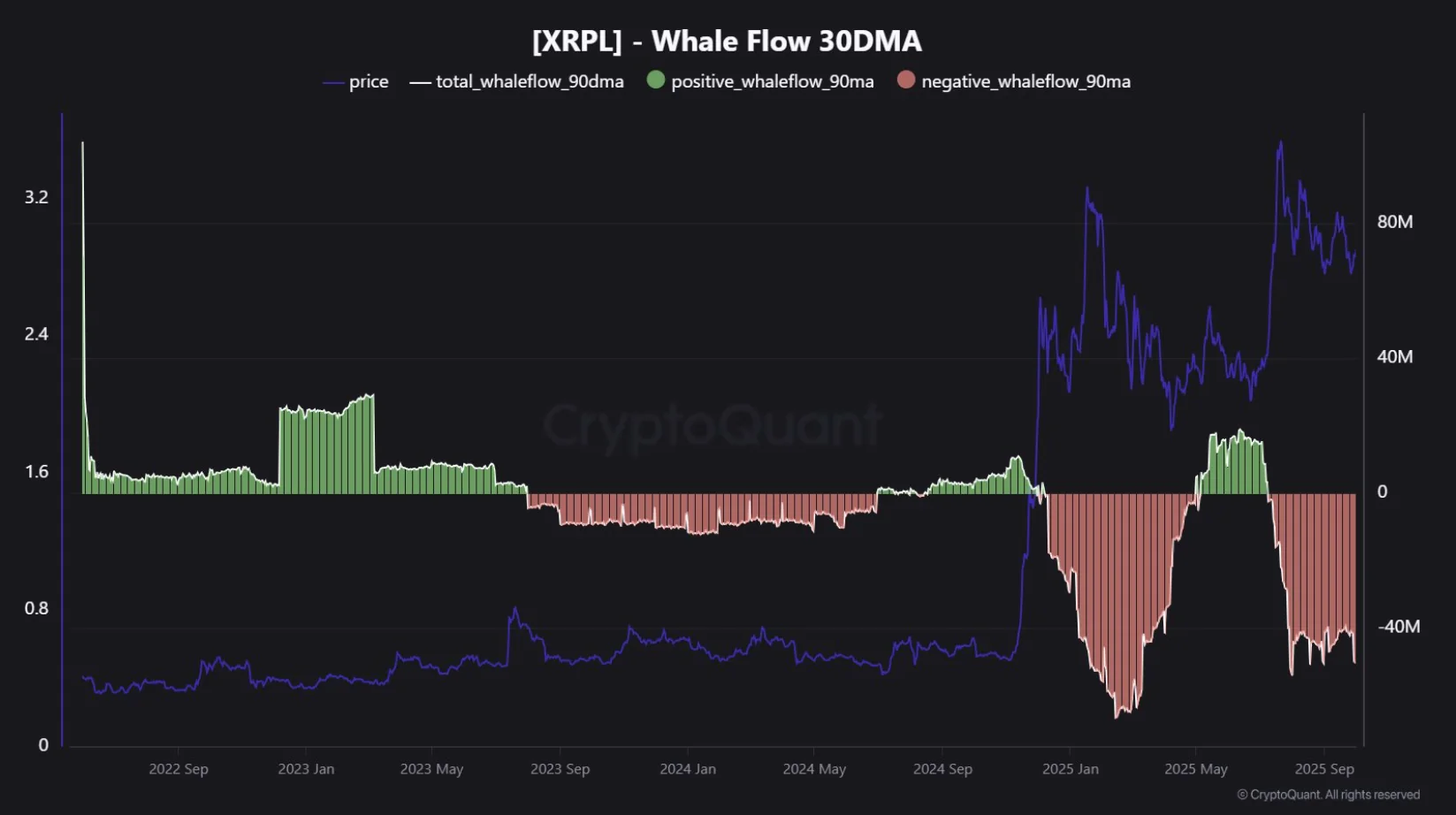

The massive sell-off of XRP continues at an alarming pace. According to recent data, over the past 30 days, large holders — often called “whales” — have been selling an average of $50 million worth of XRP every day, pushing the Ripple-linked token’s price down more than 7% this week, notably underperforming the broader crypto market.

XRP Named “Top Short Candidate” by Analysts

Veteran trader Peter Brandt, known for his accurate technical forecasts, recently identified XRP as the “top short candidate.”

On the daily chart, the token is forming a descending triangle, a pattern typically signaling a bearish continuation or reversal. Brandt warned that if the formation breaks down, XRP could plunge to as low as $2.2.

Both technical indicators and market flow data suggest that selling pressure is steadily intensifying, reflecting increasingly bearish sentiment among large investors.

Over $12 Million in XRP Liquidated as Whales Bet Both Ways

Data from CoinGlass reveals that $11.83 million worth of XRP has been liquidated in the past 24 hours, with short positions accounting for 81.3% of the total.

Exchange Bybit led with $4.41 million in liquidations, while a whale on Hyperliquid opened a $3.44 million short position, already pocketing nearly $100,000 in profit.

Interestingly, however, 58.81% of whales on Hyperliquid remain bullish on XRP — highlighting a deep divide among major investors: some continue to bet on further declines, while others are positioning for a potential rebound.

XRP Slips in Rankings But Retains Massive Market Cap

Following the recent downturn, XRP has fallen to fifth place by market capitalization, overtaken by Tether (USDT) and BNB. Nevertheless, it still boasts an impressive market cap of nearly $170 billion, underscoring its enduring influence despite mounting sell pressure.

As selling intensifies and whales take opposing sides, XRP finds itself at a critical crossroads — where every major move could ignite the next wave of market volatility.