What is AZCoiner Liquidity?

AZCoiner Liquidity is a liquidity pool developed based on the principles of Automatic Market Maker (AMM). Similar to any other Decentralized Finance (DeFi) exchange, it comprises various liquidity pools, with each liquidity pool containing two digital tokens.

You can contribute liquidity to these pools to become a liquidity provider, earning transaction fees and BNB rewards. Additionally, you can easily swap two digital tokens within the liquidity pools.

Note: Liquidity supports API functionality. For more information, please visit the Liquidity API Portal.

How to Use AZCoiner Liquidity?

- Log in to your AZCoiner app and click on [Web3].

Interface AZCoiner - Here, you will find your Web3 wallet address. Click on the icon on your right.

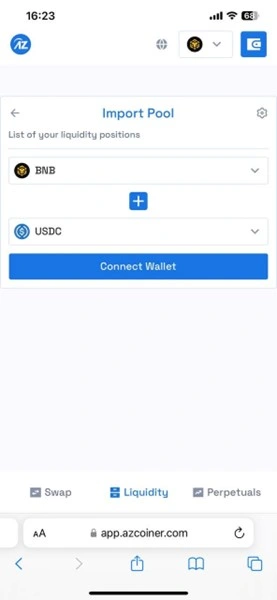

- Choose [AZCoiner Swap], then select [Liquidity].

- Connect your wallet, choose the token, and the network for adding Liquidity.

- If you decide to add liquidity to a liquidity pool with two tokens, enter the quantity for the first token, and the system will automatically display the required amount for the second token. Note that the final amount of the second token is determined by its price at the time of your order.

- If you decide to add liquidity to a single-token pool, the system will automatically convert it into the corresponding pool token proportionally. Please note that the corresponding transaction fee will incur during the conversion process.

How many types of products does AZCoiner Liquidity support?

There are two types of Liquidity Stable and Innovative.

- Stable: Developed with a hybrid constant function automatic market-making system model to facilitate transactions and pricing between two stable tokens, providing a low slippage trading experience. Prices of the two tokens in the pool are influenced by exchange rate/token price fluctuations, and rewards for liquidity providers are more stable compared to Innovative products.

- Innovative: Developed with a constant mean value automatic market-making system model to achieve transaction and pricing for two digital tokens. Prices of the two tokens in the pool are influenced by exchange rate/token price fluctuations, and rewards for liquidity providers fluctuate more greatly.

Related: AZCoiner Warning About Fake News

Some notes to consider when participating in AZCoiner Liquidity

- Current pool size: The composition of the pair in the current pool. When you add assets, you will also add them in proportion to the composition.

- Add: Provide liquidity for the liquidity pools.

- Remove: Remove your tokens from the liquidity pools.

- Price: The swap price between the pair in the pool. The final price depends on the proportion of the pair in the liquidity pool and is calculated by a formula.

- Portion: The pool portion you are expected to get after adding liquidity.

- Portion of the pool: The estimated share of the pool that you are expected to get after adding liquidity.

- Slippage: The estimated percentage that the ultimate executed price of the swap deviates from the current price due to the trading amount.

- Total Yield: The estimated annualized yield a user can expect to receive for providing liquidity in this pool.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

Great Network with a clear and trusted road map, keep it up.

好

okok

thanks