Around 2015, Bitcoin had trouble scaling its transaction capacity to match the rapid growth of its user base. More users started exchanging bitcoin (BTC) which caused the overall processing time to slow down. If nothing is done to speed up the process, Bitcoin transactions can take days or weeks to complete. The slowness of this network may also require users to pay higher fees to speed up transactions. Both scenarios are not ideal and this is known as the Bitcoin scalability problem. Hard fork is one of the proposed solutions to solve Bitcoin’s scalability problem. What Are Bitcoin Hard Forks? Why Did the Bitcoin Hard Fork Happen? What hard forks has bitcoin gone through?

What is Bitcoin Hard Fork?

A Bitcoin Hard Fork is simply an event that changes the rules of the Bitcoin protocol causing old blocks and transactions to be invalidated. Once the Hard Fork takes place, all nodes and users are required to upgrade the client software to the latest version.

In case, some nodes do not accept the new rule and still use the old rule, the network will have an event called Split Chain – splitting the blockchain into two different blockchains with different visions and missions. .

And the majority of Bitcoin’s Hard Fork happened this block chain split. That is why many people mistakenly think that Hard Fork is synonymous with Split Chain. But that’s not true. The block chain split can happen without a Hard Fork or a Soft Fork.

Why Bitcoin HardFork?

There are many reasons why developers create Hard Forks.

Serving user needs: After operating for a while, the network will need to change to match user needs and change existing rules.

Ensure security issues: Maybe because a serious risk or error has been discovered in the old software version, it is necessary to add new features or reverse transactions to prevent hackers from taking advantage of the vulnerability. gap.

Conflict in the vision of the development team: In general, a hard fork is a positive change for Bitcoin, but the change will create conflict due to not having the same vision and direction. Force the Bitcoin Hard Fork to split from the chain to form 2 separate chains.

Personal interests and developer groups: Because when a coin is created from a Hard Fork, before the time of the Hard Fork, BTC holders will be airdropped that coin at a ratio of 1:1. And many projects have hooked up with the exchange to create a new coin through the Bitcoin Hard Fork. Then, they will support listing on the exchange for the purpose of releasing the generated tokens to collect a huge amount of money.

However, this does not mean that Bitcoin will increase after each Hard Fork update.

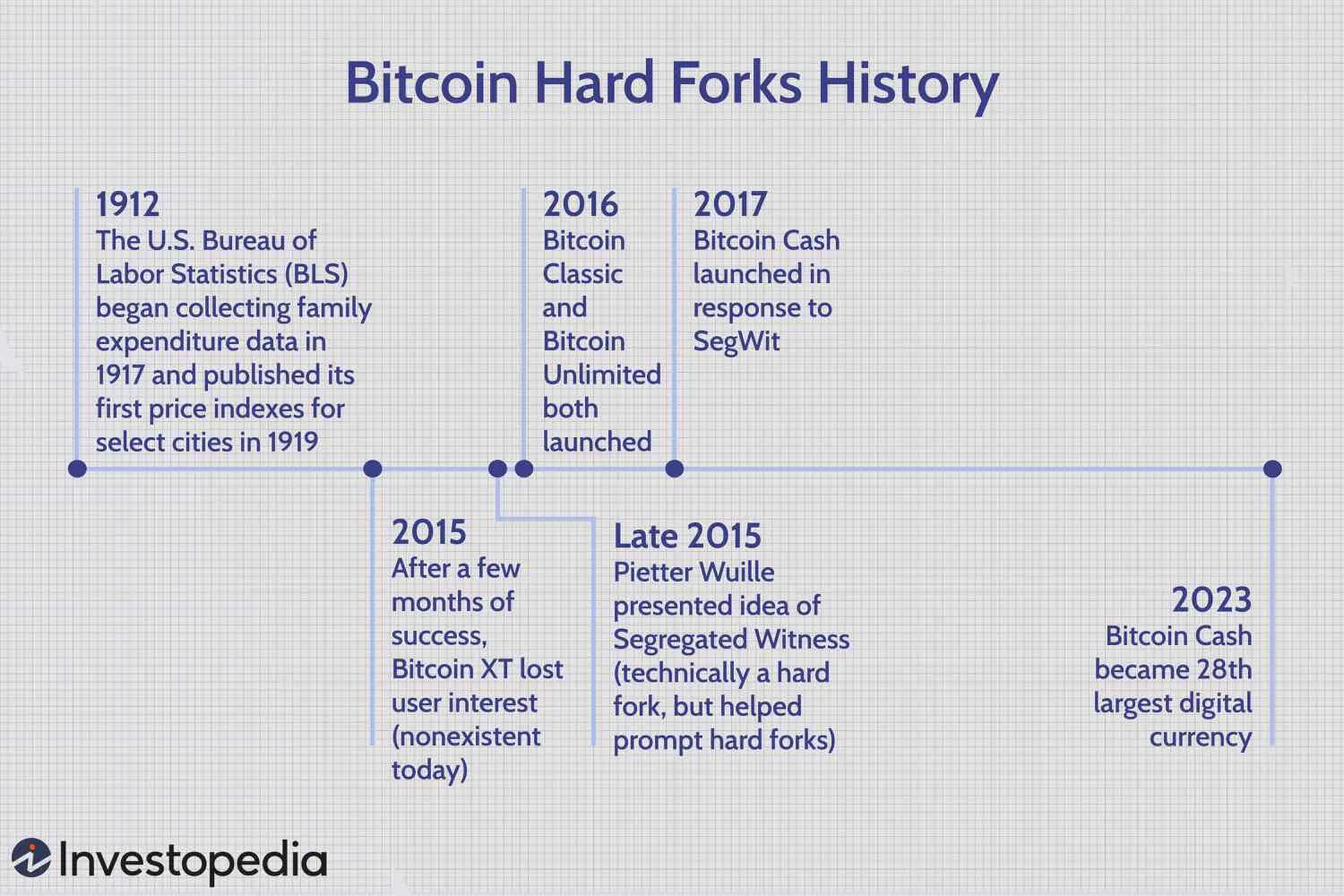

A Timeline of Bitcoin Hard Forks

Bitcoin XT

Bitcoin XT was one of the first notable hard forks of bitcoin. The software was launched by Mike Hearn in late 2014 in order to include several new features he had proposed. While the previous version of bitcoin allowed up to seven transactions per second, Bitcoin XT aimed for 24 transactions per second. In order to accomplish this, it proposed increasing the block size from one megabyte to eight megabytes.

Bitcoin XT initially saw success, with anywhere between 30,000 to over 40,000 nodes running its software in the late summer of 2015. However, just a few months later, the project lost user interest and was essentially abandoned by its users. Bitcoin XT is no longer available.

Bitcoin Classic

When Bitcoin XT declined, some community members still wanted block sizes to increase. In response, a group of developers launched Bitcoin Classic in early 2016. Unlike XT, which proposed increasing the block size to eight megabytes, classic intended to increase it to only two megabytes.

Like Bitcoin XT, Bitcoin Classic saw initial interest, with a range of about 27,000 up to 200,000 nodes for several months during 2016.5 The project also still exists today, with some developers strongly supporting Bitcoin Classic. Nonetheless, the larger cryptocurrency community seems to have generally moved on to other options.

Bitcoin Unlimited

Bitcoin Unlimited has remained something of an enigma since its release in early 2016. The project’s developers released code but did not specify which type of fork it would require. Bitcoin Unlimited set itself apart by allowing miners to decide on the size of their blocks, with nodes and miners limiting the size of blocks they accept, up to 16 megabytes.67

Despite some lingering interest, bitcoin unlimited has largely failed to gain acceptance.

Segregated Witness

Bitcoin Core developer Pieter Wuille presented the idea of Segregated Witness (SegWit) in late 2015. Put simply, SegWit aims to reduce the size of each bitcoin transaction, thereby allowing more transactions to take place at once. SegWit was technically a soft fork. However, it may have helped to prompt hard forks after it was originally proposed.8

Bitcoin Cash

In response to SegWit, some bitcoin developers and users decided to initiate a hard fork in order to avoid the protocol updates it brought about. Bitcoin Cash was the result of this hard fork. It split off from the main blockchain in August 2017, when Bitcoin Cash wallets rejected bitcoin transactions and blocks.9

Bitcoin Cash remains the most successful hard fork of the primary cryptocurrency. As of June 2023, it is the 28th largest digital currency by market cap.1

Bitcoin Cash allows blocks of 32 megabytes and did not adopt the SegWit protocol.10

Bitcoin Gold

Bitcoin Gold was a hard fork that followed shortly after bitcoin cash, in October 2017. The creators of this hard fork aimed to restore the mining functionality with basic graphics processing units (GPU), as they felt that mining had become too specialized in terms of equipment and hardware required.

A unique feature of the Bitcoin Gold Hard Fork is “pre-mine”, a process by which the development team mined 100,000 coins after the fork took place.

Many of these coins have been placed in a special “endowment”. The developers have indicated that this funding will be used to develop and fund the Bitcoin Gold ecosystem, with a portion of those coins also being set aside to pay developers.

All in all, Bitcoin Gold adheres to many of the fundamentals of Bitcoin. However, it differs in the proof of work (PoW) algorithm it requires for miners. To make Bitcoin miners more accessible by changing hardware.

The impact of the BTC hard fork event on the market.

Any hard fork can have a profound impact on cryptocurrencies, and so can the BTC hard fork. This is usually a volatile time for cryptocurrencies. In some cases, the community will be divided over the need and impact of the changes being driven by the fork. Also, the price of cryptocurrencies in general is very volatile around the time of the hard fork.

Conclusion

Since its inception, bitcoin has already spawned a large number of forks. While no one can say for sure, it is likely that cryptocurrencies will continue to undergo both hard forks and soft forks in the future to suit the context. Hope this article was useful to you when learning about the btc hard fork event.

Read more: Characteristics of Bitcoin, What You Need To Know