Whale Trader Flips $1B Bet, Shakes Up the Market

James Wynn made headlines after opening a $1 billion short position on Bitcoin with 40x leverage, risking nearly his entire $50 million wallet in a cross-margin trade. What made this move even more dramatic was that just hours earlier, he had closed a $1.2 billion long position on BTC, taking a $17.5 million loss after wrongly predicting that Bitcoin would reach $110,000.

Wynn’s short entry at an average price of $107,077 quickly paid off, reportedly netting him around $3 million as BTC dipped slightly. Despite the earlier loss, Wynn’s total profit on Hyperliquid still stands at over $40 million, showing the massive scale and impact of his trades.

HYPE Rallies Amid FOMO and Whale Moves

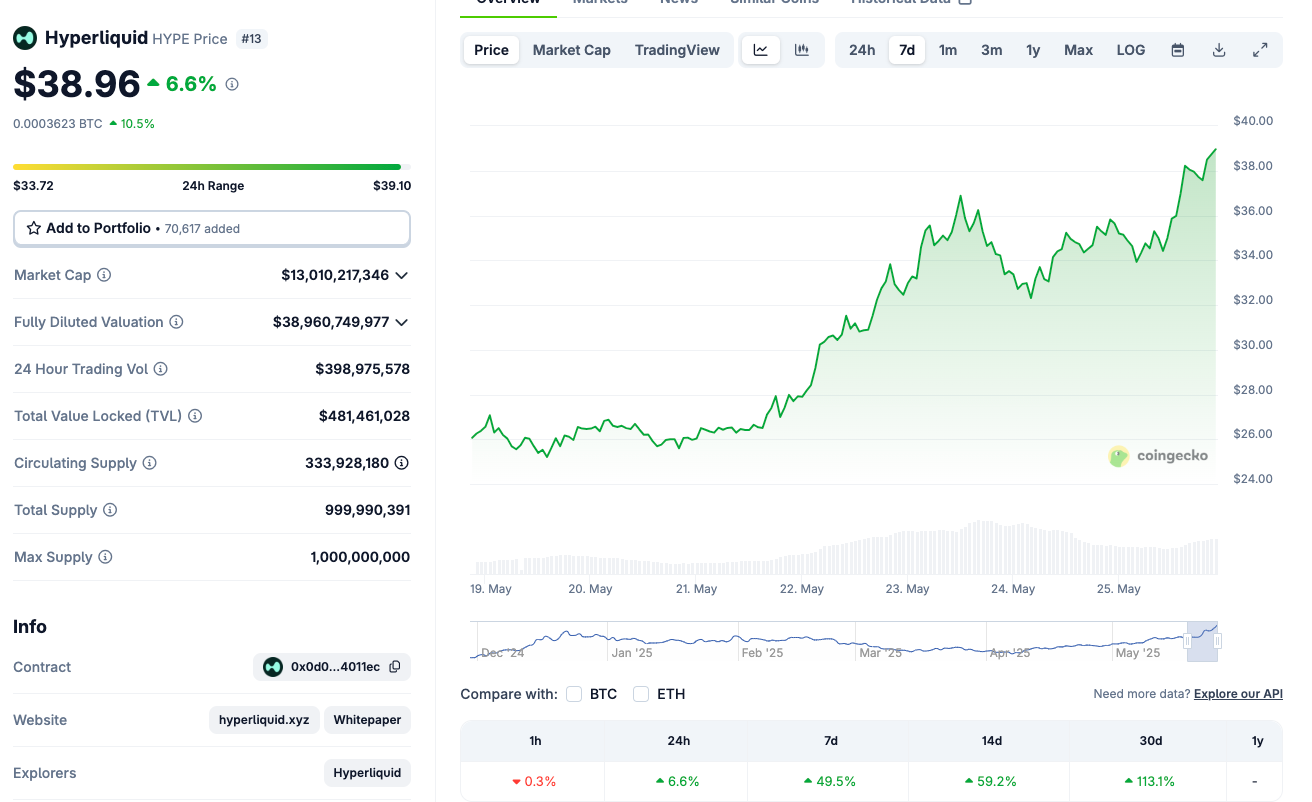

Alongside Wynn’s high-stakes actions, HYPE surged nearly 9% in just 24 hours, reaching close to its all-time high of $39. At the same time, its market cap soared past $13 billion — an impressive 113% increase over the past month.

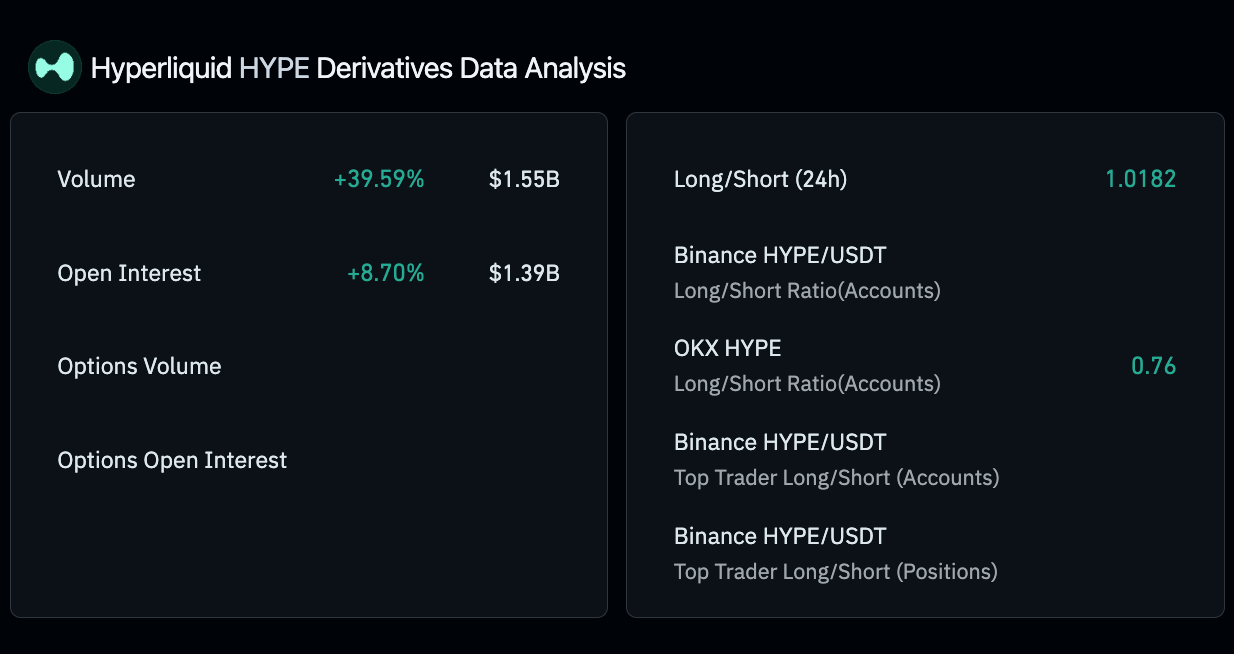

According to CoinGlass, open interest on Hyperliquid has also reached record levels, surpassing $1.3 billion. This spike reflects strong investor interest and confidence in further price gains, even as the token trades near peak levels.

The surge in trading volume and on-chain activity signals growing user trust in Hyperliquid’s platform, especially given its ability to handle billion-dollar positions like Wynn’s. These factors further solidify its position as a key player in the decentralized finance (DeFi) ecosystem.

Social Media Buzz Adds to the Momentum

Hyperliquid’s rise isn’t just happening on the charts — it’s going viral online too. According to LunarCrush, social media engagement for HYPE has exploded in the past month, with 25.6 million interactions, over 21,000 mentions, and content from 5,600 unique creators.

This wave of social attention, combined with record-breaking trades and rising open interest, paints the picture of a rapidly growing ecosystem. As traders like Wynn make billion-dollar bets and HYPE continues to climb, Hyperliquid is emerging as a major force in on-chain derivatives trading.

The big question now: can this bullish momentum continue, or is a correction around the corner?