What is a Market Maker?

Market Maker (abbreviated as MM), also known as market makers, are entities that play a crucial role in ensuring the liquidity and efficiency of financial markets in general and cryptocurrencies in particular. They are large investors with abundant capital and extensive experience in trading assets such as tokens, stocks, bonds, forex, and commodities.

The primary function of Market Makers is to provide liquidity to the market by continuously buying and selling assets at quoted prices. They maintain a small spread between the bid and ask prices, creating liquidity for trades and attracting more participants. This contributes to increased trading volume and profits for Market Makers.

How important are Market Makers?

Continuous Liquidity Provision:

- Market Makers continuously provide buy and sell orders for various assets on exchanges. This helps supply liquidity to the market, allowing traders to buy and sell assets more easily. Their active participation through order placement helps narrow the gap between bid and ask prices, thereby maintaining market liquidity.

Reducing Market Volatility:

- The continuous buying and selling activities of Market Makers help absorb fluctuations in supply and demand in the market. This plays a crucial role in controlling and limiting price volatility, especially in highly liquid cryptocurrency markets. When there are sudden changes in demand, Market Makers can act as balancers by providing or absorbing the necessary supply, reducing price fluctuations.

Ensuring Smooth Market Operations:

- The presence and participation of Market Makers are essential factors in ensuring the market operates smoothly and efficiently. They help maintain flexibility and conditions for smooth transactions, avoiding market freezes or stagnation.

How do Market Makers operate?

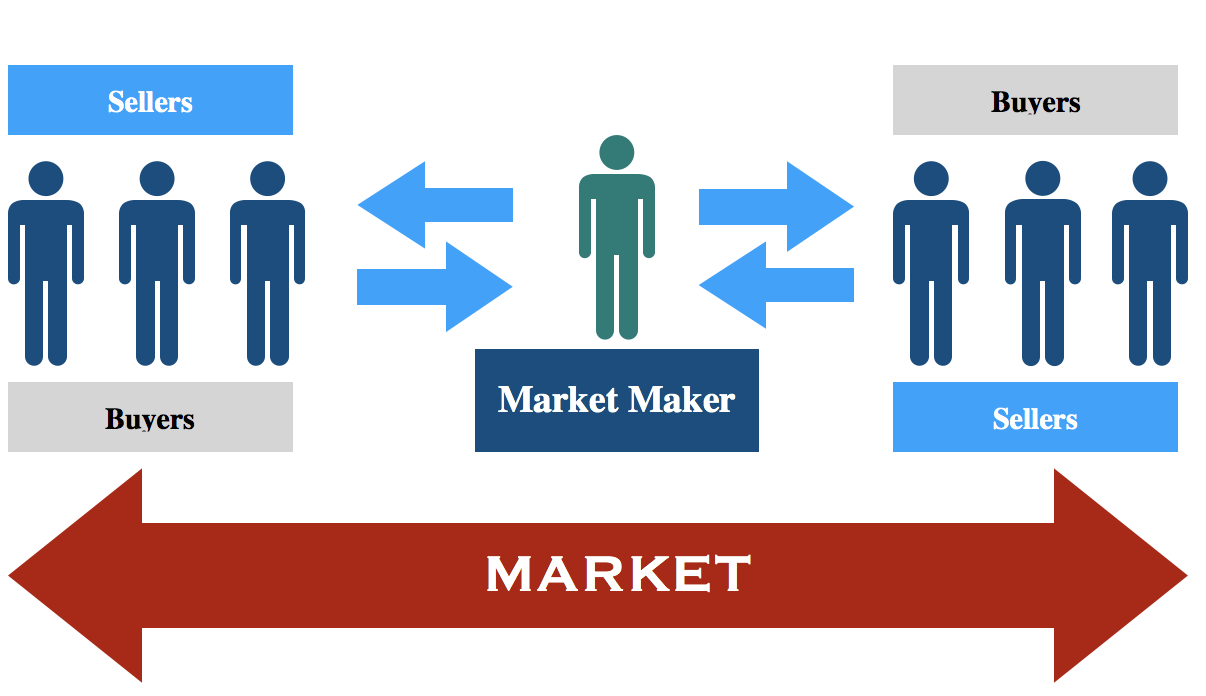

Market Makers act as intermediaries in asset trading by continuously providing bid (buy) and ask (sell) prices for various assets. Here’s how their mechanism works:

Setting Bid and Ask Prices:

- The bid price is the price at which Market Makers are willing to buy assets from investors.

- The ask price is the price at which Market Makers are willing to sell assets to investors.

Matching Trade Orders:

- When an investor wants to sell an asset, they place a sell order at the bid price of the Market Maker. Here, the Market Maker matches this sell order with a buy order from another investor or buys the asset from the investor at the bid price.

- Similarly, when an investor wants to buy an asset, they place a buy order at the ask price of the Market Maker. Here, the Market Maker matches this buy order with a sell order from another investor or sells the asset to the investor at the ask price.

Market Makers profit from the difference between the buy (bid) and sell (ask) prices, known as “spreads.” They always strive to maintain this spread at a reasonable level to attract high trading volumes and ensure liquidity for the market.

Register for a Binance account here.

How do Market Makers earn profits?

Market Makers play a crucial role in maintaining the liquidity and efficiency of financial markets. They earn profits through two main sources:

- Spread:The spread, or the price difference between the bid and ask prices, is a traditional source of income for Market Makers. They offer a bid price slightly lower than the ask price. When an investor wants to buy an asset at the ask price, the Market Maker matches this buy order with a sell order placed at a slightly lower bid price. The difference between the bid and ask prices is their profit.

- Commission Fees:In addition to spread income, Market Makers also charge commission fees on each transaction. These fees are typically applied to large investors who execute significant trading volumes.

The larger the trading volume, the more opportunities Market Makers have to profit from both spreads and transaction fees. Therefore, they are incentivized to maintain market liquidity and activity. However, to achieve this goal, some Market Makers may use marketing strategies like pump-and-dump activities to create FOMO effects (fear of missing out), attracting more investors, especially newcomers to the market.

Related: What is Pump and Dump? What Should You Do When This Phenomenon Occurs?

Benefits of Collaborating with a Market Maker

Collaborating with a reputable and reliable Market Maker brings several significant benefits to token issuers. These benefits include:

- Increased Liquidity:Continuous liquidity provided by Market Makers allows investors and founders to buy, sell, or liquidate their positions more easily on the market.

- Increased Trading Volume:Higher liquidity has the potential to attract more trading interest and demand for tokens due to lower transaction costs and reduced market impact. This contributes to increased token trading volumes.

- Reduced Price Manipulation Risks:With abundant liquidity, price manipulation of tokens becomes more difficult as it requires a significant capital to impact prices.

- Increased Project Visibility:Increased token trading volumes and the potential for listing on major exchanges generate more attention and discussion about the token project, enhancing brand recognition.

- Opportunities for Listing on Major Exchanges:Reputable cryptocurrency exchanges often prioritize listing tokens with stable and continuous liquidity from professional Market Makers.

FAQs

Q1: Do Market Makers affect market transparency?

Market Makers play a vital role in enhancing market transparency. They provide higher transparency by publicly displaying bid and ask prices in the market. This helps build trust and minimize disputes during trading, as investors can clearly observe current bid and ask prices.

Q2: Can Market Makers change asset prices?

Yes, Market Makers can influence asset prices by adjusting their bid and ask prices. Their impact on prices is usually more significant in less liquid markets, where supply and demand are more limited. By adjusting bid and ask prices, Market Makers can affect the trading prices of assets.

Q3: How can one identify a reliable Market Maker?

Some important characteristics of a reliable Market Maker include:

- A long history of operations and reputation in the industry.

- Providing stable and continuous liquidity to the market.

- Having a team of experts and extensive experience in the financial field.

- Adhering to high regulatory standards and business ethics.

- Being trusted and selected by leading exchanges and projects.

Q4: When should Web3 projects approach Market Makers?

Web3 projects should seek collaboration with Market Makers at various stages of development:

- Pre-token listing: New projects yet to list tokens can connect with Market Makers for advisory support and connections to major exchanges to increase the likelihood of successful token listing.

- Post-token listing: Projects that have already listed tokens can collaborate with Market Makers to provide stable liquidity, expand listing portfolios on multiple exchanges, and increase token trading volumes.

With their experience and deep industry relationships, Market Makers can effectively support Web3 projects in accessing and increasing liquidity in the cryptocurrency market.

Conclusion

Market Makers play a crucial role in maintaining liquidity and stability in financial markets. By placing buy and sell orders, they facilitate readiness for trading, reduce volatility, and ensure reasonable prices. Understanding this role not only helps individual investors make informed trading decisions but also builds a strong market.

Have you understood Market Makers through this article? If not, feel free to leave a comment below to get your questions answered!

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

Nice