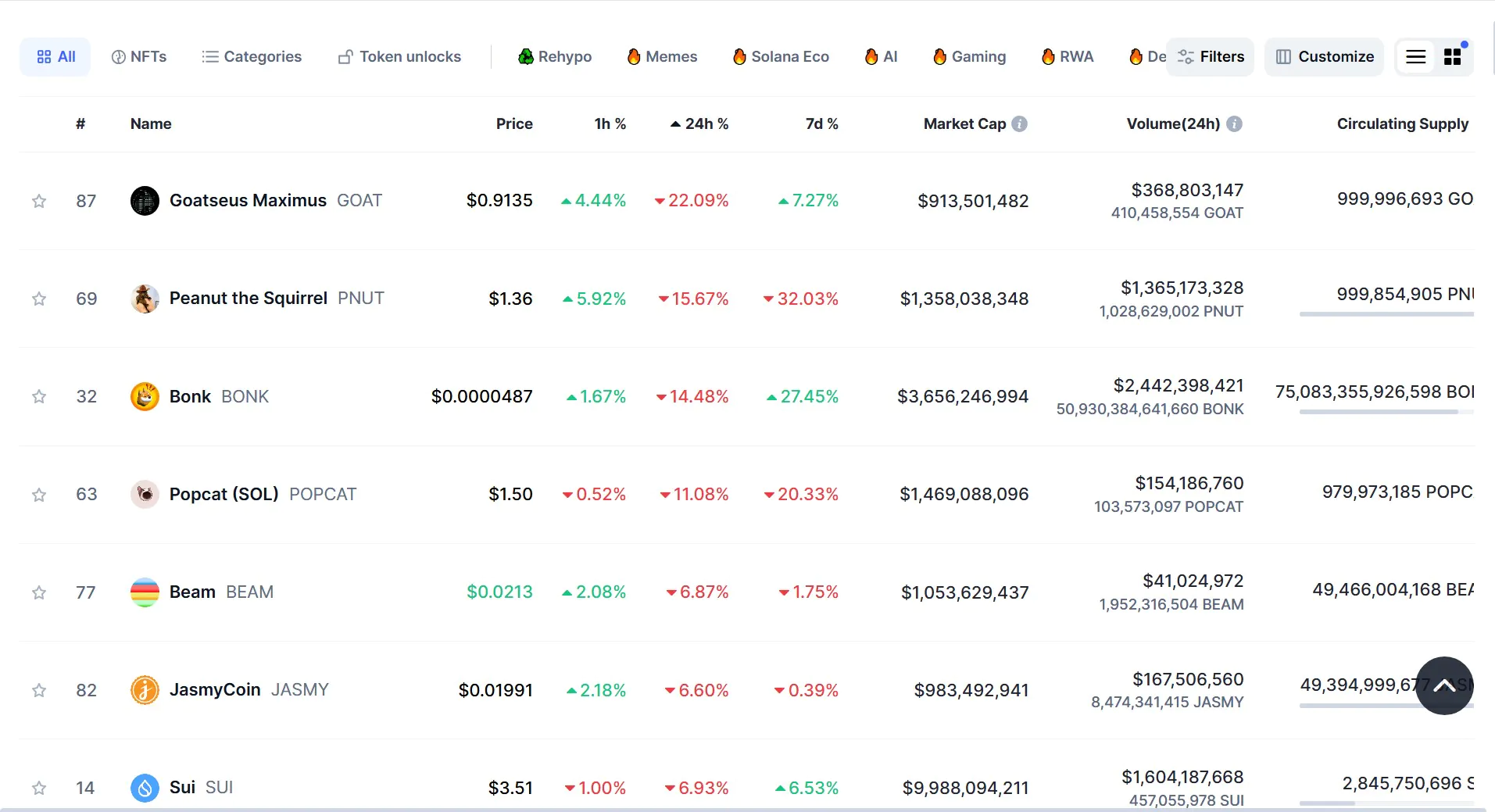

Goatseus Maximus (GOAT), the leading AI meme coin, launched on Pump.fun – Solana’s largest token issuance platform [SOL], has seen notable market movements.

Currently, GOAT is trading at $0.91, down more than 20% in 24 hours. After reaching $1.40, GOAT faced strong selling pressure, resulting in a significant pullback. This is a key resistance level, creating bearish pressure. During the decline, the token began to retest support support levels, which are often retested to stabilize the price.

Crypto analyst Miles Deutscher identified that GOAT’s price is following “indicator currencies”, representing support zones through gray bands on the chart. Deutscher highlighted that GOAT has “bounced from this level” multiple times before recording new price increases.

Market Transition Potential

According to data from Coinalyze, the Open Interest (OI) for GOAT perpetual futures is at $238.8 million, down 1.75% over the past 24 hours. This is a relief from the slowing trading activity, as some advisors may have closed positions that have caused recent price volatility.

Currently, Binance and Bybitsystem account for GOAT perpetual futures market capitalization, accounting for a combined 94% of total OI. Of this, Binance holds $122.7 million, while Bybit tracks with $102.6 million. Other platforms such as OKX, Kraken, and WOO X contribute smaller portions.

Market Deployment and Trading Action

GOAT’s current price action reflects the general trend direction in the market: short-term corrections often appear after extended periods of price increases.

The ability to maintain support levels during the correction phase will play a decisive role in whether this defining data token can continue its upward trajectory.