As tensions between Israel and Iran escalate and the U.S. joins the conflict, Bitcoin has plummeted sharply, dropping to $98,500—its lowest level in months. The crypto market turned red across the board, shaking investor confidence. Yet, Changpeng Zhao (CZ), former CEO of Binance, offered a completely different take: “This is just a dip before Bitcoin reaches a new all-time high.”

From Peak to Plunge: Bitcoin Tumbles Amid Global Unrest

Just a month ago, Bitcoin was soaring, hitting a new all-time high of $111,900, capping off a strong year-long rally. However, escalating geopolitical turmoil—especially in the Middle East—combined with weak macroeconomic outlooks have sent the leading cryptocurrency spiraling downward, triggering panic across the crypto space.

In the past 24 hours, the global crypto market has shed 1.24% of its capitalization, with over $658 million in liquidations, affecting nearly 188,000 traders. Altcoins like Ethereum and Solana weren’t spared either. The Altcoin Season Index dropped to a two-year low, and hopes for a bull run in 2025 are starting to fade.

Earlier this year, many analysts predicted Bitcoin could hit $150,000 by mid-2025. But now, unexpected shifts in geopolitics and delayed interest rate cuts have thrown those projections off course.

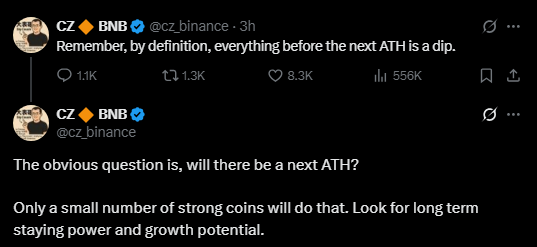

CZ: “Every Dip Is Just a Setup for the Next ATH”

In the midst of market panic, CZ remains calm. According to him, every deep correction is just part of the journey toward Bitcoin’s next all-time high (ATH). Still, he emphasized, “Not all coins will make it. Only a few strong ones have what it takes. Look for long-term resilience and real growth potential.”

Many market experts agree. Analyst SightBringer, for example, believes Bitcoin is fundamentally built for new ATHs due to its scarcity and growing demand.

However, the market is clearly undergoing a strong filtering process. Tokens lacking real utility, competitive edge, or the ability to adapt to shifting trends are likely to be left behind.

The crypto market is at a critical juncture. While Bitcoin may recover and reach new highs, it won’t be a smooth ride. Investors must stay tuned to economic, political, and technological developments—and trade strategically, rather than follow the crowd.