Introducing Aave

Aave Protocol (AAVE) is a decentralized cryptocurrency lending protocol (DeFi Lending), built on a blockchain platform and operating on smart contracts. In Aave, users have the ability to borrow and lend different cryptocurrencies, using stablecoins or other coins. In Aave, users have the ability to borrow and lend different cryptocurrencies, using stablecoins or other coins. Do you think about The Features Of Aave?

Aave has achieved success thanks to the security guaranteed through Nexus Mutual’s smart contract insurance and low costs due to the lending process not having to go through a third party. Anonymity between lender and borrower is also guaranteed, and the entire borrowing and lending process can take place instantly on a global scale. This is truly a method of generating passive income in the digital age.

https://aave.com/

The Features Of Aave

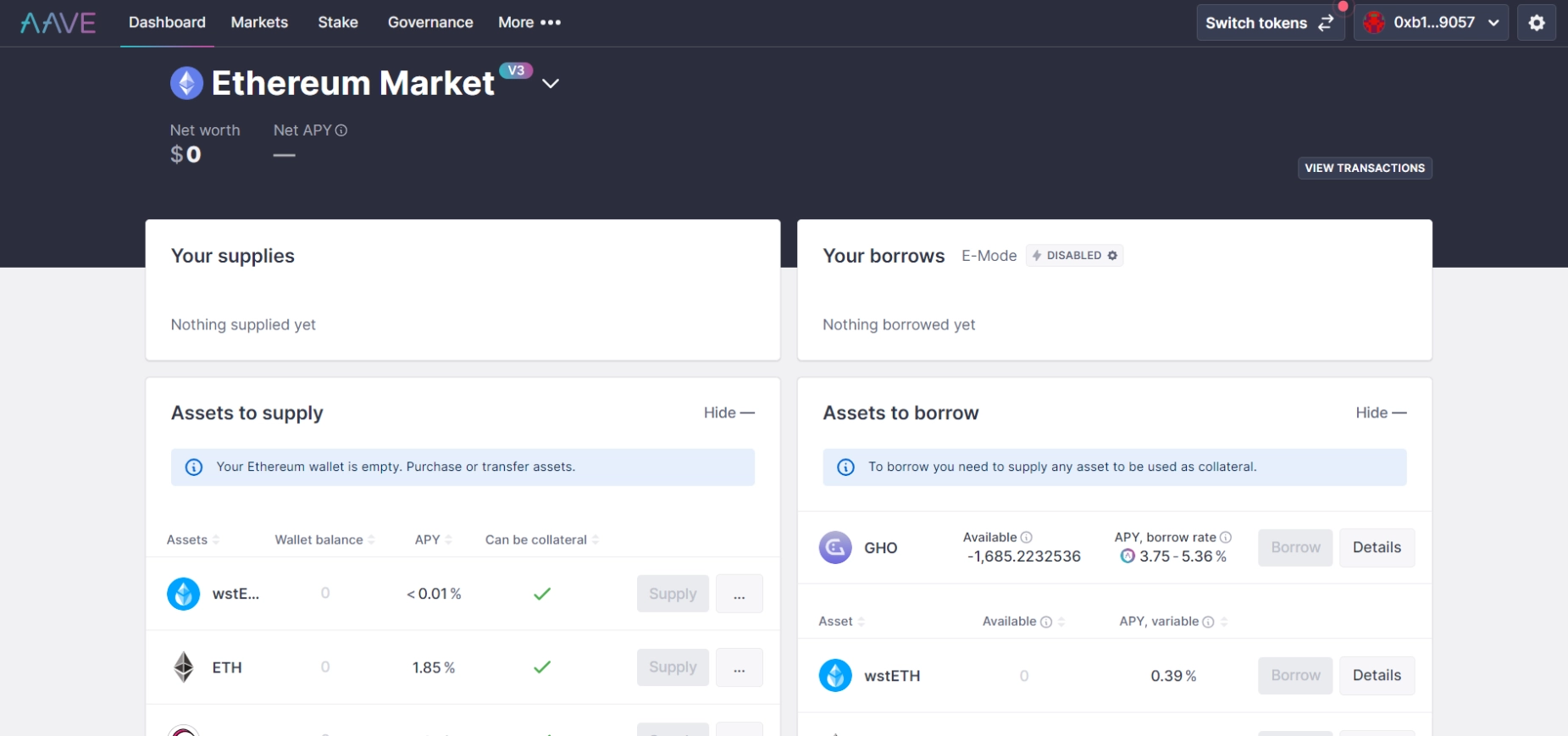

Dashboard

This is an interface that displays crypto assets that users can lend or borrow on various blockchains. Including both versions V2 and V3. Additionally, users can also view APY interest rates for lending or borrowing here.

Dashboard feature of Aave

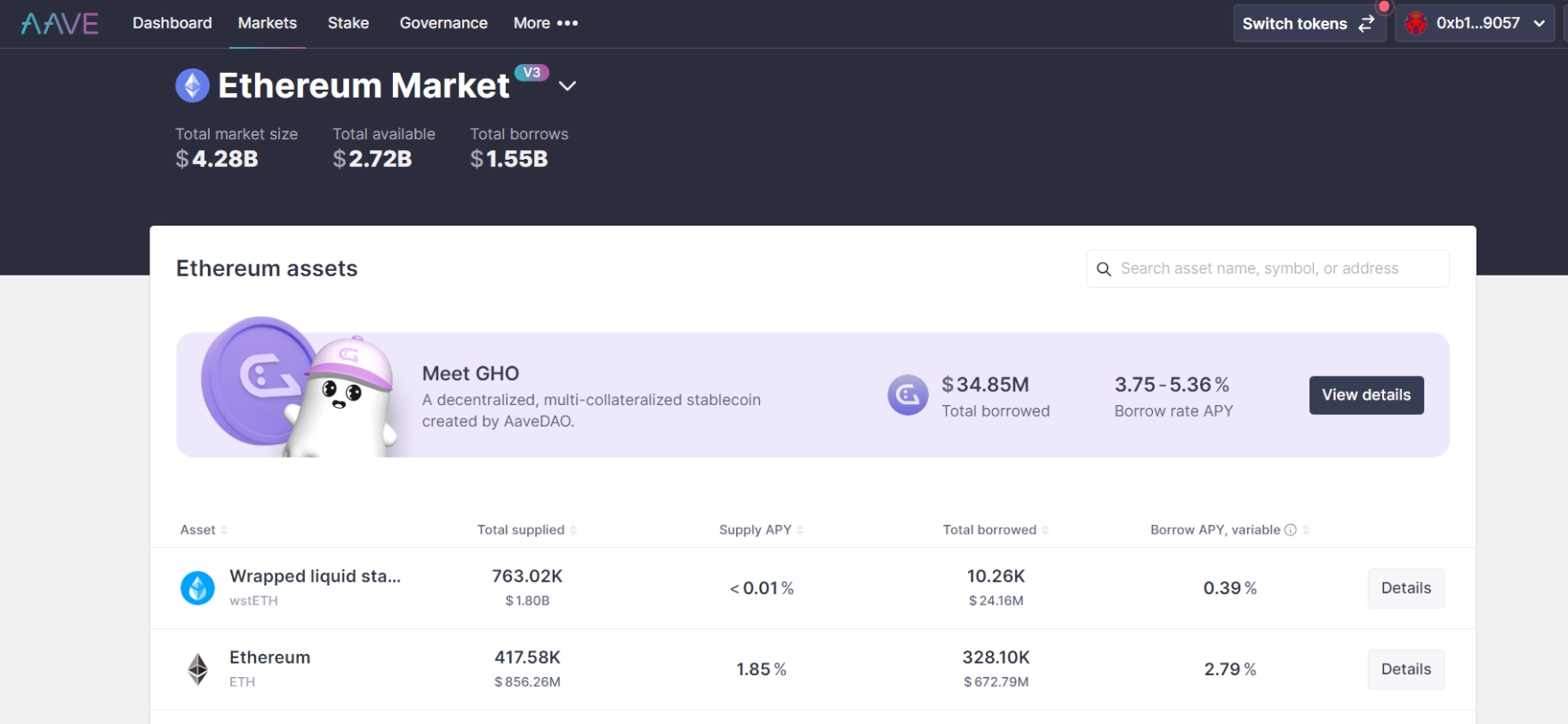

Market

This is the interface that displays all crypto assets that Aave supports. Where users can make lending or borrowing on many different blockchains. Including both versions V2 and V3. Here, users can track the APY index when participating in the lending or borrowing process for a specific asset.

Market feature of Aave

Users can select a specific asset and select “Supply” to carry out the loan process. Or choose “Borrow” to borrow by mortgaging assets. Aave also classifies asset types according to two mechanisms: eMode or Isolated Mode. Helps users have more information when going through the loan process.

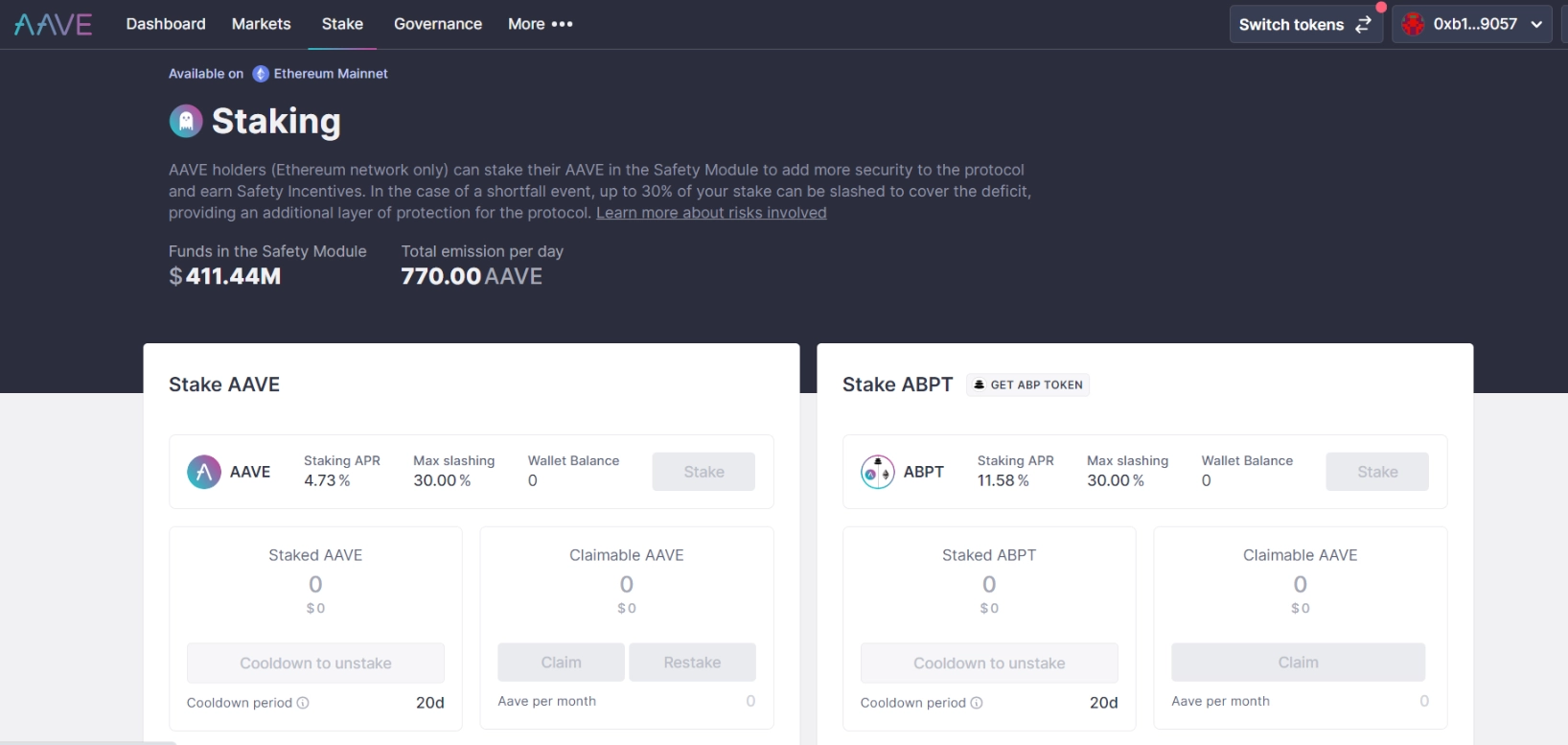

Stake

This is where users can place AAVE tokens into the Safety Module to receive stkAAVE from the protocol. In case of a shortfall event. Aave will sell AAVE in the Safety Module (up to 30%) to compensate for the shortfall. In return, users will receive a reward of Safety Incentives with 550 stkAAVE distributed every day. When the user wants to withdraw AAVE. They must wait 10 days before they can withdraw AAVE from stkAAVE, to avoid affecting the entire protocol.

Staking feature of Aave

Governance

This is where recommendations are displayed for users holding AAVE tokens who can cast governance votes on protocol decisions here.

Governance feature of Aave

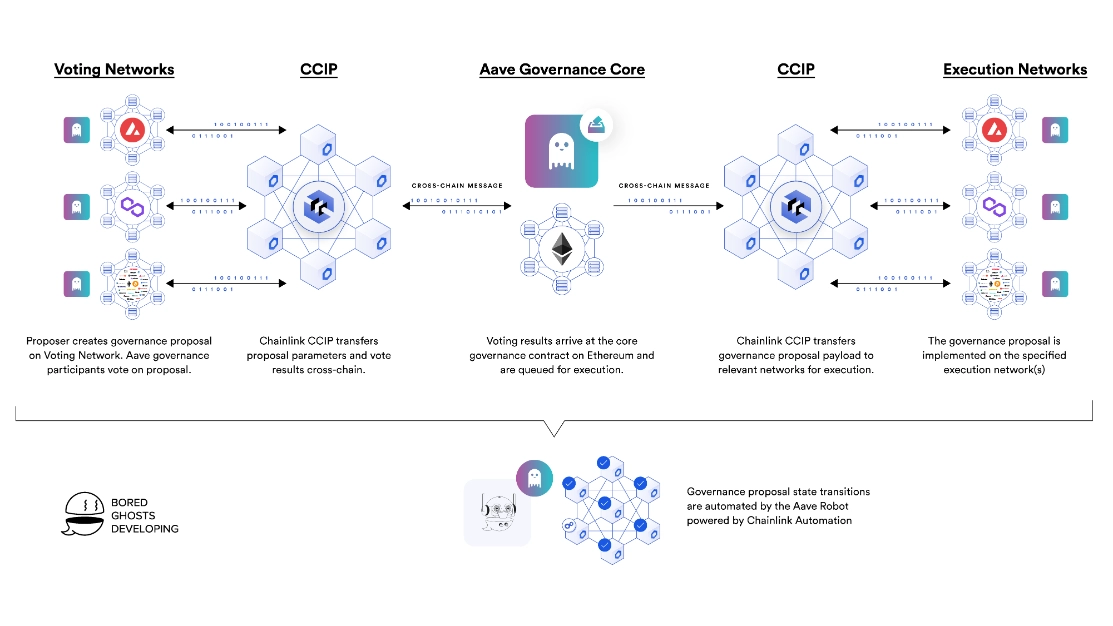

Furthermore, BDG Labs, a developer of Web3. Integrated Chainlink’s CCIP (Cross-Chain Interoperability Protocol) into Aave to ensure that the cross-chain governance system will be highly secure in the future. Integrating CCIP will give Aave the ability to easily expand to many different blockchains. And perform critical operations like administration through a highly secure solution.

Aave’s governance model when integrating CCIP

Other products in Aave’s ecosystem

Stablecoin GHO

GHO is a decentralized stablecoin. Backed by multiple crypto assets and linked to USD price. GHO is created by users (also known as borrowers) through mortgaging assets into the protocol and generating a certain amount of GHO. The ratio between the collateral and the amount borrowed will be designed to ensure the safety of the protocol. When the loan is repaid or the user’s GHO is liquidated. They will be removed from the protocol.

Aave’s GHO stablecoin

GHO also has a price equalization mechanism to keep the price at 1 USD compared to the market, and the process goes as follows:

-

If GHO > 1 USD: User creates 1 new GHO at Aave and sells them at a price higher than 1 USD on the external market. Increases the supply of GHO in the market and reduces the price of GHO.

-

If GHO User buys 1 GHO on the external market for less than 1 USD and burns them at Aave for 1 USD. Reduces the supply of GHO in the market and pushes up the price of GHO.

Related: What is The Difference between Aave and MakerDAO?

Aavegotchi

Aavegotchi is a game in the virtual world (metaverse), inspired by the game Tamagotchi. Where players can raise virtual pets through NFT technology on the Ethereum network. Built on a combination of DeFi, NFT and Metaverse. Aavegotchi gives players unique experiences when participating in the game.

Aavegotchi

Aavegotchi has a native token, GHST, which is used as a unit to purchase digital assets, stake rewards, and participate in governance in AavegotchiDAO.

So how to earn Aave Tokens?

Based on the outstanding characteristics of Aave, it can be seen that this is a potential cryptocurrency and attracts the attention of many investors, from large to small. Here are some ways to invest and profit with Aave tokens:

-

Yield farming: Supports staking and testing which lending pools bring optimal profits.

-

Liquidity mining: Rewarding liquidity will create a private currency market to facilitate better borrowing for users.

-

Exchange: Users can own Aave tokens simply by purchasing on listed exchanges.

Conclude

Currently, Aave, with new protocols and unique, useful features continuously updated from the ETHLend platform to support consumers, has become a leading brand in the field of Decentralized Finance ( DeFi). Aave is not only a leading lending protocol with liquidity pools surpassing $3 billion, but also continuously launches new services and products to increase its competitiveness in the DeFi market.