What is Lista DAO?

Lista DAO is a Liquid Staking Derivatives (LSD) project operating within the BNB Chain ecosystem. It focuses on enhancing the liquidity of users’ assets. Lista DAO offers two main products: Collateralized Debt Positions (CDP) and Liquid Staking. Both are designed to optimize the use of assets that users hold within DeFi applications without requiring them to sell those assets.

Enhancing liquidity means that users can leverage the assets they own to participate in DeFi activities instead of selling them to free up capital.

Lista DAO aims to become the most widely used protocol for leveraging rewards from the Proof-of-Stake (PoS) model and yield-generating assets.

Previously known as Helio Protocol, Lista DAO was established in 2022 with the ambition to become the MakerDAO equivalent on BNB Chain. In July 2023, Helio merged with Synclub and introduced the LSDFi Foundation, subsequently rebranding to Lista DAO. The name “Lista” is derived from combining “LIquid STAking”.

Related: Binance Introduces Lista (LISTA) on Binance Megadrop

What are the Main Products of Lista?

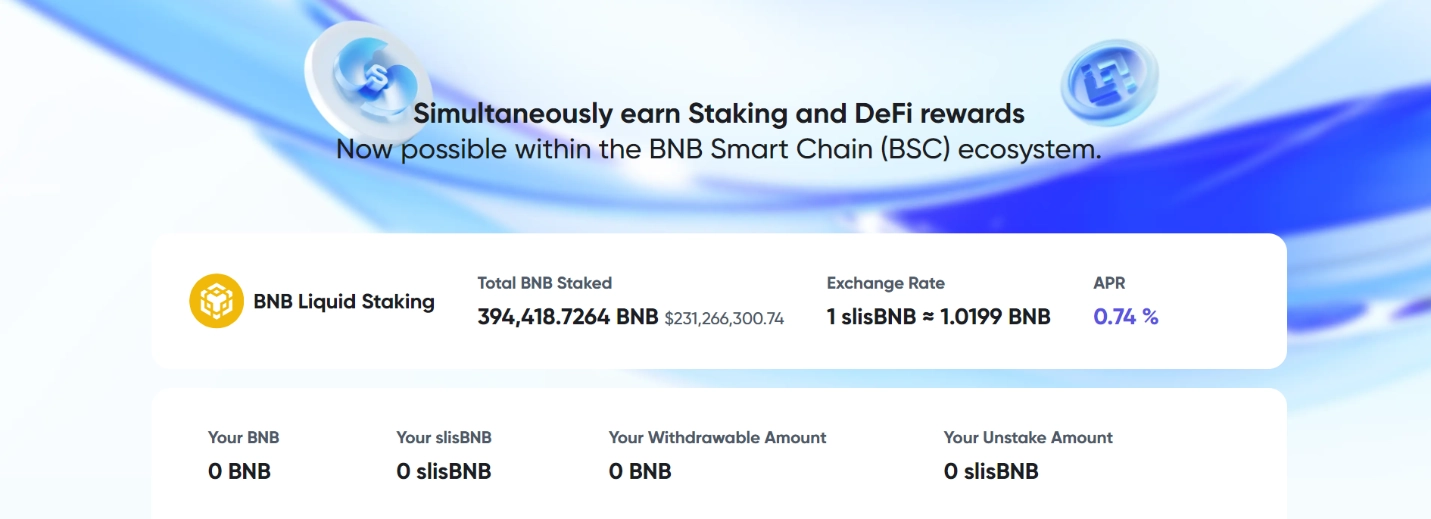

Liquid Staking

Lista DAO allows users to stake BNB tokens and earn an APR ranging from 1% to 3% in the form of slisBNB tokens. This type of Liquid Staking token functions similarly to Rocket Pool’s rETH. The value of slisBNB appreciates over time as it accumulates staking rewards from the BNB Chain, independent of BNB’s price fluctuations.

How it works:

- Users stake BNB on the Lista DAO platform.

- Lista DAO delegates this BNB to validators who operate the PoS network of BNB Chain.

- The validators earn BNB rewards for maintaining the network.

- Lista DAO distributes the rewards: 95% to users who staked BNB and 5% to Lista DAO’s treasury.

- Users receive slisBNB, which represents their staking position and rewards.

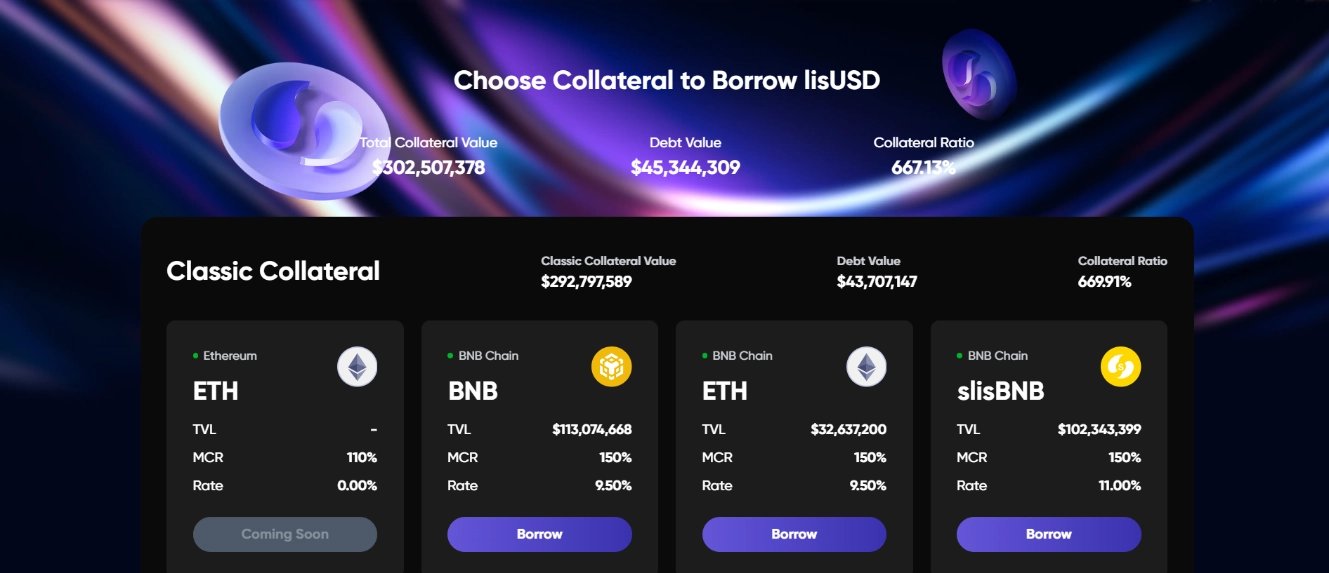

Stablecoin lisUSD

LisUSD is a stablecoin issued by Lista DAO. Users can mint lisUSD by collateralizing their assets into the protocol. When the debt is repaid or the collateralized position is liquidated, lisUSD is burned.

Assets eligible for collateral to mint lisUSD include:

- Classic Collateral: ETH, BNB, wBETH, slisBNB, and BTCB.

- Innovation Zone: weETH, ezETH, and STONE.

What are the Highlights of Lista DAO?

Currently, many stablecoin protocols rely entirely on one model – either fully collateralized or purely algorithmic. Collateralized stablecoins pose custodial risks and require over-collateralization, while algorithmic designs often lack stability. Decentralized lending protocols also face issues with capital efficiency.

Lista DAO addresses this by allowing users to optimize their capital through CDPs (Collateralized Debt Positions) and leverage it via Liquid Staking. This combination, along with the MakerDAO model and liquidity from LPs on DEXs, helps Lista avoid the pitfalls of fiat-backed and algorithmic stablecoins.

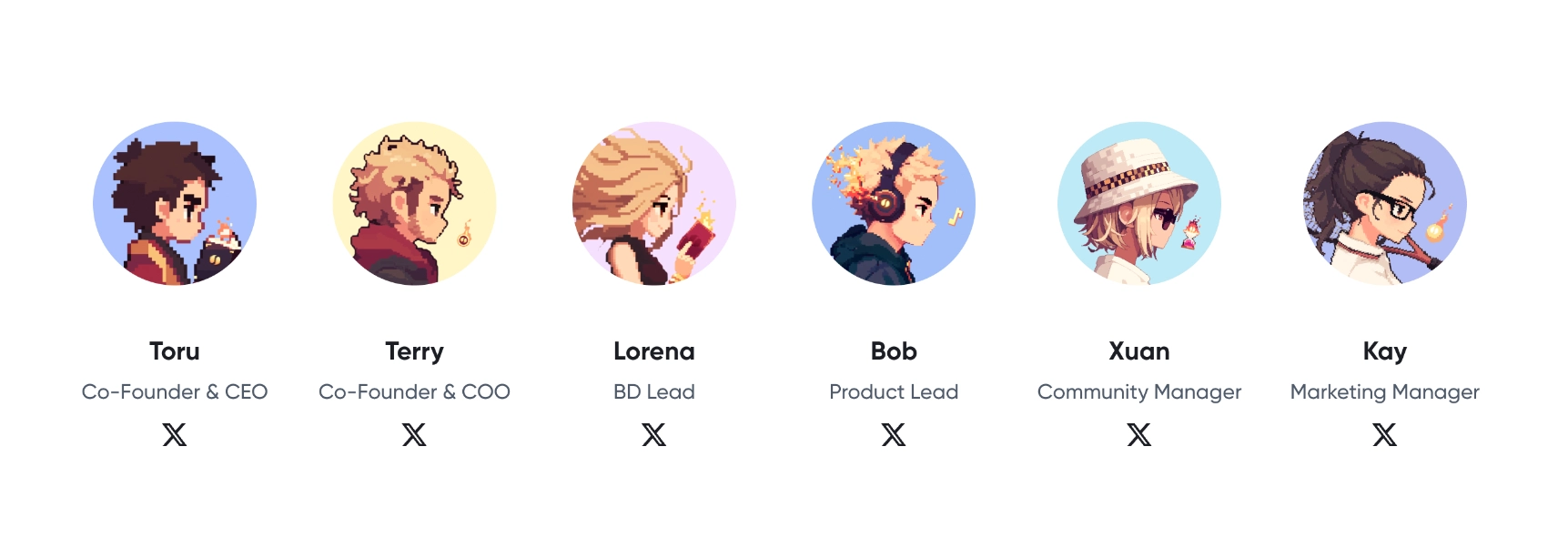

Team

The Lista DAO project is led by two founders:

- Toru – Co-founder and CEO of Lista DAO.

- Terry – Co-founder and COO of Lista DAO. Previously, he spent 3.5 years at Binance Labs and served as a Project Lead there.

Investors

On August 11, 2023, Binance Labs announced a $10 million investment in Lista DAO. The project also receives incubation support from Binance Labs.

What is LISTA Token?

After understanding what Lista DAO is, let’s delve into the project’s token – LISTA.

LISTA Token Information

- Project Name: Lista DAO

- Token Symbol: LISTA

- Blockchain: Ethereum, BNB Chain.

- Token Standard: BEP-20 and ERC-20.

- Contract Address: 0xFceB31A79F71AC9CBDCF853519c1b12D379EdC46 (BNB)

- Total Supply: 1,000,000,000 LISTA

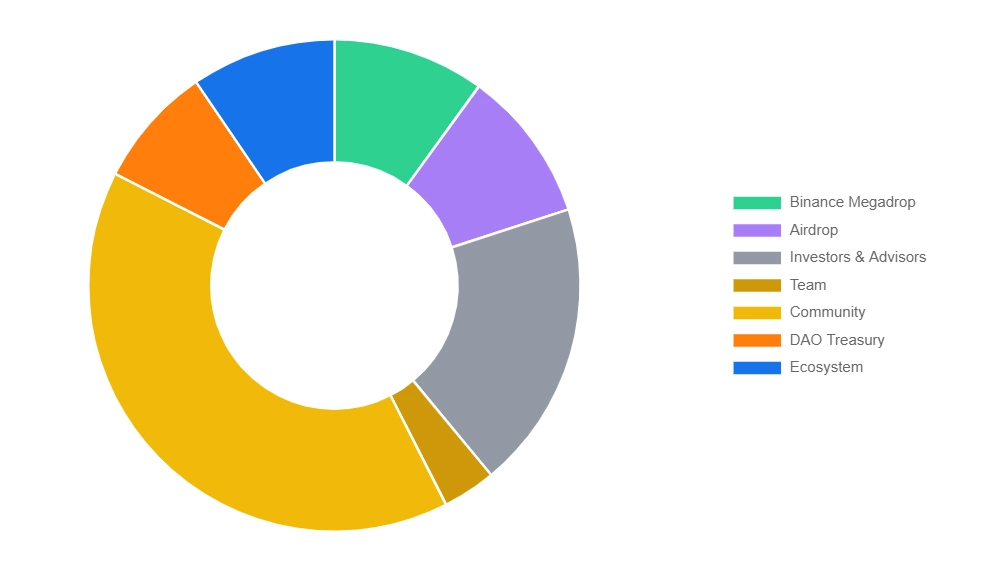

LISTA Token Allocation

- Binance Megadrop: 10%

- Airdrop: 10%

- Investors & Advisors: 19%

- Team: 3.5%

- Community: 40%

- DAO Treasury: 8%

- Ecosystem: 9.5%

Lista’s token distribution significantly emphasizes the community, with about 60% of the total supply allocated to the community (Megadrop, Airdrop, Community). 19% is allocated to investors and advisors, most of which are held by Binance Labs. This could give Binance Labs potential control over the token price in the future. The team holds only 3.5% of the total supply, which requires them to stay motivated and committed to the project long-term.

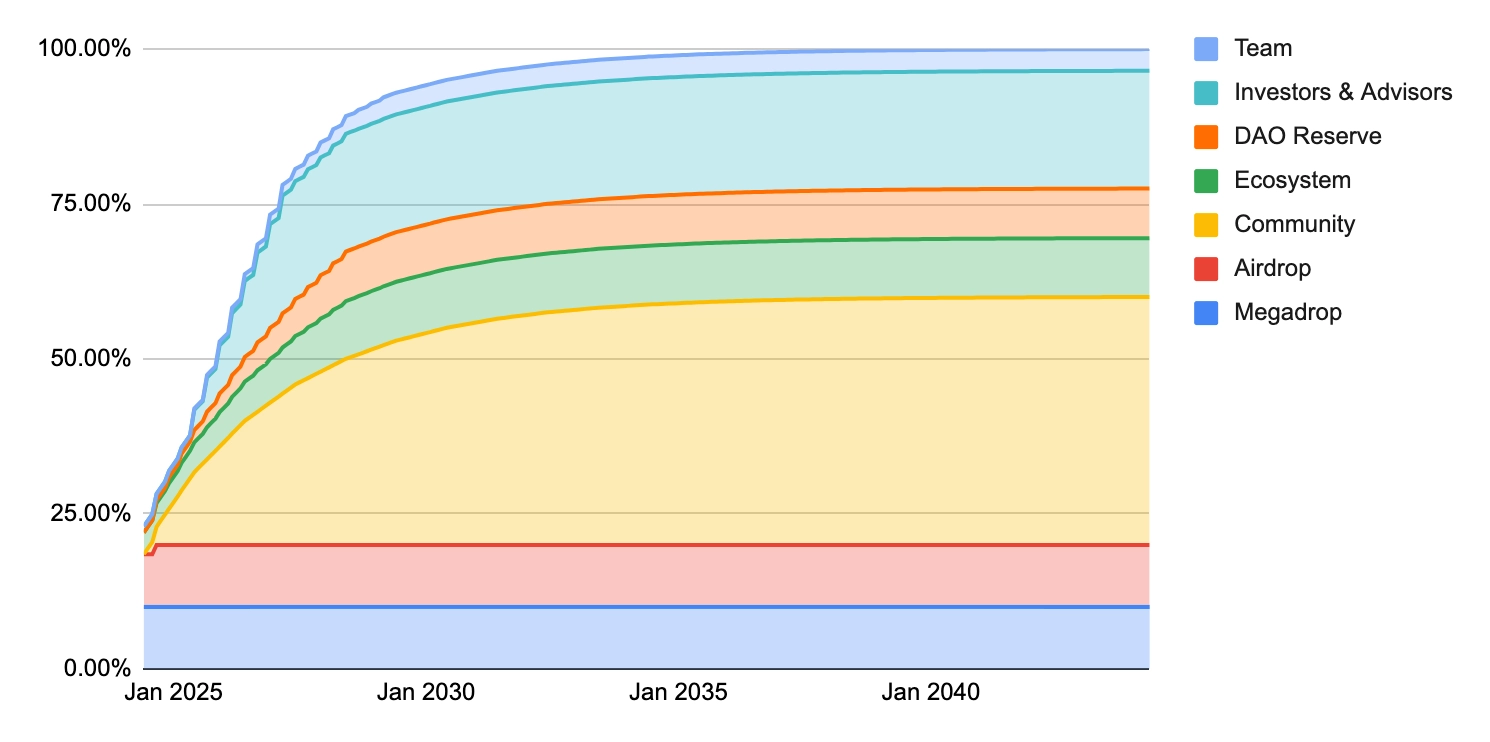

LISTA Token Release Schedule

The initial supply of LISTA is approximately 230 million tokens, representing 23% of the total supply, coming from Airdrop (10%), Megadrop (10%), and Ecosystem (3%). From early 2025 to 2028, the bulk of the tokens will be unlocked from Community (40%), Investors and Advisors (19%), Ecosystem (6.5%), and Team (3.5%).

Use Cases for LISTA Token

- Governance: LISTA token holders can propose and vote on governance proposals, determining future features, upgrades, and parameters of Lista DAO.

- Operational Management: LISTA holders have the right to participate in the operational management and running of Lista DAO.

- Stablecoin: lisUSD serves as a stablecoin and transactional medium on the platform, such as in lending & borrowing, and minting operations.

Trading LISTA Token

Currently, LISTA Token is being traded on major exchanges such as Binance, Bitget, and Gate.io.

Roadmap

Q2:

- Build a secure and robust protocol with solid liquidity and strong utility for lisUSD on BNB Chain.

- Form and strengthen partnerships and integrations with other DeFi protocols on BNB Chain.

- Integrate ETH LST and corresponding LP tokens as collateral options for lisUSD, offering users more collateral choices.

- Upgrade smart contracts to enhance scalability.

- Explore multi-chain strategies, starting with Ethereum.

- Transition the codebase from MakerDAO to Liquity.

Q3:

- Introduce BNB restaking and the corresponding Liquid Restaking Token (LRT) into the Lista DAO ecosystem.

Similar Projects

In the LSD space, notable projects include Renzo and those on Megadrop like BounceBit (BB).

Potential Evaluation

Lista DAO is the latest entrant to the Binance Megadrop. Positioned in the LSDfi space and preparing to launch a Restaking model, Lista shares many similarities with projects that Binance has listed, such as Renzo, AltLayer, or Ether.fi. Binance listing a Restaking project outside the Ethereum ecosystem highlights significant opportunities for similar projects on other blockchains, particularly the Solana ecosystem.

The Restaking trend is emerging in the post-ETH ETF landscape, with capital likely shifting from Ethereum to BNB Chain to exploit additional yield. Lista DAO plans to deploy the BNB Restaking model in Q3 2024, coinciding with the trading debut of EigenLayer’s $EG token. This could signal a boom period for the Restaking sector at that time.

Project Information Channels

- Website: https://bouncebit.io/

- Discord: https://x.com/bounce_bit

- Twitter:https://discord.com/invite/bouncebit

Conclusion

Through this article, we have introduced what Lista DAO is and provided information about the LISTA Token. If you have any questions or comments, please leave them below for immediate answer