What is Chainlink?

Chainlink is a decentralized Oracle network founded by Sergey Nazarov in 2017. Initially operating on the Ethereum blockchain, its primary function is to bridge the gap between smart contracts and external data sources, ensuring secure access to off-chain information for these contracts.

However, with the introduction of innovative products like the Verifiable Random Function (VRF), Automations, and the Cross-Chain Interoperability Protocol (CCIP), Chainlink has significantly expanded its capabilities beyond being a mere Oracle provider.

What Problems Does Chainlink Solve?

Smart contracts on the blockchain have a critical limitation: they need off-chain data to function effectively but cannot directly access this data due to the isolated nature of blockchain environments. This limitation significantly constrains their real-world applications.

To bring data onto the blockchain, the most common solution is through an Oracle—a middleware that fetches data from the outside world and brings it into the blockchain. However, relying on a single centralized Oracle poses the “Oracle problem,” where the smart contract’s outcome could be compromised or manipulated by that Oracle.

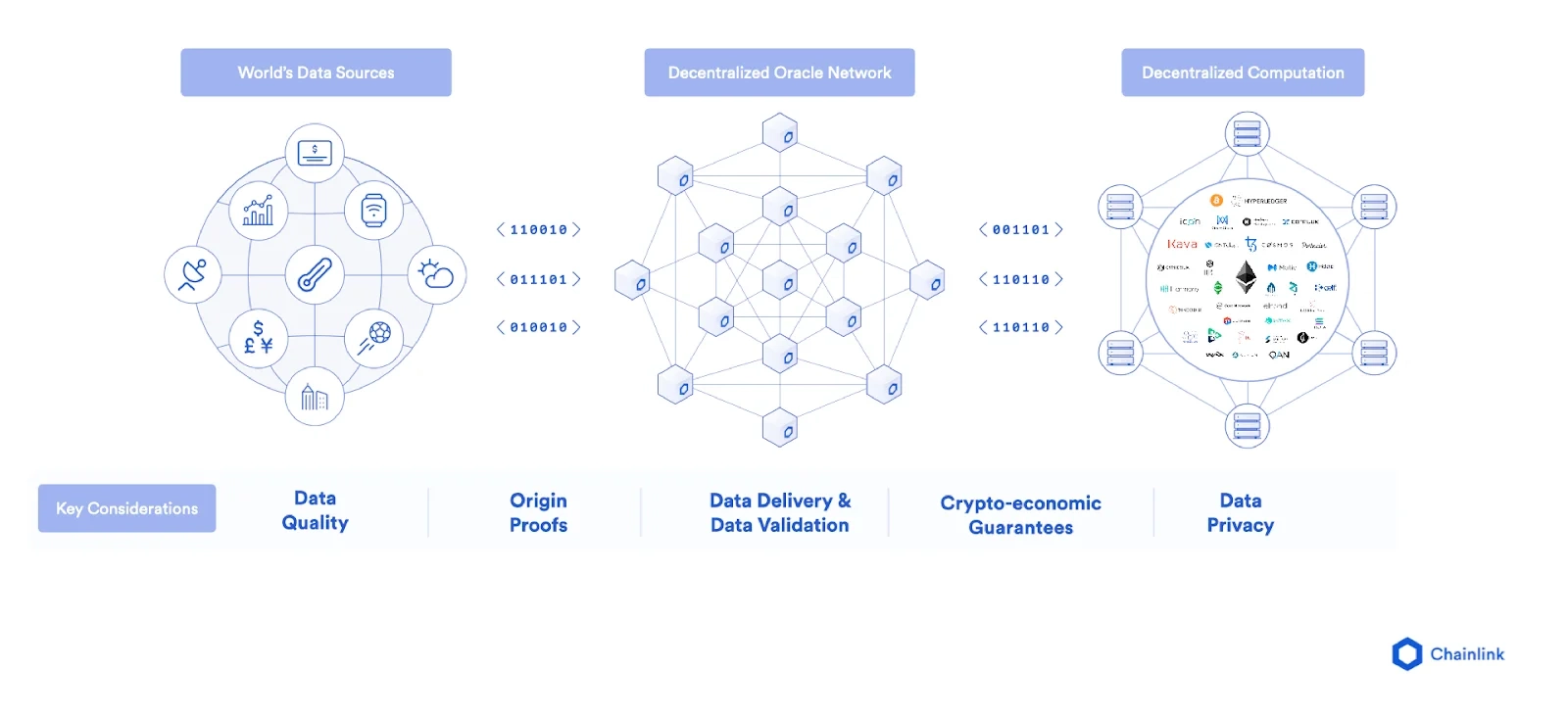

Chainlink addresses these challenges by constructing a sophisticated system comprising both on-chain and off-chain components:

- On-Chain: This includes smart contracts and Oracles that handle user data requests.

- Off-Chain: These are Oracle nodes operating outside the blockchain, connected to the Ethereum network. These nodes gather and process off-chain data before transmitting it on-chain via the Chainlink Core software.

Off-chain Oracle nodes are incentivized through the receipt of LINK tokens for their data collection and transmission services.

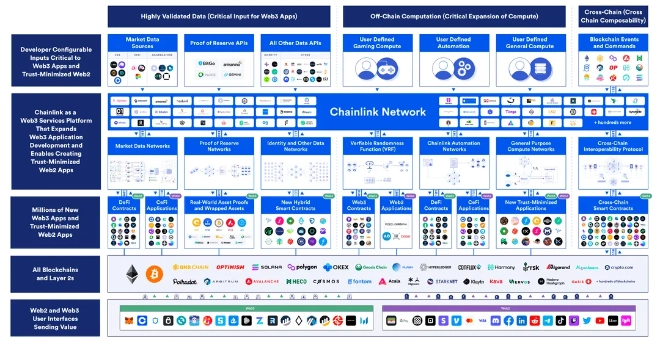

Chainlink’s Products

Market and Data Feeds

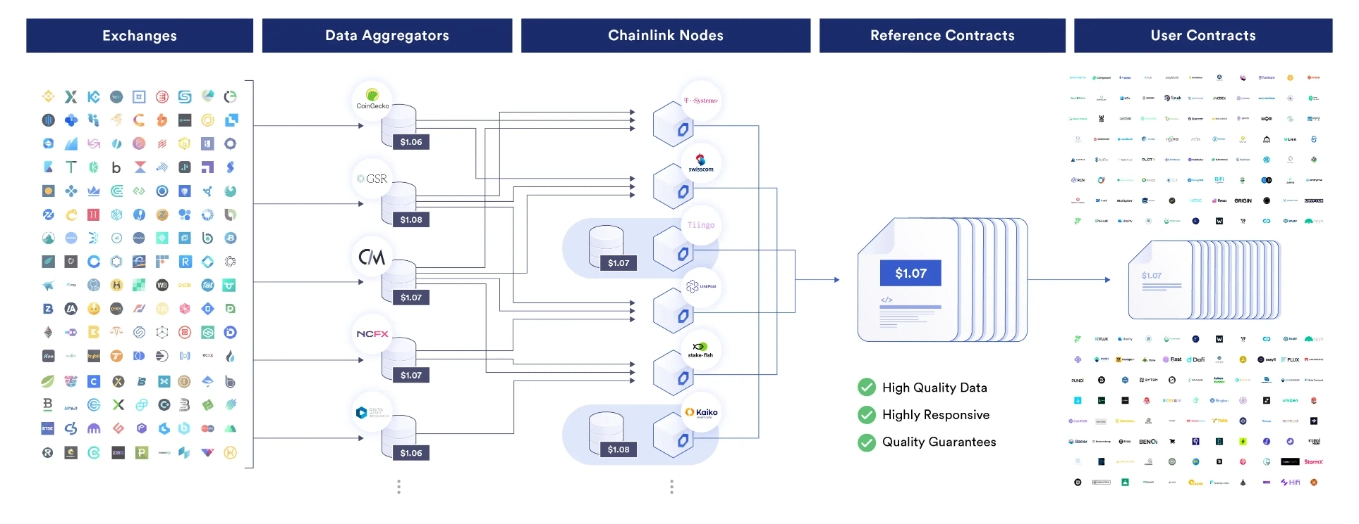

Chainlink offers a variety of price feeds for both cryptocurrency and traditional assets like Bitcoin, Ethereum, and USD, supporting DeFi applications and dApps through its Price Feeds. Key features of Chainlink Price Feeds include:

- Reliability: By leveraging a multi-oracle model and robust security measures, Chainlink ensures that price data is aggregated from numerous independent sources, minimizing the risk of inaccuracies and data manipulation.

- Transparency: Chainlink Price Feeds publish price information publicly on the blockchain, enabling anyone to verify the accuracy and integrity of the data.

- Broad Scope: Supporting a wide range of assets, from traditional currencies like USD and EUR to popular cryptocurrencies such as Bitcoin, Ethereum, and various altcoins, Chainlink expands the applicability and integration of diverse data sources.

Verifiable Random Function (VRF)

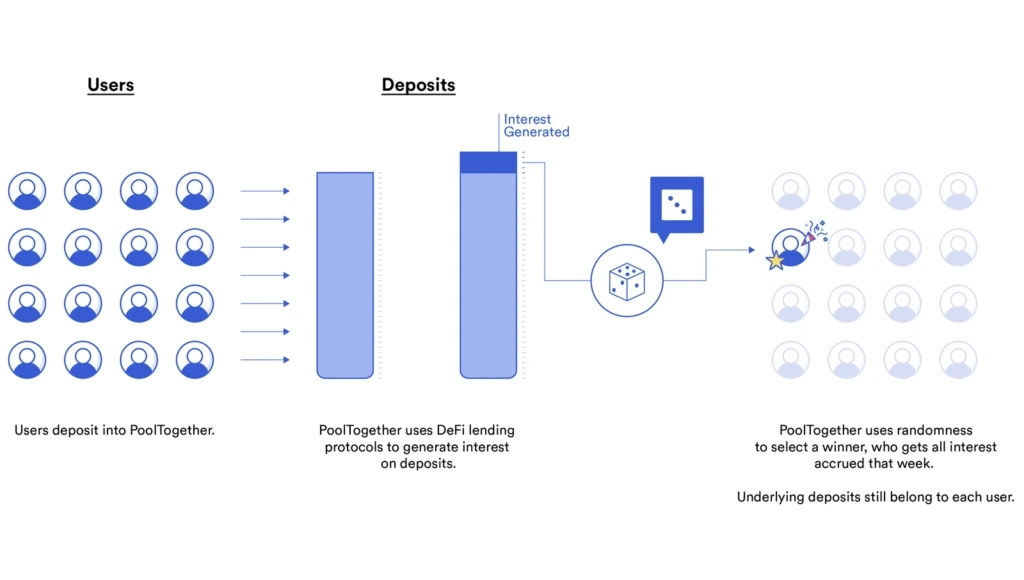

Chainlink VRF is a blockchain-based technology that generates verifiable random numbers, which are crucial in DeFi applications, particularly GameFi. This technology ensures that randomness is reliable and immune to manipulation or fraud. Key features include:

- Reliability: Chainlink VRF guarantees that random numbers generated within the decentralized environment cannot be controlled by any single entity.

- Verifiability: Built on the blockchain, the randomness produced by VRF can be validated for accuracy and trustworthiness.

- Unpredictability: The random numbers generated by Chainlink VRF are unpredictable, ensuring fairness and security in applications such as games, contests, or reward distributions.

Chainlink VRF catalyzed the GameFi boom in 2021, enabling GameFi projects to generate randomness for minting in-game items, opening Mystery Boxes, NFTs, and more.

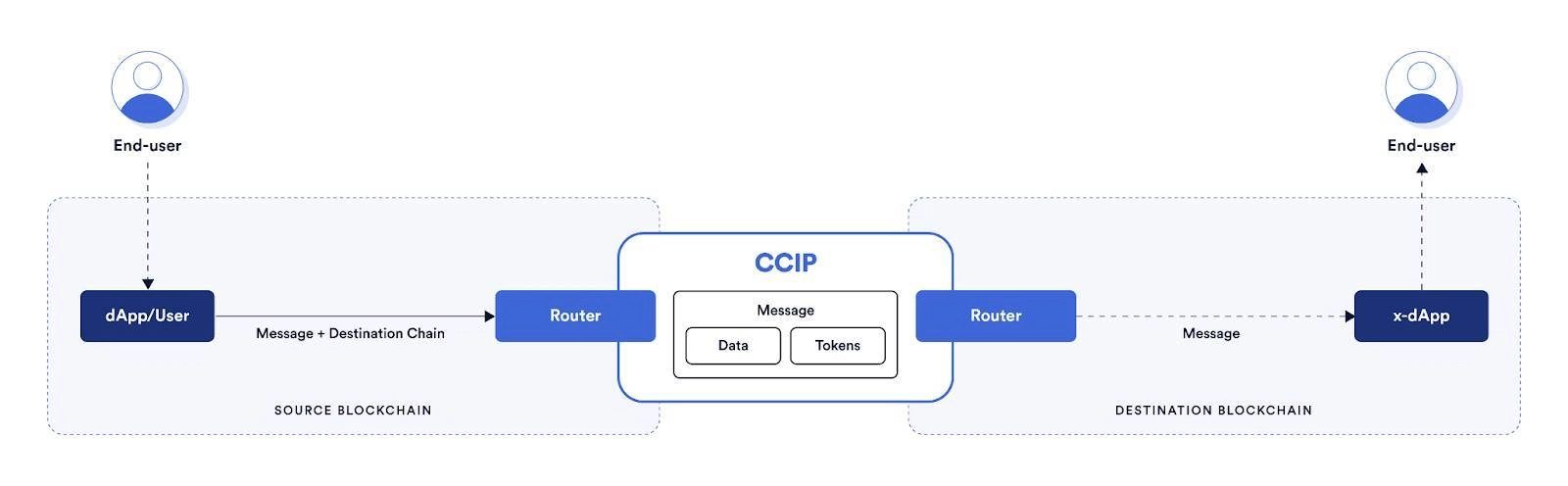

Cross-chain Communication

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) facilitates the secure transfer of assets and data across different blockchains, mitigating the risks associated with traditional cross-chain bridge solutions. Some applications of CCIP include:

- Cross-chain Lending: CCIP allows users to lend and borrow crypto assets across multiple DeFi platforms operating on separate blockchains.

- Transaction Cost Optimization: It helps offload transaction processing to cost-optimized blockchains.

- Performance Optimization Across Blockchains: Users can transfer collateral assets between DeFi protocols to maximize yields.

- Development of New dApps: CCIP enables leveraging network effects on certain blockchains while utilizing the computational and storage capabilities of others.

Currently, CCIP supports blockchains like Avalanche, Ethereum, Optimism, and Polygon, and users can register for Mainnet Early Access.

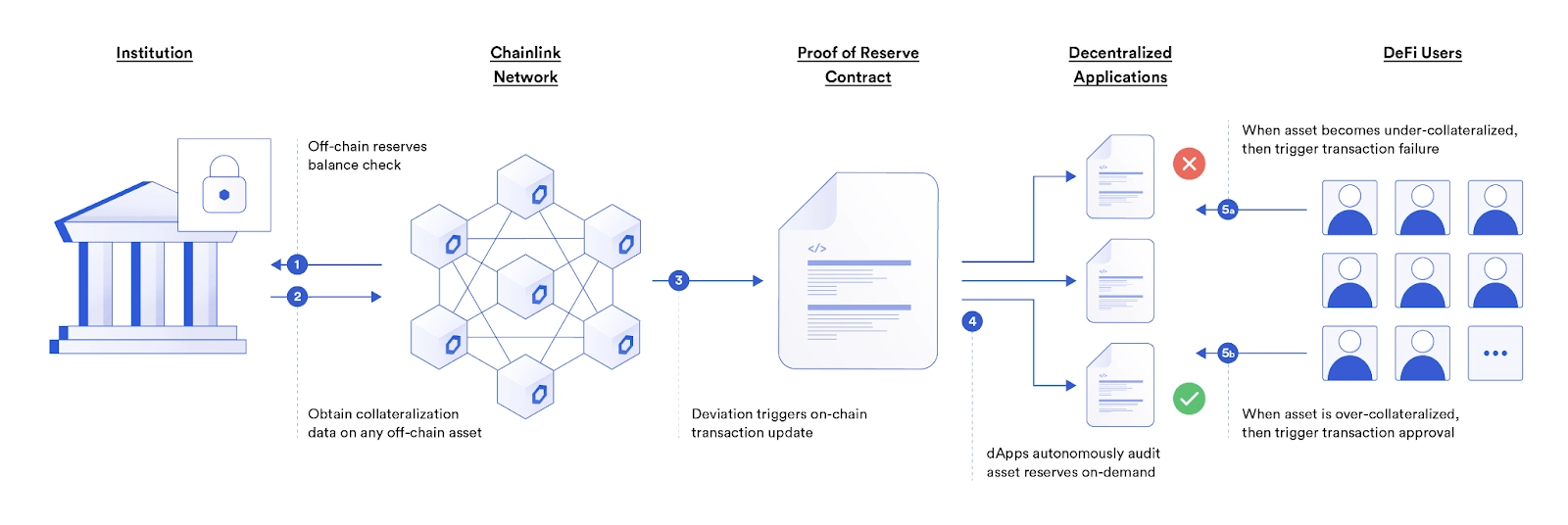

Proof of Reserves (POR)

Chainlink Proof of Reserves is a technology that verifies and certifies the adequacy of assets held within DeFi applications. This verification is crucial for ensuring that organizations and DeFi platforms possess the promised asset quantities, maintaining system transparency.

Deployed through a decentralized Oracle network, Chainlink POR allows automatic auditing of off-chain collateral assets to protect users from partial reserve practices or fraudulent activities by financial custodians.

Integrating Chainlink POR enables DeFi platforms to demonstrate that they hold sufficient assets to meet user requirements, preventing fraudulent activities. This builds user trust in DeFi platforms and other decentralized financial services.

Chainlink POR has been adopted by several projects, including Paxos, BitGo, and TrustToken.

Chainlink Data Streams

Chainlink Data Streams offer low-latency, verifiable off-chain market data on the blockchain. This enables dApps to access high-frequency market data on demand, supported by a decentralized and transparent infrastructure. Combined with Chainlink Automation, Data Streams facilitate automated trading and minimize the risk of front-running.

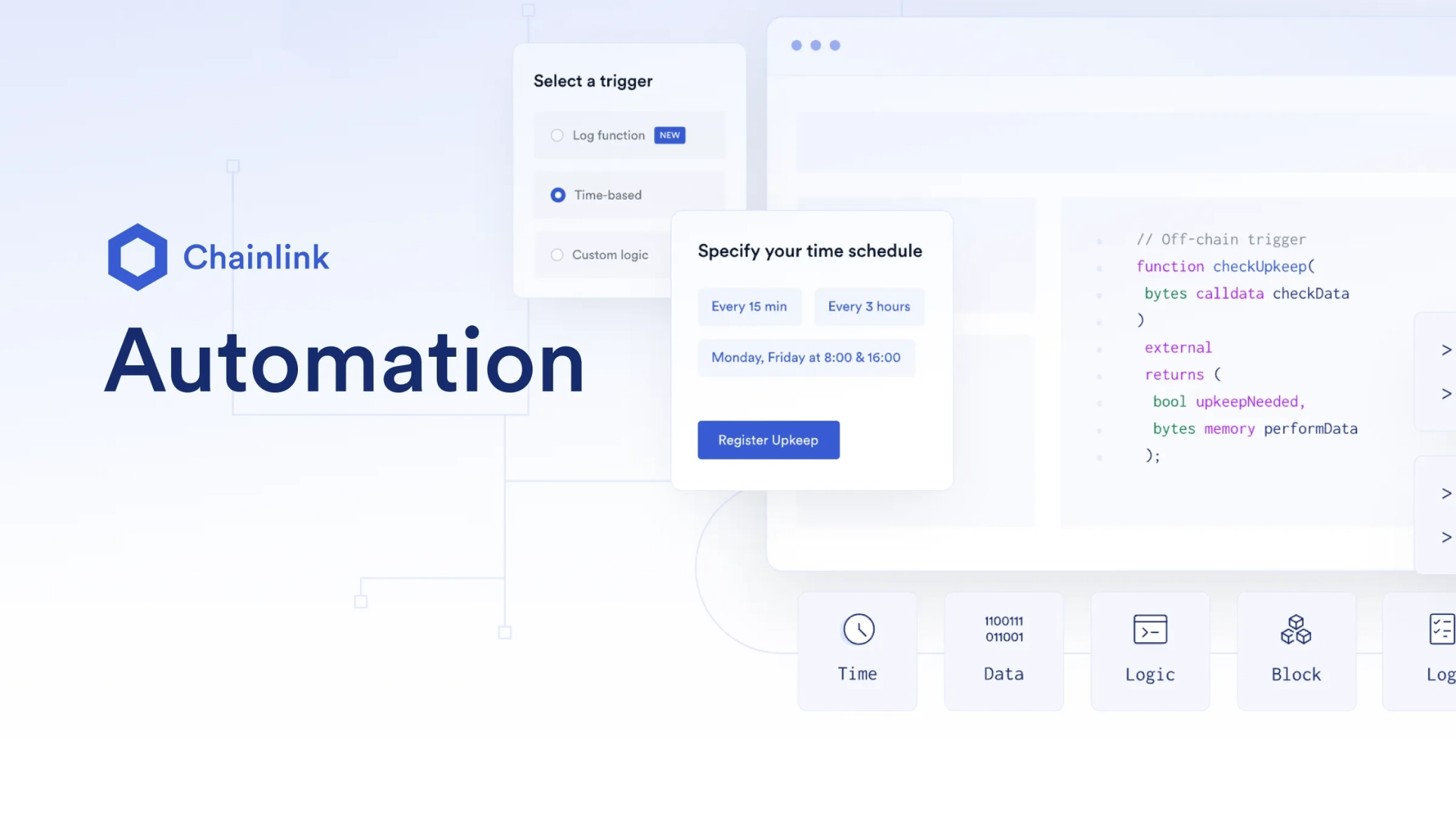

Automation

Chainlink Automation empowers Web3 developers to automate smart contract functions. It provides a toolkit for building automated workflows that can be triggered by external events or conditions, such as asset price changes, payment completions, or specific dates and times.

Currently, Automation is utilized by projects like StakeDAO and PancakeSwap.

Functions

Chainlink Functions is a serverless Web3 development platform that allows fetching any data from any API and running custom computations on Chainlink’s secure and reliable network.

This latest offering from Chainlink is already being used by partners like Dopex, Playground, Thirdweb, and BlockScholes.

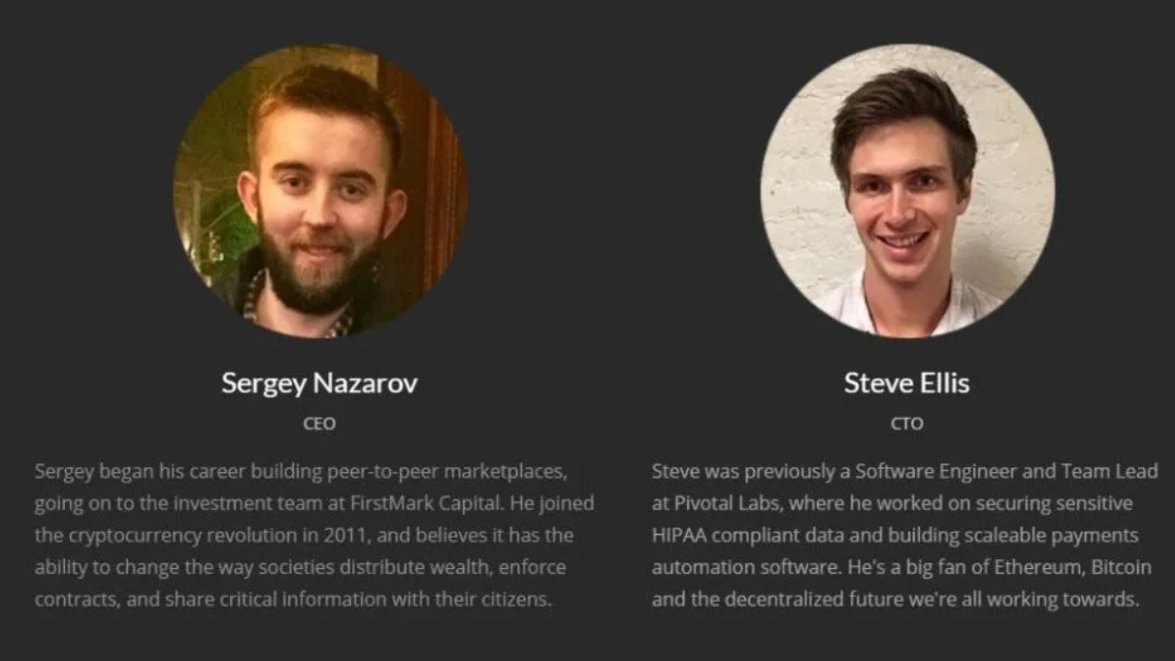

Team

Chainlink was launched under the leadership of Sergey Nazarov (CEO) and Steve Ellis (CTO) from the tech company SmartContract.

- Sergey Nazarov, the visionary CEO of Chainlink, is a renowned entrepreneur who founded several prominent projects before co-founding SmartContract. His ventures include Secure Asset Exchange and CryptoMail, a decentralized email service, demonstrating his deep expertise in smart contracts and blockchain technology.

- Steve Ellis, the CTO, brings a robust technical foundation to the project. Before joining forces with Sergey Nazarov at SmartContract, Steve worked as a software engineer at Pivotal Labs, a leading software development firm. He also co-founded Secure Asset Exchange with Sergey. Steve’s extensive software development experience and passion for blockchain technology have been instrumental in building and maintaining Chainlink’s technical infrastructure.

Under their leadership, Chainlink has quickly established itself as the leading decentralized Oracle network, laying the groundwork for numerous advanced blockchain applications and driving the growth of DeFi technology worldwide.

Investors

According to Crunchbase, Chainlink raised $32 million through a Pre-sale and ICO in September 2017, providing the necessary funding to support the development team.

Partners

Chainlink has one of the broadest partner ecosystems in the crypto space, spanning traditional markets, CeFi, and DeFi. Some key partnerships include:

- Blockchain Platforms: Ethereum, BNB Chain, Solana, Polygon, Avalanche, Arbitrum, Optimism, Fantom, Klaytn, Metis, Moonbeam, Moonriver, HECO, Harmony, Gnosis, and more.

- DeFi Projects: Uniswap, Aave, Compound, Beefy Finance, Coin98, MetaMask, PancakeSwap, and others.

- Traditional Companies: SWIFT, Google, Oracle, Intel, and Microsoft.

With thousands of partners, Chainlink has built a vast ecosystem.

Related: Chainlink Completes Collaboration Pilot with U.S. Banks

What is the LINK Token?

After exploring what Chainlink is, let’s delve into the project’s token—LINK.

Basic Information about LINK Token

- Token Name: Chainlink

- Ticker: LINK

- Blockchain: Ethereum, Near, Gnosis, BSC, Polygon, HECO, Optimism, Harmony, Avalanche, Arbitrum, Sora, Fantom, Milkomeda (Cardano), Energi, Osmosis.

- Smart Contract Address: 0x514910771AF9Ca656af840dff83E8264EcF986CA (Ethereum)

- Total Supply: 1,000,000,000 LINK

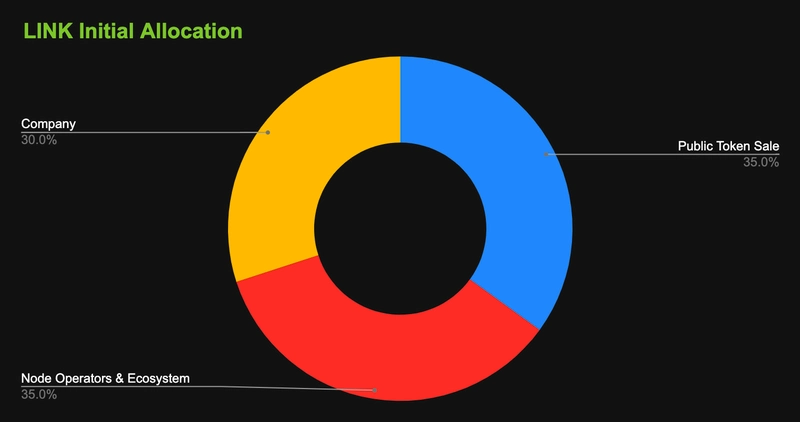

LINK Token Allocation

- Team Members: 30%

- Node Operators & Ecosystem: 35%

- Public Token Sale: 35%

LINK Token Release Schedule

The exact release schedule for LINK tokens is not publicly disclosed by Chainlink.

What is the LINK Token Used For?

- Payment: LINK is used as a payment method for services on the Chainlink network. Data providers are rewarded in LINK tokens.

- Staking: Data providers must stake a certain amount of LINK to ensure they always deliver accurate data. They are penalized by forfeiting their staked LINK if they act maliciously.

- Governance: LINK holders can participate in the governance of the Chainlink network, voting on proposals to change network parameters or add new features.

- Collateral and Liquidity Provision: LINK can be used as collateral and to provide liquidity in DeFi applications like Aave and decentralized exchanges (DEXs).

Trading LINK Tokens

LINK tokens are actively traded on most major exchanges such as Binance, Bybit, and Coinbase.

Related: How Do I Create a Binance Account? The Step-by-Step Guide

Roadmap

- Chainlink 1.0 (2017-2021): This phase focused on developing the world’s first decentralized Oracle platform. During this period, Chainlink introduced key services like Data Feeds and VRF.

- Chainlink 2.0 (2022-Present): This phase is centered on expanding and enhancing the Chainlink platform. It includes the development of new features such as Cross-chain Communication, Chainlink Staking, and Chainlink Keepers.

Similar Projects

Chainlink is classified in the Real World Assets (RWA) category alongside projects like ONDO and GFI.

Related: What is Real World Assets (RWA)? Top 5 Outstanding Projects

Project Information Channels

- Website : https://chain.link/

- Twitter: https://twitter.com/chainlink

- Discord: https://discord.com/invite/chainlink

Conclusion

Chainlink has made significant strides in enhancing data quality for its partners, cementing its leadership in the Oracle market. This success has laid a solid foundation for Chainlink to continue expanding and evolving.

With its extensive applications in both DeFi and CeFi, Chainlink has proven itself as one of the most valuable projects in the cryptocurrency market.

Through this article, we have provided an overview of Chainlink and its LINK Token. If you have any questions or need further clarification, please leave a comment, and we will respond promptly!

Happy investing!