What is Lido?

Lido is a unique liquid staking solution that helps optimize profits from locked ETH when participating in ETH 2.0 and other crypto assets. This project belongs to the field of Liquid Staking Derivatives (LSDs).

Currently, Lido has expanded its operations across five different networks, including Ethereum, Solana, Polygon, Polkadot, and Kusama.

lido.fi

Staking is the act of holding a certain amount of coins in a wallet or Nodes/Masternodes of a Blockchain project for a period of time to receive rewards. This reward depends on the amount of coins staked and the stake duration.

Lido is the pioneer project in unlocking liquidity for ETH locked in ETH 2.0 and is leading in this field, with up to 4,832,979 ETH being staked on the platform.

Lido products

Lido has three main products:

Staking Pool

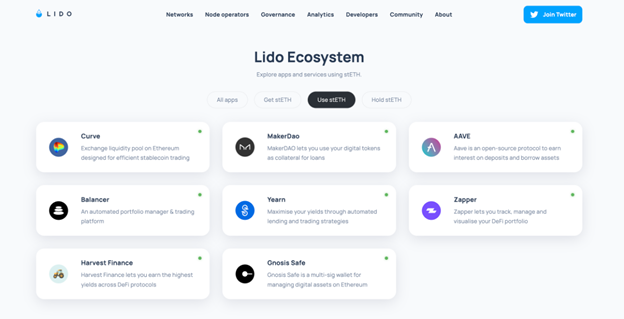

LIDO’s most important product is Staking Pool. Users stake ETH into Lido and receive stETH at a 1:1 ratio. This stETH can be widely used on Dapps that support stETH. The current list of Dapps that support stETH can be viewed here.

The ecosystem revolves around Lido Finance

Lido then uses the user’s ETH to authorize partner Validators. Validators who are staking Lido’s ETH will receive rewards over time. The reward is divided into 2 parts: 90% for stETH holders and 10% is Lido’s stETH mint fee, of which:

-

5% fees for Node Operators

-

5% fee for Lido Treasury

Synthetics token – stETH

stETH is a token that represents ownership of ETH being staked in Ethereum 2.0. Holding stETH, users can participate in many different DeFi activities such as Trading, Lending, Farming, Staking,…

Currently with stETH, users can participate in activities such as:

-

Liquidity provision: Curve, 1inch, Uniswap V3, Balancer.

-

Loans: Anchor, Aave.

-

Optimize profits on Aggregator platforms: Yearn Finance, Harvest Finance.

Lido DAO

Lido DAO is a decentralized autonomous organization responsible for governance within the ecosystem. Members have the right to make decisions with Lido’s products and operating models through LDO Token.

Lido DAO accumulates fees from protocol operations for research, development, version upgrades, and liquidity incentives.

Role of Lido DAO

Lido V2

In February 7, 2023, Lido introduced Lido V2 with Staking Router and Withdrawals. These two features include:

-

Staking Router: Lido’s cellular core, where stakers, developers and node operators can collaborate seamlessly.

-

Withdrawals: Allows users to unstake stETH and receive ETH back at a 1:1 ratio after Ethereum’s Shanghai update.

Highlights of Lido

Lido stands out with the following characteristics:

-

Flexible: Users can stake an arbitrary amount of ETH on Lido to receive stETH at a 1:1 ratio. The stETH number can be used for many different activities such as staking, lending, trading on any platform that supports stETH.

-

Double Yield: When staking ETH on Lido, users receive stETH and yield. Continuing to use stETH or lending will receive continued yield, creating an effective passive income source.

Currently, in the field of Liquid Staking, Rocket Pool is taking second place only after Lido Finance.

Related: What Is Ethereum (ETH)? An Overview of the ETH Project

What is LDO Token?

LDO Token Key Metrics

-

Token Name: Lido DAO

-

Ticker: LDO

-

Blockchain: Ethereum

-

Token Contract: 0x5a98fcbea516cf06857215779fd812ca3bef1b32

-

Token Type: Governance

-

Total Supply: 1,000,000,000 LDO

-

Circulating Supply: 890,192,051 LDO

LDO Token Use Cases

LDO token will be used for governance. Holders of an LDO have the right to participate in governance and make decisions affecting protocol development.

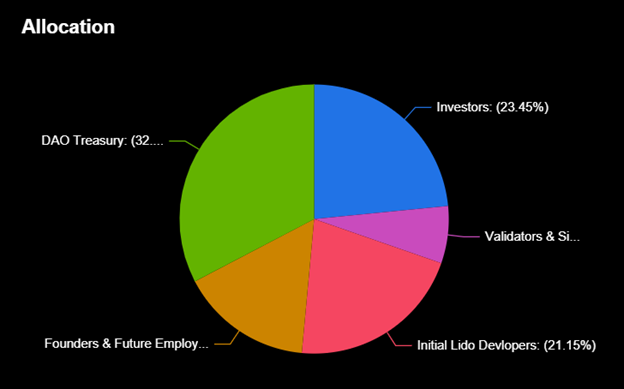

LDO Token Allocation

LDO is allocated proportionally as follows:

-

DAO Treasury: 32.3%

-

Investors: 23.45%

-

Initial Lido Developers: 21.15%

-

Founders & Future Employees: 16.6%

-

Validators & Signature Holders: 6.5%

LDO Token Allocation

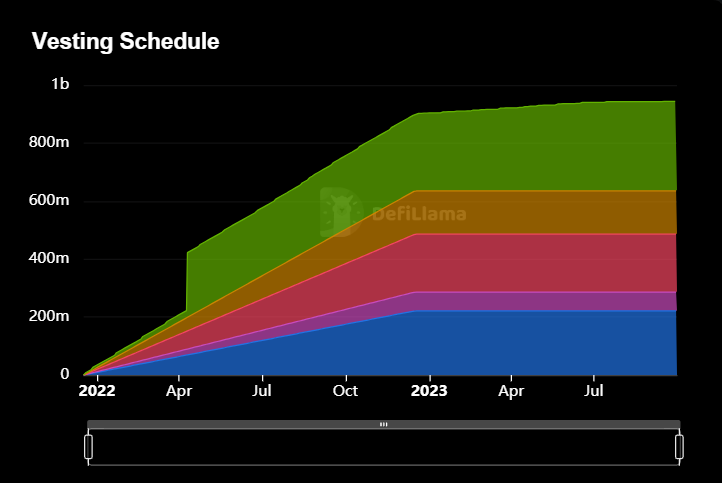

LDO Token Release Schedule

Vesting Schedule

The LDO token number of the team and investors will be locked for one year (fully unlocked on December 17, 2021), then vesting for 1 year.

The plan to allocate 32% of the remaining LDO tokens needs to go through the governance proposal process on Lido DAO. DAO can also decide to issue additional tokens to raise capital, marketing or create incentives for users.

Where to buy LDO Token?

Users can purchase LDO Token through the following platforms:

-

Centralized exchange (CEX): Binance, Coinbase, OKX, KuCoin,…

-

Decentralized exchange (DEX): UniSwap v3, 1inch, Balancer, SushiSwap, Kyberswap,…

Reputable LDO Token storage wallet

Because LDO is an ERC-20 standard token, users can store it on all wallets that support the Ethereum network such as: Metamask, Trust Wallet,…

Roadmap & updates

-

December 2020: Lido officially launches on Ethereum

-

March 2021: Lido expands to Terra with bLUNA

-

September 2021: Lido expands to Solana with stSOL

-

March 2022: Updated introduction to Distributed Validator Technology (DVT), No

-

de Operators Score (NOS) and balance creation mechanism in governance.

-

February 2023: Introducing Lido V2 with two main updates: Staking Router and Withdrawals. This is Lido’s biggest upgrade ever. The promise is to move the protocol closer to decentralization.

Project team

Lido is governed as a decentralized autonomous organization (DAO). The initial members of Lido DAO include many names who are Founders and Co-founders of famous projects in the market such as:

-

Banteg: Core developer of yEarn Finance.

-

CryptoCobain: KOL with more than 220k followers.

-

Anton Bukov: Co-founder of 1Inch.

-

Will Harborne: Co-founder of Deversifi

-

Julien Bouteloup: Founder & CEO of Stake Capital

-

Kain Warwick: Founder of Synthetix.

There are also many professional investment organizations and funds such as: Semantic VC, ParaFi Capital, Libertus Capital, Bitscale Capital, StakeFish, StakingFacilities, Chorus, P2P Capital and KR1.

Investors & Partners

Investors and Funding round

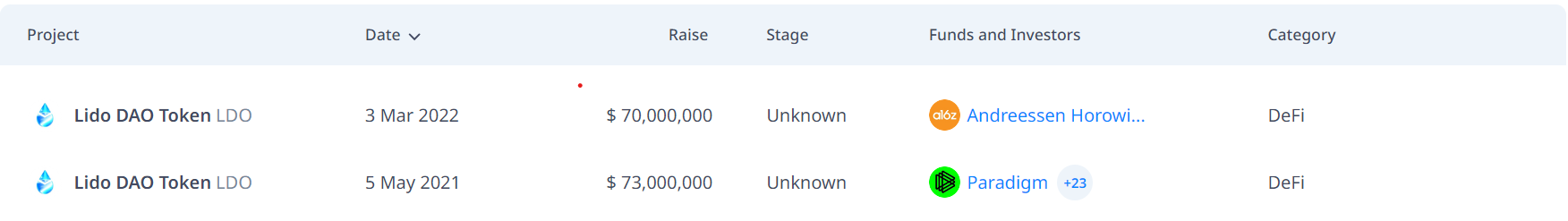

Lido Finance has a total of 2 capital calls spanning over 3 years with a total amount of up to 143M USD. There is the presence of famous names such as A16z, Paradigm, Dragonfly, KR1, along with more than 30 different investors such as Semantic Ventures, Staking Facilities, ParaFi Capital, Stake.fish…

Investor and Funding round

Partner

Lido Finance’s partners include two main groups:

1. Product support partners: These are DApps that support stToken coins so that users can use them for a variety of purposes on the platform

2. Validator Partners: This group will receive ETH from Lido to protect and validate the network. This helps accumulate rewards from validation.

Similar projects

Some similar projects in the same field as Lido include: Rocket Pool (RPL), Ankr Protocol (ANKR).

Conclude

Through this article, you probably have some basic information about the project to make your own investment decision. azc.news is not responsible for any of your investment decisions. Wishing you success and earning a lot of profit from this potential market.