What is Tokenomics and Why is it Important?” have you grasped the concept of tokenomics and understood its importance to the cryptocurrency market? If not, please leave a comment below to have your questions answered!

Very good insight.

I have been more educated reading your articles on this platform. This is great. Keep it up.

AZcoiner is where I add to my knowledge bank

I always look for something to read

Thanks

Awesome

Very impressive, it’s an eye opener for me

I read current news about crypto here in Azcoiner.

Thank you for this aspect.

Very insightful.

Thanks

Thanks for this enlightenment.