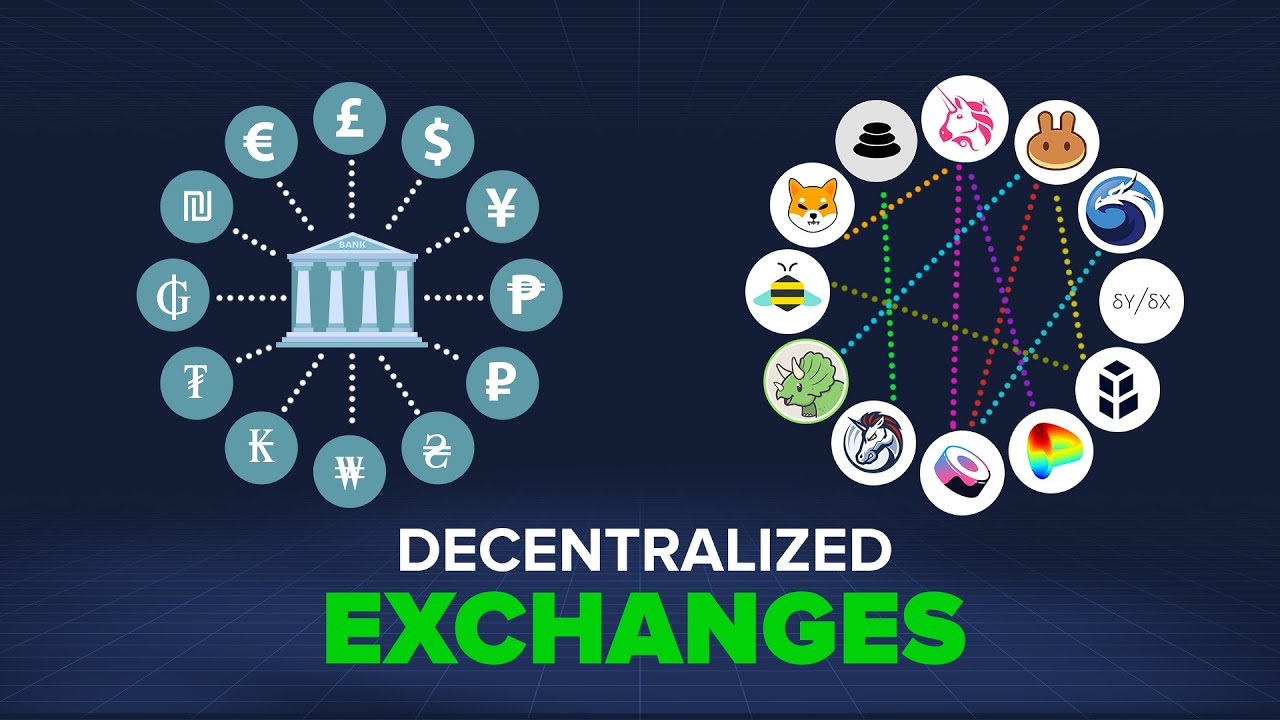

According to the development of the cryptocurrency market, decentralized exchanges (DEX) have emerged to address the limitations of centralized exchanges (CEX) that existed before. So, what are decentralized exchanges, how does it work. Let’s follow this article from AZCoiner to find the answers.

What is a DEX?

A DEX, or Decentralized Exchange, is a non-centralized trading platform that operates on the blockchain. It allows users to trade cryptocurrencies without the need for third-party intermediaries. DEXs can automatically execute trades through smart contracts to ensure safety and reliability during the trading process.

The idea behind DEX is “no intermediaries,” meaning it eliminates intermediaries to enable regular users to trade directly with each other. DEXs do not provide custody of users’ cryptocurrency assets. Instead, users always retain full control of their assets in their wallets.

How Do Decentralized Exchanges Work?

There are three main types of decentralized exchanges: Automated Market Makers (AMMs), Order Book DEXs, and Aggregator DEXs. All of them allow users to trade directly with each other through their smart contracts.

Automated Market Makers (AMMs)

AMMs are inspired in part by Ethereum co-founder Vitalik Buterin’s vision for decentralized exchanges. These AMMs rely on blockchain-based services to aggregate data from exchanges and other platforms to price the traded assets, known as blockchain oracles. Instead of matching buy and sell orders, these DEXs use liquidity pools.

Liquidity providers deposit equivalent values of different assets into a trading pair to earn profits by holding their cryptocurrencies. This process is called liquidity mining. If they attempt to deposit more of one asset than the other, the smart contract behind the pool will disable the transaction.

Using liquidity pools allows traders to execute orders or earn profits without the need for permission or trust. These exchanges are often ranked by their Total Value Locked (TVL) in their smart contracts. However, AMMs can face temporary losses when there is insufficient liquidity, causing price slippage.

Liquidity providers also face various risks, including temporary losses due to asset volatility. If the price of one asset fluctuates more than the other while liquidity providers hold it, the DEX’s trading can deplete one asset’s quantity in the liquidity pool. However, transaction fees collected over time can offset these losses.

Order Book DEXs

Order Book DEXs aggregate the profiles of all open orders to buy and sell specific assets. Buy orders indicate that traders are willing to buy an asset at a specific price, while sell orders indicate that traders are willing to sell or request a specific price for an asset.

The price difference between these orders determines the depth of the order book and the market price on the exchange.

Order Book DEXs come in two types: on-chain and off-chain. On-chain DEXs store information about open orders on the blockchain while users hold their funds in their wallets. These exchanges may allow traders to leverage their positions by borrowing from lenders on the platform. Leveraged trading increases the potential profit of the trade but also carries the risk of liquidation as borrowed funds must be repaid even if the trade goes against the trader.

However, DEXs that keep their order books off-chain minimize fees and expedite transactions to meet users’ desired prices.

Aggregator DEXs

Aggregator DEXs use various protocols and mechanisms to address liquidity concerns. Essentially, these platforms aggregate liquidity from multiple DEXs to minimize price slippage for large orders, optimize exchange fees, and provide users with the best possible prices in the shortest time.

Protecting users from price discrepancies and reducing the risk of failed transactions are other important goals of Aggregator DEXs. Some Aggregator DEXs also leverage liquidity from centralized exchanges to offer a better user experience while avoiding surveillance by integrating with specific centralized exchanges.

Read more: Solar Dex to relaunch on Quai Network

How to Use a Decentralized Exchange (DEX)

Unlike CEXs, you don’t need to register an account and verify your identity to use a DEX. Instead, you’ll need a wallet compatible with the smart contracts on the exchange’s network and the native tokens to pay transaction fees on a specific network. Anyone with a smartphone, computer, and an internet connection can interact with DEX features.

To use a DEX, the first step is to check which networks and wallets the exchange supports.

Next, download a wallet compatible with the DEX. These wallets are browser extensions that allow users to access their funds directly in their web browsers, making it easy to interact with decentralized applications (DApps) like DEX. They are installed just like any other browser extension and require users to import an existing wallet through a seed phrase or private key or create a new wallet. The wallet will ask you to set a password for enhanced security.

Once you have a wallet, you’ll need to deposit the native tokens of the network to pay transaction fees on the chosen network. These tokens must be purchased on centralized exchanges and withdrawn to your wallet or received from another wallet. It’s important to use the correct wallet address and select the correct chain to avoid asset loss.

Finally, users connect their wallets through a popup prompt or by clicking the “Connect Wallet” button in one of the corners of the DEX’s website. After successfully connecting your wallet to the DEX, you can proceed to execute buy and sell orders.

Popular DEXs

Here are some prominent DEXs categorized by their ecosystems:

- Ethereum Ecosystem, Arbitrum, Optimism: Curve, Uniswap, Sushiswap,…

- BNB Chain Ecosystem: Pancakeswap, Biswap,…

- Polygon Ecosystem: Curve, Uniswap, Quickswap,…

- Tron Ecosystem: Sunswap,…

- Cosmos Ecosystem: Osmosis.

Currently, most DEXs support Multichain rather than being exclusive to one ecosystem, allowing users to trade multiple chains on a single DEX. However, you should still look for the DEX with the best liquidity in your chosen ecosystem to avoid price slippage.

The Future of DEXs

With the development of DeFi, decentralized exchanges will continue to grow in size and number. However, it will take some time for them to catch up with centralized exchanges. Nevertheless, DEXs undoubtedly have a lot of potential and will see more significant breakthroughs in the future. In the past, DEXs have beaten top centralized exchanges in terms of trading volume, such as when Uniswap surpassed Coinbase in spot trading volume in Q2 2023, processing around $110 billion compared to Coinbase’s modest $90 billion. Additionally, DEXs offer unique advantages, particularly in the context of humanity’s transition to the digital age, Industry 4.0.

Through this AZCoiner article, you have gained information on what are decentralized exchanges, how they work, and how to use them. Hopefully, this article has helped you better understand DEXs, enabling you to choose reputable exchanges for trading and safeguarding your assets.