What is BounceBit?

BounceBit is an innovative Layer 1 network, providing the first integrated native restaking solution for Bitcoin (BTC) tokens, while aiming to expand application possibilities for other cryptocurrencies such as USDT, DAI, and more digital assets.

In addition to integrated restaking capability, BounceBit is fully compatible with the Ethereum Virtual Machine (EVM), enabling developers to easily deploy and operate decentralized applications (dApps) on the network conveniently. Furthermore, the project also integrates BounceBit Bridge and BounceClub features, aiming to provide a seamless and user-friendly experience.

Users who stake BTC, USDT, or other digital assets will receive corresponding liquid staking tokens (LST) such as stBB, stBBTC to continue restaking on dApps and earn profits seamlessly.

How does BounceBit work?

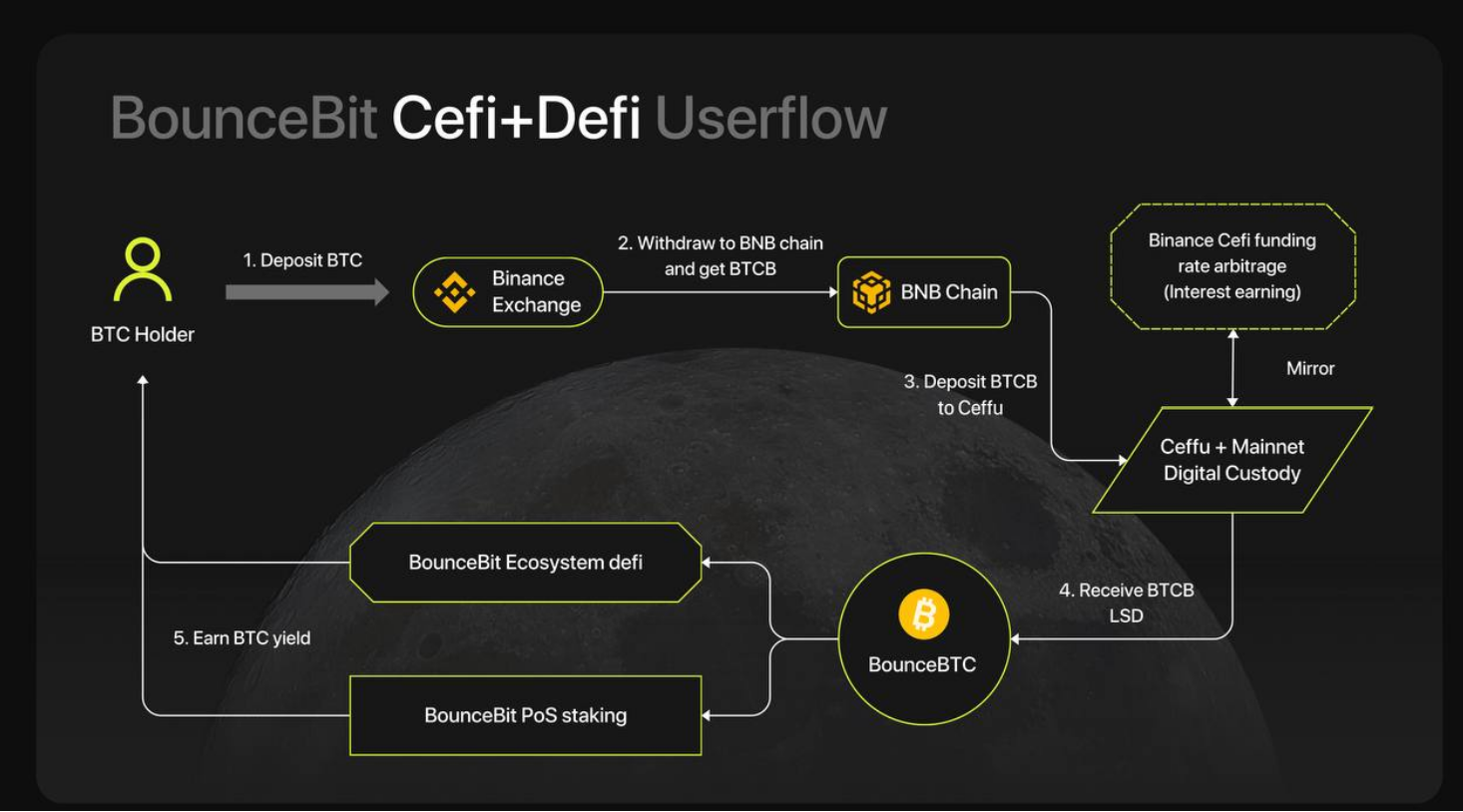

BounceBit provides a flexible conversion solution for original Bitcoin (BTC) into more potential forms like BTCB on the BNB chain and Wrapped Bitcoin (WBTC), enabling BTC holders to easily participate in decentralized finance (DeFi) protocols. Users can securely deposit their BTC into custody services accessible via the Ethereum Virtual Machine (EVM), thereby connecting these assets to the BounceBit platform. The process unfolds as follows:

- Users deposit BTC into Binance and withdraw to the BNB Chain, automatically converted into BTCB.

- Send BTCB through BounceBit’s official bridge.

- BTCB will be custodied at Mainnet Digital, and users receive BTCB and Liquid Staking Derivative (LSD) tokens.

- Users use LSD tokens to participate in asset management services on BounceBit.

- LSD tokens can be bridged to BounceBit chain for participation in other activities within the ecosystem.

Users can also stake LSD tokens to validate network nodes.

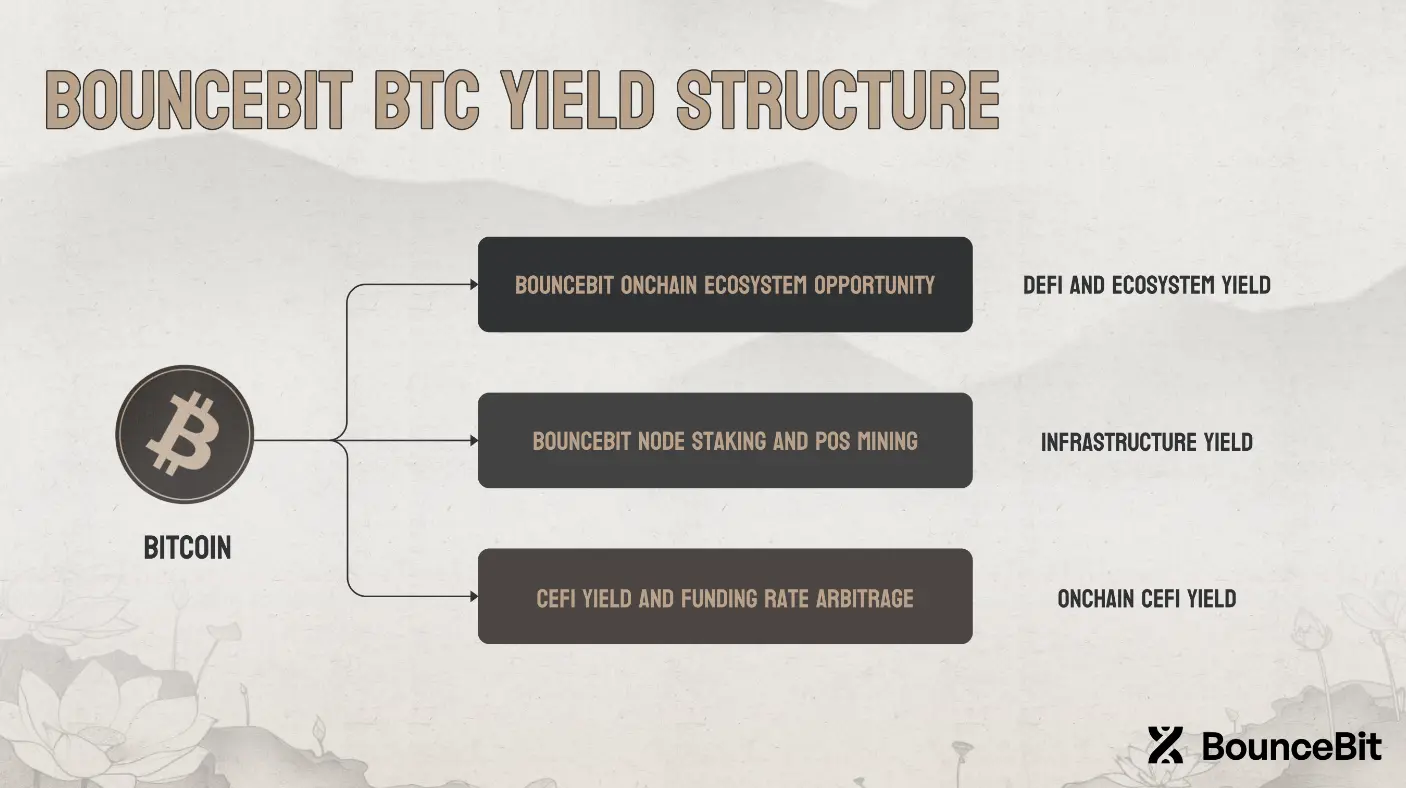

Since the Bitcoin network does not support smart contracts, deploying a DeFi ecosystem is challenging compared to other blockchains. BounceBit is created to address this issue for BTC holders. The goal is to build a decentralized validation network through the PoS mechanism, allowing BTC holders to profit from various activities. BounceBit provides three main benefits to users:

- Onchain DeFi Ecosystem Benefits: Users participate in DeFi activities such as providing liquidity, yield farming, participating in new projects/governance to earn profits from transaction fees, governance tokens, promotions, etc.

- Infrastructure Benefits: Stake BTC and BounceBit tokens to enhance network security, stability, and earn profits from transaction fees, issuing new tokens through Proof-of-Stake.

- Onchain Decentralized Financial Benefits: Participate in asset management strategies, leverage the future/current value differential; lend, borrow overcollateralized assets to earn attractive, reliable yields.

Related: What is Binance Megadrop? Guide to Using Megadrop

What is BounceBit’s product?

Solution Design

Liquid Staking Derivative (LSD) Module

Liquid Staking Derivatives (LSD) integrated by BounceBit. Token holders can delegate their BBTC and/or BB to validators and receive LST (stBBTC, stBB) as certificates. A node will be selected as a validator based on the voting weight, otherwise, it will be a candidate. The maximum number of validators is determined by the administration.

Liquid Custody

This graphic illustrates the concept of Liquid Custody. After users deposit their assets, they will receive Liquid Custody Tokens from BounceBit. Deposits will be stored in industry-standard custody solutions. Optionally, users can participate in risk-neutral Arbitrage Funding Rate strategies through off-exchange payment solutions (Ceffu’s MirrorX).

BounceBit’s Highlights

- EVM Compatibility: BounceBit is designed to be fully compatible with the Ethereum Virtual Machine (EVM) execution environment, ensuring flexibility and strong connectivity with the Ethereum community and EVM-dependent applications.

- Security and Original Bitcoin Compatibility: BounceBit utilizes a Layer 1 PoS (Proof-of-Stake) chain secured by validators staking both Bitcoin and BounceBit’s native tokens. This ensures safety, reliability, and good compatibility with original Bitcoin, attracting participation and trust from the Bitcoin user community.

- Diversification of Bitcoin Use Cases: BounceBit identifies and integrates assets like BTCB on the BNB chain and Wrapped Bitcoin (WBTC) on Ethereum. This helps diversify Bitcoin use cases, expand application scope, and create new opportunities for users to exploit and utilize Bitcoin assets.

- Expanding Ecosystem Participation and Enriching Bitcoin Assets: BounceBit facilitates convenient participation and development of the ecosystem by accepting assets like BTCB and WBTC. This helps expand and enrich the entire range of Bitcoin-related assets, providing more flexibility and diverse choices for users.

- Restaking Bitcoin: BounceBit is building a Bitcoin restaking infrastructure, where funds are securely custody through custody services provided by Ceffu, Mainnet Digital, and Fireblocks. While assets generate returns through arbitrage strategies managed by professional asset managers, users still receive a fixed version of Bitcoin called BounceBTC (BBTC), which can be delegated to network validators to receive representative stBTC tokens. Subsequently, this liquid staking derivative token can be restaked on side chains, bridges, or other oracle data sources.

- Dual-Token PoS Consensus: Dual-Token PoS is a consensus mechanism where each validator can stake both BBTC and/or BounceBit’s native tokens. This system expands the base of stakeholders and enhances the resilience, security of the network’s consensus structure.

- BounceClub: BounceClub acts as an online space allowing users to create DeFi experiences without the need for coding, using easily integrable pre-built utilities available from the App Store.

- Liquid Custody: BounceBit introduces the concept of Liquid Custody, allowing staked assets to maintain liquidity and provide easier access to profit opportunities. When users deposit assets, they receive Liquid Custody Tokens (LCT) representing custody assets at a 1:1 ratio. These tokens can be connected and used further on BounceBit.

Development Team

BounceBit was founded by a group of anonymous members, with Jack L. being the main co-founder. According to shared information, prior to founding BounceBit in 2024, Jack L. was a partner at NGC Ventures in 2018 and co-founder of the Bounce project in 2020.

In addition to Jack L., the BounceBit leadership team includes:

- Annie P.: Head of Strategy

- Joe Huang: Business Development Manager

Investors

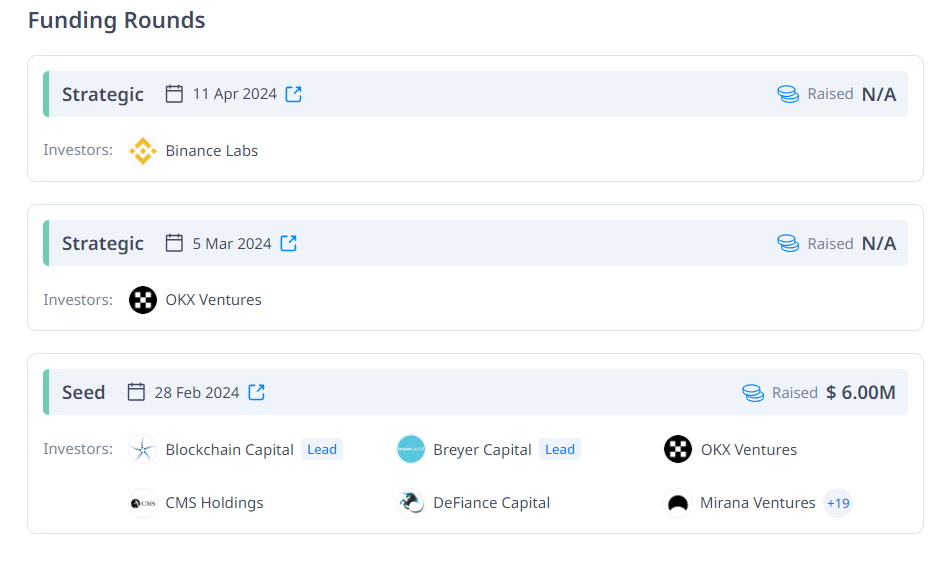

During the development process, BounceBit raised $6 million from a seed investment round led by Blockchain Capital, Breyercapital, and other investment funds. By March 2024, the project successfully raised funds from OKX Ventures in the Strategic round, although the specific amount was not publicly disclosed.

What is BB Token?

After learning about BounceBit, let’s delve into the project’s token – BB.

Basic Information about BB Token

- Token Name: BounceBit

- Ticker: BB

- Blockchain: Updating

- Token Standard: Updating

- Contract: Updating

- Token type: Utility & Governance

- Total Supply: 2,100,000,000 BB

- Circulating Supply: Updating

BB Token Use Cases

- Stake BB.

- Reward validators.

- Serve as gas fees.

- Governance and voting.

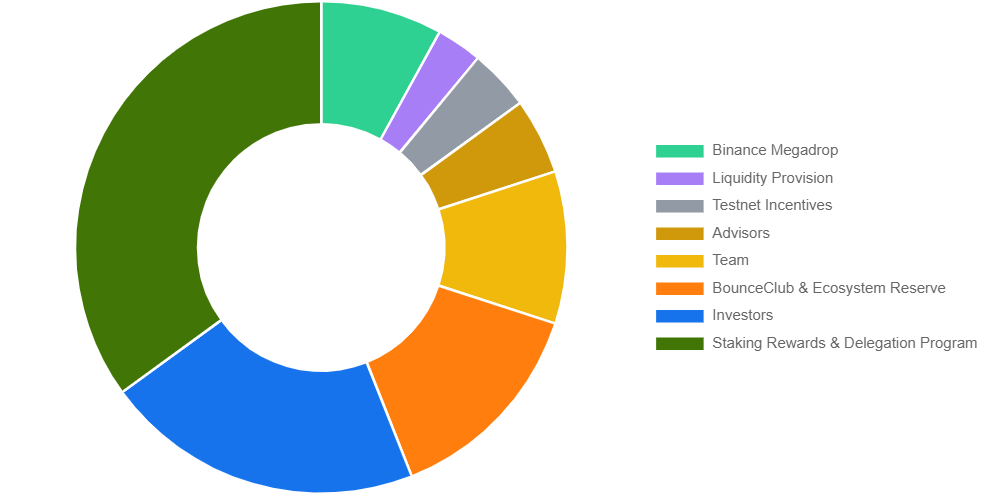

BB Token Allocation

- Binance Megadrop: 8.00% of the total token supply

- Liquidity Provision: 3.00% of the total token supply

- Testnet Incentives: 4.00% of the total token supply

- Advisors: 5.00% of the total token supply

- Team: 10.00% of the total token supply

- BounceClub & Ecosystem Reserve: 14.00% of the total token supply

- Investors: 21.00% of the total token supply

- Staking Rewards & Delegation Program: 35.00% of the total token supply

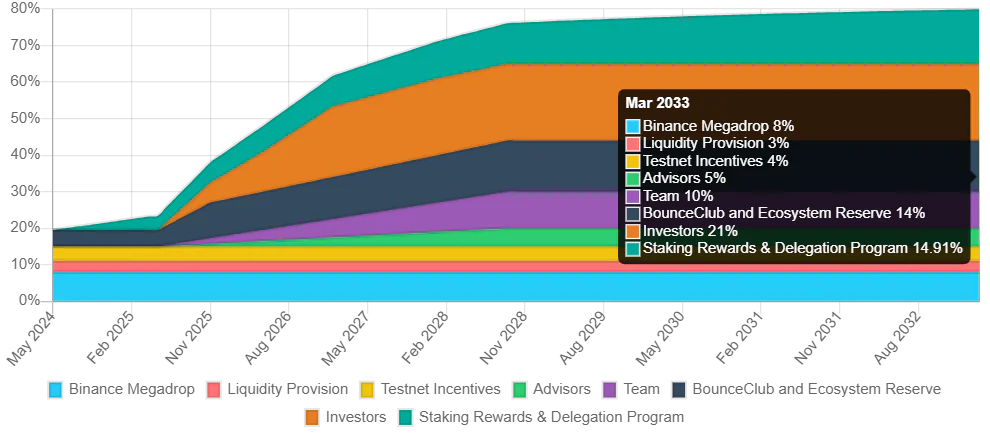

BB Token Release Schedule

Development Roadmap

Q2/2024:

- Implement the Premium Yield Program (ongoing)

- Launch the BounceBit Chain mainnet

- Build the ecosystem

- Distribute BounceClub tokens

Q3/2024:

- Develop additional CeDeFi products

- Integrate options and structured products

- Provide lending and borrowing services

Q4/2024:

- Launch the BounceBit Restaking platform

Q1/2025:

- Build Shared Security Clients (SSCs) ecosystem

Project Information

- Website : https://bouncebit.io/

- Twitter : https://twitter.com/bounce_bit

- Discord : https://discord.com/invite/bouncebit

Conclusion

Through the article “What is BounceBit? Information about BB Token“, have you understood this Bitcoin restaking protocol? If not, leave a comment below to get answers immediately!

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE