What is Ethereum Classic (ETC)?

Ethereum Classic (ETC) is a cryptocurrency developed based on Ethereum’s Blockchain technology. Initially, both Blockchains were similar to each other in every aspect. However, the discrepancy began when the second hard fork was implemented at block 1,920,000 of Ethereum, which returned all the stolen DAO funds to investors. Pre-hard fork transactions are still valid on the Ethereum Classic Blockchain, but since then, the two Blockchains have split and operate independently.

https://ethereumclassic.org/

However, Ethereum Classic retains the same key features as Ethereum, including the use of smart contracts and distributed techniques. Additionally, the technical specifications of Ethereum Classic are similar to Ethereum, including average block time, reward, and block size.

Reasons why Ethereum Classic was created

Ethereum’s 2nd Hard Fork was a controversial topic, causing the Ethereum community to split into two.

Here’s how to rewrite both sides’ positions in a more balanced and reasonable way:

Those who disagree with the Hard Fork say:

-

Cryptography is law The original DAO rules and terms should be respected.

-

All transactions on the blockchain cannot be interfered with. Hard fork will break the immutability principle of blockchain.

-

Refunding DAO investors could undermine trust in Ethereum.

-

This is considered an act of investor relief, contrary to the decentralized principle of blockchain.

Meanwhile, Hard Fork supporters say:

-

Laws need to be flexible to suit circumstances. Hard fork is necessary for the good of the community.

-

Hackers should not benefit from bad actions. Need to intervene to return justice.

-

ETH will be severely affected if the stolen ETH is left in the hands of hackers.

-

This is not a bailout action because it does not use community money, just a refund to investors.

-

The amount of money lost is huge and requires timely action to resolve it.

-

If no action is taken, the same thing could happen in the future.

Overall, both views have good reasons. Implementing a hard fork is a difficult decision that must consider the long-term interests of the Ethereum community.

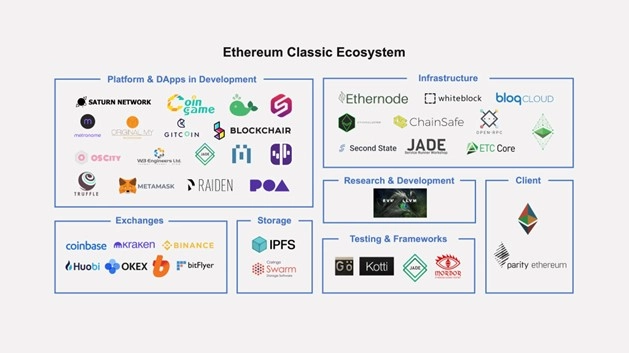

Ethereum Classic ecosystem

Compared to Ethereum, the number of projects developed on Ethereum Classic is quite limited, focusing mainly on a few areas: Infrastructure, Platform & Dapps,

Ethereum Classic and The Merge event

The Merge is a merger event between the Ethereum 1.0 blockchain using the Proof-of-Work consensus algorithm with the Ethereum 2.0 blockchain using the Proof-of-Stake algorithm.

This event is expected to take place in September 2022. At that time, miners must stop mining with mining machines and switch to staking ETH.

Due to the inability to continue mining, many miners are looking to alternatives such as Ethereum Classic. Recently, Antpool invested tens of millions of dollars into the Ethereum Classic ecosystem.

Related: What Is Ethereum (ETH)? An Overview of the ETH Project

Tokenomics of ETC

Basic information about ETC token

-

Token Name: Ethereum Classic

-

Ticker: ETC

-

Blockchain: Ethereum Classic

-

Token Standard: ERC-20

-

Token Type: Utility, Governance

-

Total Supply: 210,700,000 ETC

-

Circulating Supply: 210,700,000 ETC

ETC Token Allocation

Before the Hard Fork, there were more than 82 million Ether on the market, including:

-

72 million Ether was pre-mine by the development team for ICO.

-

More than 10 million Ether successfully mined from 2014 until Hard Fork.

After the Hard Fork event on July 20, 2016, Ethereum split into two chains, Ethereum Classic (ETC) and Ethereum (ETH). At that time, there were 82 million ETC coin and 82 million ETH coin tokens on the market at the same time.

If the user’s wallet before the Hard Fork contained 100 Ethereum, after the Hard Fork, the user’s wallet will have 100 ETC and 100 ETH at the same time. Users can sell ETC or ETH on the market.

This event is also related to speculation that the ETH Foundation and Vitalik Buterin, co-founder of Ethereum, sold off a large amount of ETC to hurt the project in the “bud”.

After the DAO Fork event, in March 2017, the Ethereum Classic community adopted a new monetary policy similar to Bitcoin. Ethereum Classic has limited supply to a total supply of 210,700,000 ETC and uses a Proof of Work (PoW) mechanism.

ETC Token Release Schedule

After nearly 5 years of mining, more than 55% of ETC is on the market. The block reward will decrease by 20% every 5 million blocks (approximately 2.4 years). On March 17, 2020, Ethereum Classic reduced mining rewards by 20% from 4 ETC/block to 3.2ETC/block.

Use Case

-

Pay gas fee on the network

-

Miner rewards help protect the safety of the network

Where to buy, sell and store Ethereum Classic (ETC)?

Currently, ETC is traded on many different exchanges with a total daily trading volume of about 4.8 billion USD. Exchanges listing this token include: Binance, Coinbase Exchange, Huobi Global, Kraken, MXEC, OKX, Kucoin, …

Users can also store ETC at the following wallet addresses: Metamask, Trust, …

Summary

Through this article, you probably have some basic information about the project to make your own investment decision. AZC News is not responsible for any of your investment decisions. Wishing you success and earning a lot of profit from this potential market.