What is EVM?

EVM, short for Ethereum Virtual Machine, is a unique type of virtual machine deployed and operated across all nodes in the Ethereum network. The EVM acts as an execution and validation engine for smart contracts, ensuring data consistency and maintaining the decentralized nature of the network.

Similar to how the Bitcoin network relies on miners to validate transactions, in the Ethereum network, nodes run EVM to validate smart contracts – where activities like lending, borrowing, token transfers, etc., take place. Thus, all nodes on Ethereum need to run an EVM to participate in the validation process and receive ETH rewards.

The EVM can be seen as an isolated sandbox where test operations and computations are carried out without affecting the external network. It is entirely isolated from the Ethereum network, ensuring that the validation process of nodes does not impact the overall network operation.

In addition to Ethereum, EVM-compatible networks also deploy smart contracts using a language similar to Ethereum – Solidity. Therefore, these networks require a virtual machine capable of validating Solidity similar to EVM. EVM-compatible networks share the same contract language and virtual machine as Ethereum.

EVM plays a crucial role in maintaining data consistency, decentralization, and validation across the Ethereum network as well as EVM-compatible networks, thereby ensuring safety and smooth operation for deployed smart contracts.

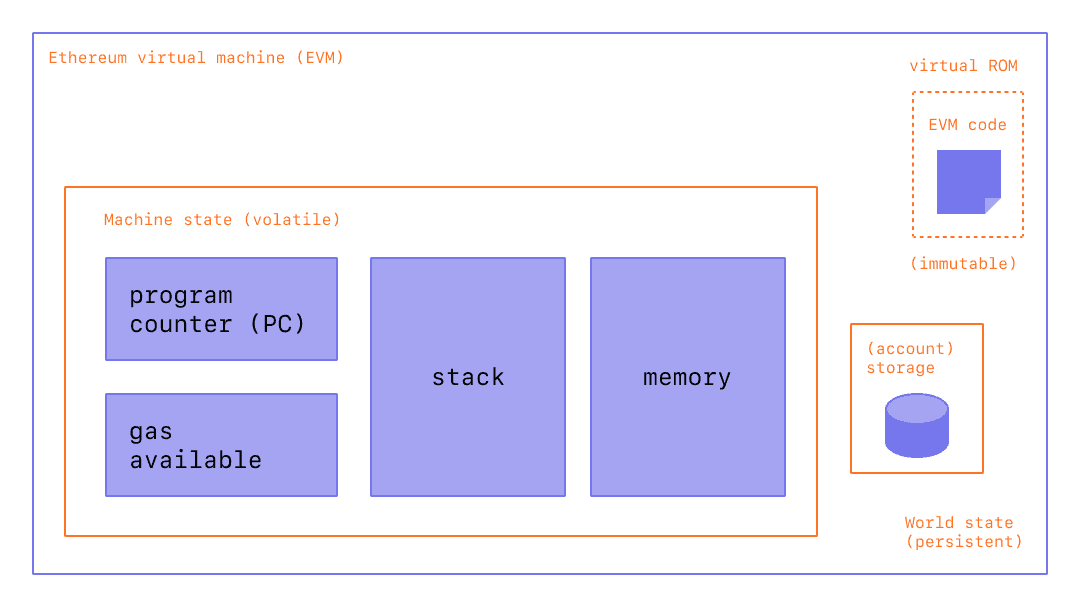

How does the EVM work?

Contrary to the concept of a “decentralized ledger” used in the Bitcoin network to describe operating rules, Ethereum employs a more complex term – “Distributed State Machine.”

To understand this better, Ethereum’s state is a collection of data on the network, including gas, contract storage, etc. This state is updated every time a new block is added to the chain.

Ethereum has the ability to freely change state between blocks, as long as it complies with the network’s rules, similar to Bitcoin. And these rules are established by the Ethereum Virtual Machine (EVM) – where the process of executing and validating smart contracts takes place.

In addition to executing smart contracts, the EVM also acts as a compiler for the Solidity programming language into bytecode – machine-readable source code that can be executed by a computer. Bytecode contains opcodes (control command codes) for the Ethereum network to process directly.

With the feature of smart contract execution, Ethereum is not only a “decentralized ledger” but also a “distributed state machine,” with the ability to change data state according to rules programmed by the EVM. This is a significant difference from the purely Bitcoin network.

Related: What is Binance? Binance Exchange Review 2024

Advantages of EVM

For Users

Using EVM-compatible blockchains brings many advantages for users, including:

- Familiarity: Most EVM-compatible networks provide a similar experience and interface to the Ethereum ecosystem, from interacting with dApps, approving tokens to wallet authentication. This helps users get acquainted easily.

- Diverse products and utilities: The emergence of many new EVM blockchains opens up many choices of financial products and services for users. For example, GMX – a lending/borrowing platform providing real yield, only available on Avalanche and Arbitrum networks.

For Developers

- Time-saving: With EVM networks, developers only need to use similar toolsets and programming languages to build dApps, saving time getting acquainted with new environments when deploying on different blockchains.

- Brand recognition: For famous dApps in an ecosystem, they can easily expand to other EVM-compatible blockchains to increase brand recognition. Trader Joe, for example, was a leading DEX on Avalanche, then quickly expanded to Arbitrum and increased Total Value Locked (TVL).

- Increased influence: Instead of being limited to a single blockchain, the products of the team can be deployed on multiple compatible networks, helping to expand influence and attract more users.

The compatibility of EVM brings many benefits for both users and developers when participating in different ecosystems, thereby promoting development and increasing diversity in the DeFi space.

Disadvantages of EVM

High Security Risk

One of the biggest concerns when using EVM is the vulnerability to network attacks. Because most EVM blockchains use the Solidity programming language, if attackers find vulnerabilities in Solidity, they can exploit them to attack multiple blockchains simultaneously. For example, the cross-chain attack on Poly Network in August 2021 caused hundreds of millions of dollars in damages and affected various ecosystems.

High Audit Costs

To ensure security and reliability, smart contracts on the blockchain need to undergo professional audit processes. However, the cost of auditing smart contracts on EVM blockchains is often very expensive, ranging from $7,500 to $100,000 depending on the scale and complexity of the project. For projects wishing to expand to multiple EVM blockchains, the audit costs will increase significantly, becoming a significant financial burden.

High Transaction Fees

Another issue with EVM blockchains is high transaction fees, especially when the network is congested. For example, on Ethereum, transaction fees can reach $7 – $10 when the network is less active, and even higher during peak times. Even on newer EVM blockchains like Avalanche or Starknet, transaction fees still hover around $1 – $2. In contrast, blockchains that do not use EVM like Solana, Sui, Aptos, etc., usually have transaction fees of only $0.01 – $1, much lower than EVM blockchains.

The Relationship Between Gas Fees and EVM on Ethereum

According to the Ethereum technical document (yellow paper) authored by Gavin Wood, the Ethereum Virtual Machine (EVM) is described as a “quasi Turing complete” machine – equivalent to a Turing machine but with a single limitation on computational ability. This limitation is related to the “gas” mechanism – the unit of measurement for computational costs on Ethereum.

In the Ethereum network, every transaction and computation requires a certain amount of gas for the EVM to execute. The gas limit is the maximum amount of gas that the EVM will use to complete a transaction.

For example, a simple Ether transfer transaction requires a minimum gas limit of 21,000 gas. Users have to pay a fee corresponding to the amount of gas used to complete the transaction.

This gas mechanism helps prevent sending infinite transactions, which would waste network resources. It also determines the complexity of a transaction – the more complex the transaction, the more gas is required for computation. Therefore, the computational ability of the EVM depends on the gas limit that users are willing to pay for each transaction.

A similar gas mechanism is also applied on other blockchains using EVM, such as Avalanche, Binance Smart Chain, etc. Although the EVM is theoretically a complete computer, in practice, a mechanism like gas is necessary to control computational costs and prevent abuse of network resources.

The Future of EVM

Although the Ethereum Virtual Machine (EVM) has brought significant innovations to the blockchain ecosystem, the technology for interpreting and executing its code is still being improved by various other blockchain projects.

The ability for cross-chain interaction is crucial for developers. Therefore, many EVM-compatible blockchains have emerged, promising lower gas fees and faster transaction speeds compared to Ethereum. As a result, these blockchains can seamlessly interact with Ethereum users through bridges, facilitating the transfer of assets to their own networks.

However, after Ethereum completes its transition to Proof-of-Stake through The Merge in September 2022, the next goal is to transition from EVM to Ethereum WebAssembly (eWASM).

eWASM is designed with high modularity and platform independence, being considered the next “game-changing” technology for the Ethereum protocol. It may drive other blockchains to adopt this smart contract execution environment. However, whether eWASM will completely replace EVM remains a question without a definitive answer.

Moreover, the recent Denouement upgrade has significantly improved EVM.

With continuous improvements, it is evident that Ethereum developers are striving to enhance performance and address the limitations of EVM. This will help Ethereum maintain its leading position in the blockchain space while opening up opportunities for other projects to keep up with trends and compete more fairly.

Conclusion

EVM is the dynamic heart behind the strong development of the Ethereum ecosystem and the entire blockchain industry. With its core ability to execute smart contracts and create decentralized applications (DApps), EVM has opened up a promising new universe for creativity and business in the cryptocurrency field.

After reading the article “What is EVM? Advantages and disadvantages of EVM for Ethereum” do you understand EVM? If not, please leave a comment below to get your questions answered right away!

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

i like evm

This is a well detailed article that covers or summarizes EVM . But please can you recommend books that are relevant to this article and also covers a wider scope of crypto currency ? Thank you