A Decentralized Exchange (DEX) is a cryptocurrency trading platform that operates in a decentralized manner, eliminating the need for third-party intermediaries. Trades on a DEX are executed directly between participants through smart contracts, providing transparency and enhanced security. So, what is a DEX and why is it important in the cryptocurrency world? Let’s delve into that in this article!

What is a DEX?

A Decentralized Exchange (DEX) is a type of cryptocurrency exchange where trades are conducted without centralized supervision. This means there is no third party intervening or monitoring the trading process and storing digital assets. Instead, users have full control over their assets and can trade directly from their wallets.

Rather than using order books like centralized exchanges (CEX), DEXs typically rely on smart contracts to execute trades. However, trading volume on DEXs is often lower than CEXs, so DEX platforms often provide incentives to attract users to provide liquidity.

Liquidity Providers (LPs) are users who provide liquidity by depositing their digital assets into liquidity pools. They typically deposit an equal value of trading pairs (e.g., two types of tokens) to earn profits from cryptocurrency trading. Each trade on a DEX typically incurs a transaction fee, which is then distributed to liquidity providers.

DEXs eliminate the need for any supervisory authority and allow peer-to-peer cryptocurrency trading, safeguarding users’ privacy. Aggregator tools and wallet extensions have helped improve liquidity issues and enhance users’ trading experience in the decentralized finance (DeFi) space.

How Does a DEX Work?

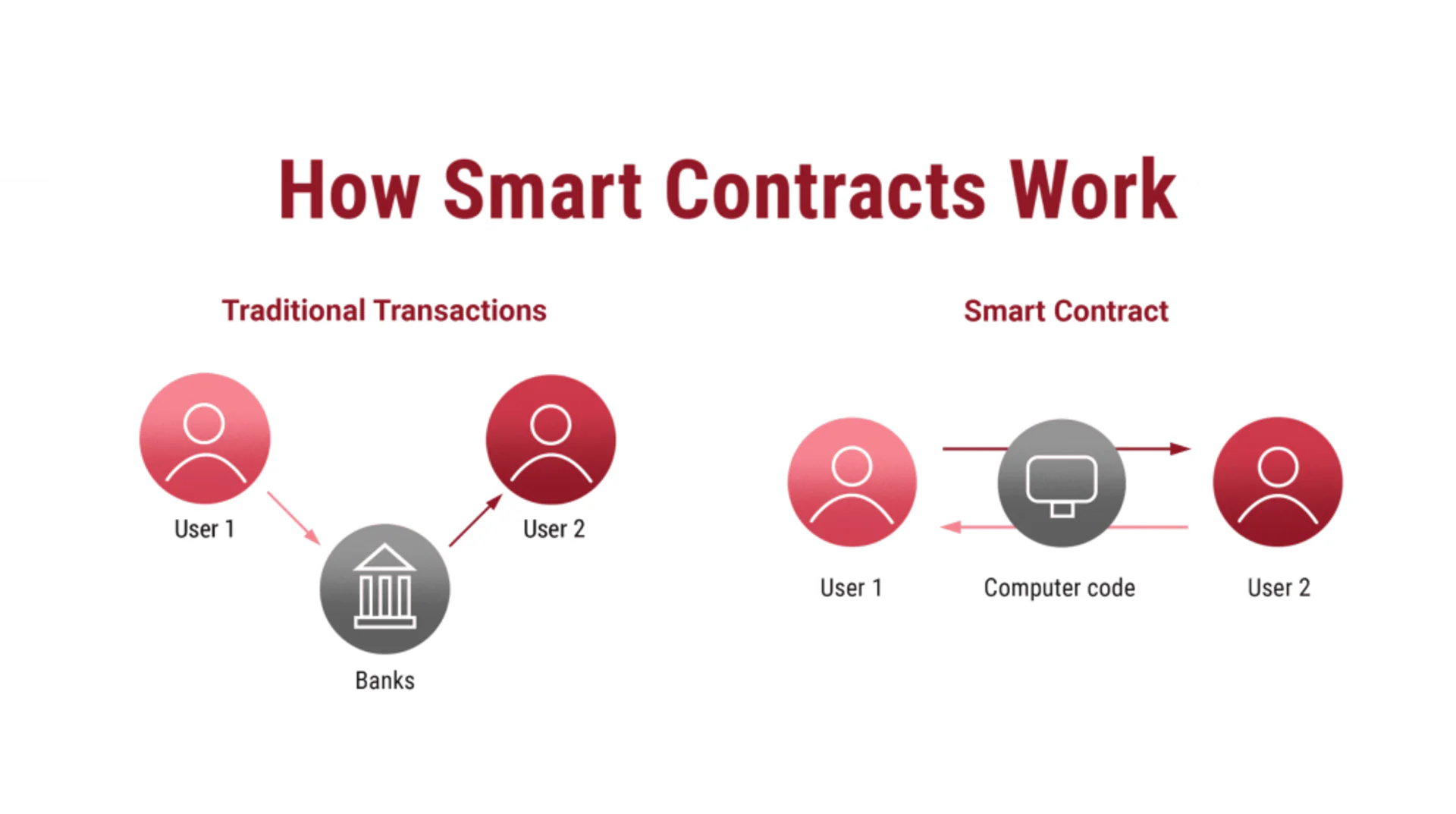

Having understood what a DEX is, let’s explore how it facilitates decentralized and anonymous cryptocurrency trading through the use of smart contracts – pieces of code that determine whether an agreement between two parties is executed and when. Smart contracts act as auxiliary aids on traditional exchanges – they only allow trades to be executed if the conditions of the agreement behind that trade are met.

- Smart Contracts: In most cases, a DEX creates a trading environment through smart contracts. These contracts contain specific code for trades and are deployed on the blockchain. When users execute trades on a DEX, they are effectively interacting directly with these smart contracts.

- Peer-to-Peer Trading: DEXs allow direct trading between users without the intervention of an intermediary. These trades are recorded on the blockchain, creating an immutable ledger. The lack of intermediaries helps protect users’ privacy and security.

- Liquidity Pools: To address liquidity issues, many DEXs use liquidity pools. These pools are supported by liquidity providers, who provide their digital assets to underpin trading on the platform. In return, they receive transaction fees or other rewards.

- Order Types: DEXs typically support simple order types like market orders and limit orders. However, more advanced platforms also provide features to execute more complex orders, helping users optimize their trading strategies.

- On-Chain and Off-Chain Operations: While most trades on a DEX are conducted on-chain, some platforms also use off-chain order matching mechanisms to improve their speed and efficiency. This combination of on-chain and off-chain operations helps provide a better trading experience for users.

- Fees and Gas Fees: While DEXs often reduce or eliminate intermediary fees, there are still other costs such as gas fees. Gas fees are the transaction fees paid in the native cryptocurrency of the blockchain network, necessary to process and validate transactions on the blockchain. These fees are directly transferred to network miners or validators.

Advantages and Disadvantages of DEXs

Advantages

- Reduced Fees: Decentralized exchanges reduce transaction fees compared to centralized exchanges, only charging network fees (gas fees) instead of other fees like deposit, withdrawal, and asset trading fees.

- Open Source and Transparency: DEX platforms are often open-source, creating a transparent and reliable trading environment, enabling users and developers to verify fairness and security.

- Resilience: DEXs have better resilience than centralized exchanges, reducing the risk of disruption due to the decentralized nature of the system.

Disadvantages

- User Experience: User experience on DEXs may not be as user-friendly as centralized exchanges, requiring users to have a deeper understanding of blockchain technology.

- Liquidity: DEXs often face challenges regarding liquidity compared to centralized exchanges, which can lead to higher price slippage and less favorable trading conditions.

- Speed: Transaction speed on DEXs may be slower due to the decentralized nature and factors like network congestion and block times.

Use Cases of DEXs

Token Swapping

One of the most prominent features of decentralized exchanges (DEXs) is the ability to swap tokens quickly and conveniently. Whether you want to exchange one cryptocurrency for another or participate in decentralized finance (DeFi) activities, DEXs always provide a simple means to conduct transactions without relying on any third party.

Initial Decentralized Offerings (IDO)

For projects looking to raise funds in a decentralized manner, DEX platforms offer a significant advantage. Initial Decentralized Offerings (IDOs) can be deployed directly on DEXs, allowing projects to raise funds without the need for a centralized entity, thus streamlining the fundraising process and making it more democratic.

Yield Farming and Liquidity Pools

For those looking to earn passive income through cryptocurrencies, DEX platforms often offer opportunities for yield farming and liquidity pools. By providing liquidity for a specific trading pair, users can earn rewards in the form of transaction fees or tokens. This not only incentivizes user participation but also helps address liquidity issues that many decentralized exchanges face.

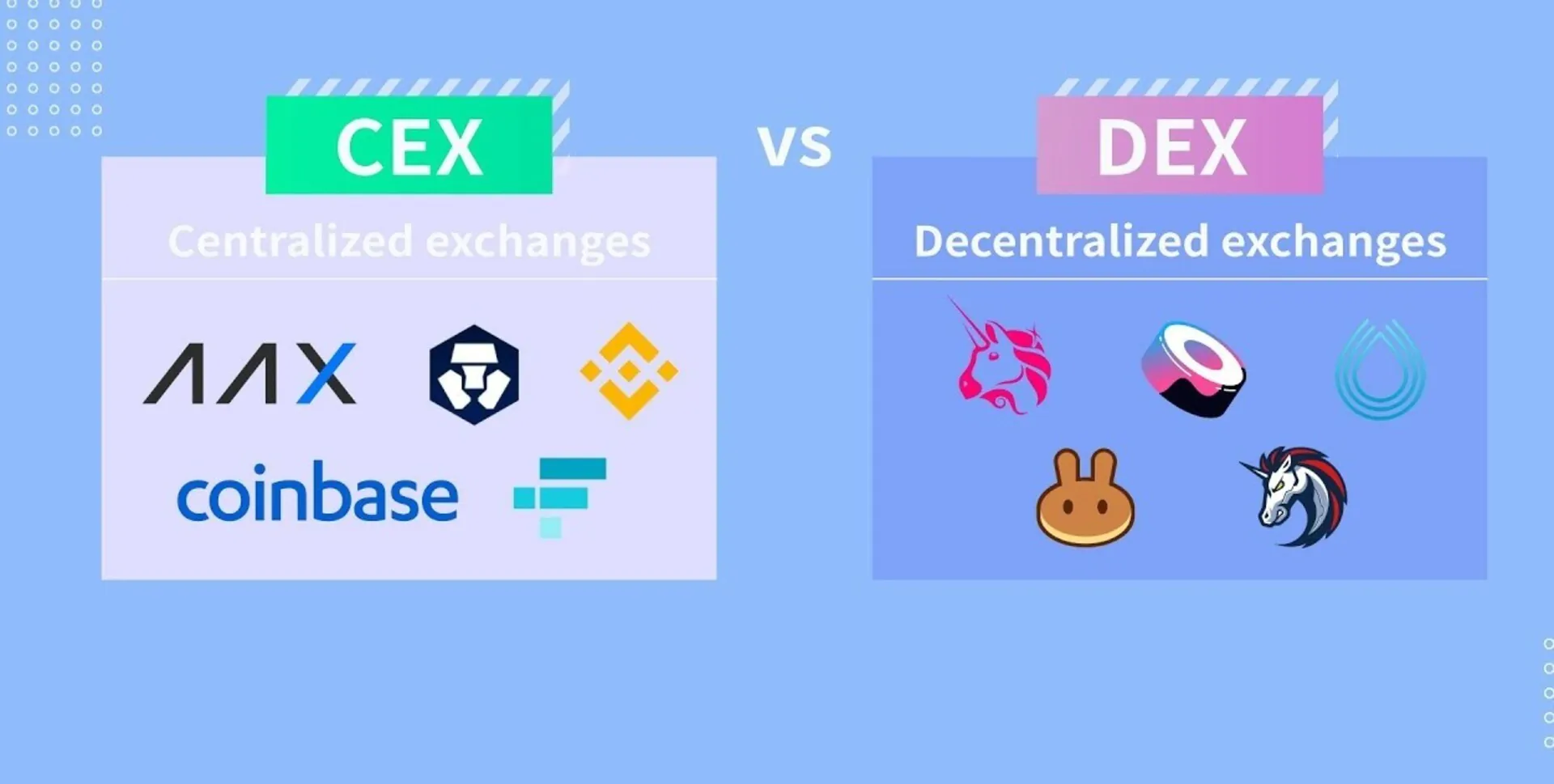

Differences Between DEXs and CEXs

Centralized Exchanges (CEXs) and Decentralized Exchanges (DEXs) are two common trading models in the cryptocurrency market. However, there are several fundamental differences between the two types of exchanges, influencing users’ experiences and choices.

- Centralization:

- CEX: Operates on a centralized platform, with an organization managing all transactions. Users need to create accounts and provide personal information.

- DEX: Operates on blockchain smart contracts, without a centralized intermediary. Users do not need to create accounts or provide personal information.

- Asset Management:

- CEX: Users need to deposit funds into the exchange’s account to conduct trades. The exchange holds control over their assets.

- DEX: Users hold their assets in personal wallets and only need to connect their wallets to the DEX through applications or gateways.

- Security:

- CEX: CEXs are often threatened by network attacks and security risks, as users’ assets are stored on centralized servers.

- DEX: There is no centralized point storing users’ assets, making DEXs potentially safer from network attacks.

- Transaction Fees:

- CEX: Transaction fees are often higher, including trading fees, withdrawal fees, and others.

- DEX: Transaction fees are typically lower, only including gas fees to execute trades on the blockchain.

- Liquidity:

- CEX: Higher liquidity due to more users and liquidity providers participating.

- DEX: Lower liquidity due to fewer trades and potentially limited liquidity providers.

Top 5 Notable Decentralized Exchanges (DEXs) in 2024

- Uniswap (UNI): Uniswap is one of the largest and most popular decentralized exchanges in the market. It primarily operates on the Ethereum network and is renowned for providing liquidity to DeFi tokens.

- SushiSwap (SUSHI): SushiSwap is a fork of Uniswap and quickly became one of the leading decentralized exchanges. It not only offers automated trading but also features like farming and yield aggregation.

- PancakeSwap (CAKE): PancakeSwap operates on the Binance Smart Chain (BSC) and has become one of the most popular decentralized exchanges on BSC. It’s known for features like staking, farming, and integration with other DeFi projects.

- dYdX: A decentralized exchange for derivative trading, primarily operating on Ethereum. There have been times when the 24-hour trading volume on dYdX surpassed even Uniswap.

- Curve Finance (CRV): Curve Finance focuses mainly on providing liquidity for stablecoin pairs. It aims to reduce slippage for trades between stablecoins and has become a vital decentralized exchange on the Ethereum network.

Conclusion

In summary, decentralized exchanges (DEXs) offer many benefits such as transparency, security, and diversity. Although there are still challenges such as low liquidity and security risks, the development of DEXs is driving the cryptocurrency market towards decentralization and greater safety. To safely participate in trading on DEXs, users need to understand how they work and the risk factors of this platform.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

0key