In the ever-evolving world of finance, a new buzzword has emerged: DeFi. But what exactly is DeFi, and why is it garnering so much attention? If you’re new to the concept, fear not. This beginner’s guide to decentralized finance will break down the key aspects of DeFi, its benefits, risks, and how you can get involved.

What is DeFi? (Decentralized Finance)

Decentralized finance (DeFi) is a burgeoning financial technology utilizing secure distributed ledgers akin to those underpinning cryptocurrencies.

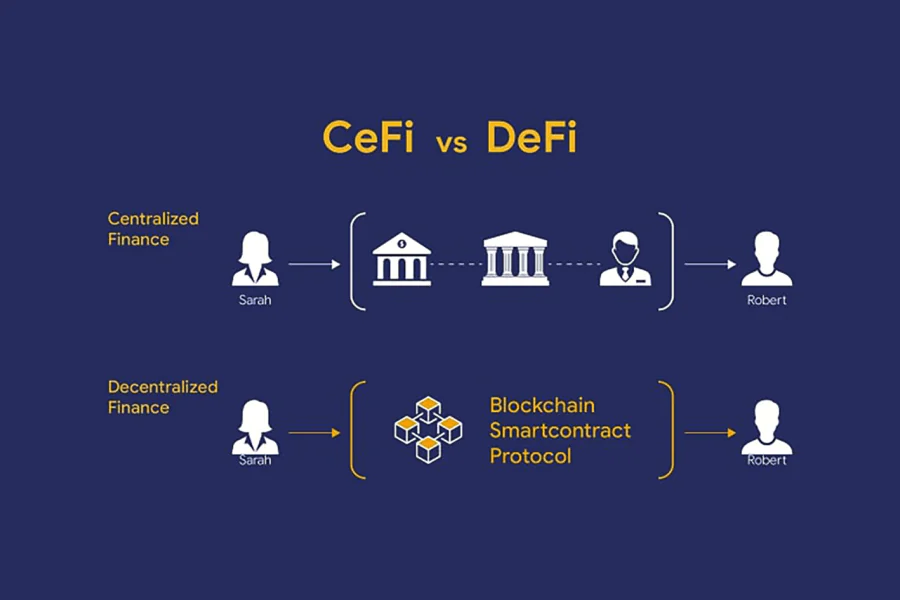

DeFi offers functionalities similar to traditional banking services—earning interest, borrowing, lending, purchasing insurance, trading derivatives, assets, and more—but with enhanced speed and devoid of cumbersome paperwork or intermediaries. Much like cryptocurrencies in general, DeFi operates on a global scale, facilitating peer-to-peer transactions without reliance on centralized systems. Transactions are pseudonymous and accessible to all.

In the United States, regulatory bodies such as the Federal Reserve and the Securities and Exchange Commission (SEC) establish guidelines for centralized financial institutions like banks and brokerages, which serve as the primary conduit for consumers to access capital and financial services. DeFi disrupts this centralized financial model by empowering individuals with direct peer-to-peer transactions.

How Does DeFi Work?

Users typically engage with DeFi via software called dapps (“decentralized apps”), most of which currently run on the Ethereum blockchain. Unlike a conventional bank, there is no application to fill out or account to open.

Here are some of the ways people are engaging with DeFi today:

-

Lending: Lend out your crypto and earn interest and rewards every minute – not once per month.

-

Getting a loan: Obtain a loan instantly without filling in paperwork, including extremely short-term “flash loans” that traditional financial institutions don’t offer.

-

Trading: Make peer-to-peer trades of certain crypto assets — as if you could buy and sell stocks without any kind of brokerage.

-

Saving for the future: Put some of your crypto into savings account alternatives and earn better interest rates than you’d typically get from a bank.

-

Buying derivatives: Make long or short bets on certain assets. Think of these as the crypto version of stock options or futures contracts.

Related: What is GameFi?

DeFi with Traditional Finance

What are the benefits?

- Financial Inclusion: One of the most significant advantages of DeFi is its potential for financial inclusion. Traditional financial systems often exclude individuals without access to banks. DeFi, on the other hand, only requires an internet connection, allowing anyone with a smartphone or computer to participate.

- Transparency and Security: DeFi transactions are recorded on a public ledger, ensuring transparency and security. This reduces the risk of fraud and corruption, as all transactions are visible to anyone on the blockchain.

- Accessibility: Accessing DeFi platforms is relatively straightforward. Users can connect their cryptocurrency wallets and start engaging with various DeFi services, such as lending, borrowing, and trading.

Risks and Challenges

- Smart Contract Vulnerabilities: While smart contracts offer automation and security, they are not immune to vulnerabilities. Bugs or errors in the contract code can lead to financial losses.

- Regulatory Uncertainty: The regulatory landscape for DeFi is still evolving. This uncertainty can pose risks for both users and developers, as governments worldwide consider how to regulate this emerging sector.

How to Get Started in Decentralized Finance (DeFi)

Getting started with decentralized finance (DeFi) might feel overwhelming initially, but there are numerous avenues to explore. To dive into DeFi, begin by researching the activities that pique your interest the most. A crucial step is acquiring a suitable wallet. With a plethora of options available, take the time to understand each one and select the one that aligns with your preferences.

Once you’ve chosen your wallet and identified the activities you wish to engage in, seek out a reputable exchange that facilitates your desired DeFi activities. Purchase some cryptocurrency through the exchange and commence your journey into DeFi.

Conclusion

In conclusion, DeFi represents a transformative shift in the world of finance. Its decentralized nature, transparency, and accessibility make it an attractive option for many. However, it’s crucial to be aware of the risks involved and approach DeFi with caution.