What is MakerDAO?

MakerDAO is a platform for lending and borrowing with the stablecoin DAI, launched in 2014. To understand, the way MakerDAO works is similar to a bank: users provide collateral to receive cash (in the case of MakerDAO, DAI).

To understand more about how it works:

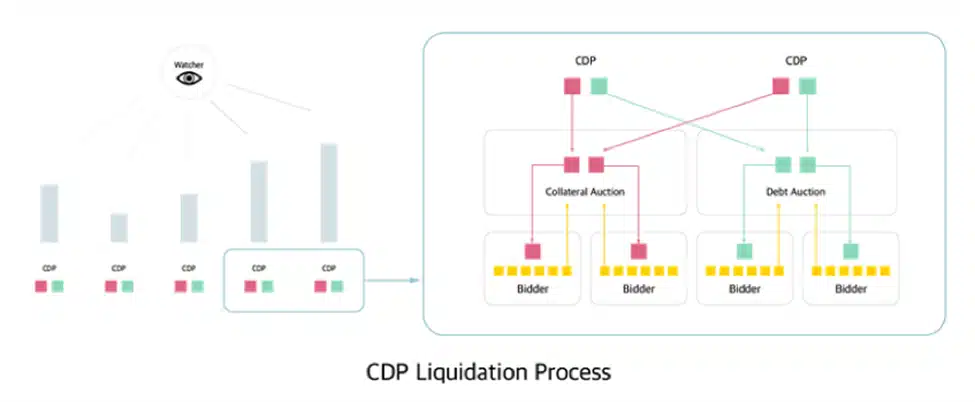

- Users interact with MakerDAO by creating CDPs (Collateralized Debt Position Smart Contracts) – these are smart contracts related to collateralized debt.

- They receive DAI corresponding to a portion of the value of the assets they put up as collateral.

- Users pay a stable fee and a certain amount of borrowed DAI to redeem the collateral.

DAI Stablecoin or the DAI ecosystem includes DAI Stablecoin (DAI) and MakerDAO (MKR). This platform operates to create a stablecoin in the MakerDAO & DAI ecosystem.

DAI Stablecoin (DAI) is a type of stablecoin pegged to other cryptocurrencies. This currency acts as a price stabilizer, with a value equivalent to the USD: 1 DAI = 1 USD.

Principles of operation of MakerDAO & DAI

This system operates based on the principles of a decentralized autonomous organization (DAO) to manage MakerDAO (MRK) and maintain stability for the price of DAI. An important part of the success of this project depends on the operators and the management of the operating process.

The MakerDAO platform is used by all DAI holders. Users can own DAI by collateralizing their assets to exchange for DAI through the Maker smart contract, called CDP (Collateralized Debt Position). Then, they can reclaim their assets after paying off the debt along with a fee, stabilizing the price of DAI.

Highlights of MakerDAO

MakerDAO is one of the first projects to efficiently address the capital utilization problem. This project allows users to use their existing assets to borrow stablecoins, enabling them to have cash without having to sell their assets.

In the context of the strong development of DeFi in 2021, users are not only interested in buying assets to wait for price increases but also want to hold stablecoins to participate in yield farming or optimize capital usage. MakerDAO has become the unique solution, and since then, it has developed strongly. According to Defi Llama, the largest total value locked (TVL) of MakerDAO in 2021 was over $18 billion.

Not only TVL highlights the success of MakerDAO. According to CoinGecko, by 2022, it took DAI only about 3 years to increase its market cap from $1 million to nearly $10 billion (reaching its peak in 2022), meaning a 10,000-fold increase. This demonstrates the strength and necessity of DAI during the golden age of DeFi.

MKR Token Information

Key Metrics MKR

– Token Name: Maker

– Ticker: MKR

– Blockchain: Ethereum.

– Token Standard: ERC-20

– Contract: 0x9f8f72aa9304c8b593d555f12ef6589cc3a579a2

– Token type: Governance

– Total Supply: 1,005,577 MKR

– Circulating Supply: 977,631 MKR

MKR Token Allocation

Unable to find MKR allocation. However, as of 2023, almost all MKR has been unlocked. Therefore, knowing the MKR allocation is not too important.

MKR Token Sale

– In 2017, some investors like a16z, Polychain Capital… participated in buying MKR at $300/MKR.

– In 2018, a16z invested $15 million in MakerDAO (at $250/MKR) by buying 6% of MKR from the total supply.

– In 2019, MakerDAO sold tokens to Paradigm and Dragonfly Capital to expand operations to the Asian market.

MKR Token Release Schedule

As of 2022, almost all MKR has been unlocked.

Token Use Case

Users holding MKR have the right to manage the project. They can vote on proposals regarding MakerDAO parameters.

MKR Storage Wallet & Trading Platform

MKR Storage Wallet

Users can store MKR in wallets such as Metamask, Trust, …

MKR Trading Platform

MKR is currently traded on Binance, OKX, Uniswap, Sushiswap…

Project Team, Investors & Partners

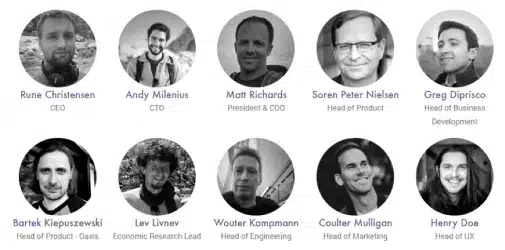

Project Team

One of the prominent members is Rune. Previously a Co-Founder, but now has separated and is only a contributing member to MakerDAO.

Investors

Through fundraising rounds from 2017 to 2019, MakerDAO has notable investors behind it, including Paradigm, a16z, Dragonfly Capital…

Partners

Many entities accept DAI in their operations. For example, Inverse Finance previously used DAI as an asset to mint their stablecoin DOLA, or Aave allows MakerDAO to supply or withdraw DAI to maintain interest…

Roadmap & Update

April 2021

MakerDAO and Aave announced the proposed D3M (Direct Deposit DAI Module), allowing MakerDAO to supplement or withdraw DAI directly from Aave to ensure interest for DAI for a specific period. This proposal has been approved.

During the same period, the proposal to use RWA (Real World Assets – Real-world assets) as collateral was also approved. Accepting RWA is not a random idea; on the contrary, since early 2020, they have been aiming to use real assets as collateral.

Similar Projects

Venus (XVS): This is a fork project from MakerDAO with the VAI stablecoin, operating on the BNB Chain.

Conclusion

Through this overview of the MakerDAO project, AZC News hopes that readers will grasp the basic information about this project to make their own investment decisions. Wishing you successful investments!