Are XRP whales defying prevailing market trends? Recent data signals a noteworthy surge in accumulation among prominent Ripple [XRP] holders. Interestingly, amidst this ongoing accumulation trend, there has been a simultaneous reduction in the overall supply, particularly those in a profitable position.

Prominent Ripple Whales Bolster Their Positions

Prominent players in the Ripple ecosystem, colloquially known as whales, are not shying away from augmenting their positions. Following Ripple XRP’s ascent to over $0.7 and subsequent correction to around $0.6, the cryptocurrency has steadfastly maintained its stance within this price band.

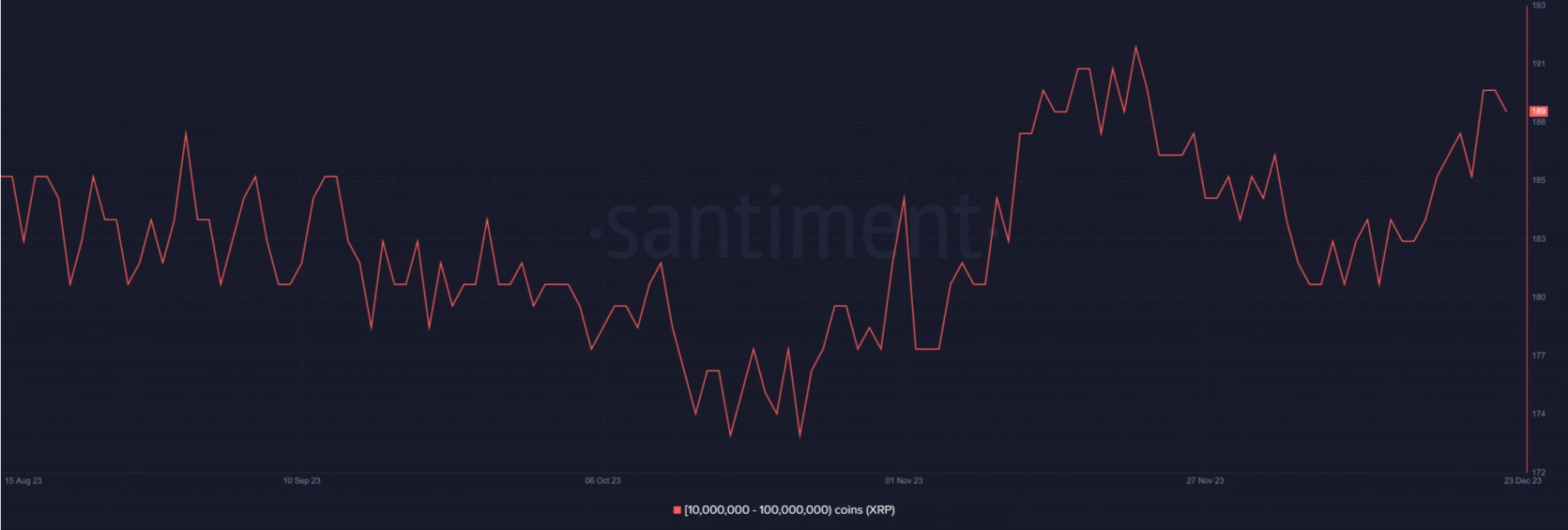

Remarkably, a discernible surge in accumulation is evident among whales possessing 10 million to 100 million XRP tokens, as revealed by Santiment’s supply distribution data. Notably, this upward trajectory in accumulation had a brief dip around December 13th.

These sizeable wallets have successfully amassed approximately 360 million XRP in the preceding week alone, translating to a value of approximately $223 million. Although the number of wallets in this category has marginally decreased to 189 at the time of this analysis, it represents a modest uptick from the 184 wallets observed on December 13th.

This nuanced pattern implies that these major stakeholders are actively expanding their Ripple holdings, a trend generally interpreted as a bullish signal anticipating an imminent price surge.

XRP Profitability Experiences Modest Downturn

Despite the accumulation surge, there is a nuanced development in the XRP landscape. Assessing the current scenario using data from CoinMarketCap, the total XRP supply hovers around 99.9 billion, with a circulating supply of approximately 54 billion. This dynamic suggests a complex interplay of factors in the XRP market, with whales strategically accumulating while the cryptocurrency’s profit-making potential experiences a slight downturn.

As of the latest analysis, it was observed that the total XRP supply in a profitable position amounted to 86.63 billion, representing a substantial 86% of the overall supply, as depicted in an accompanying chart. Notably, this percentage has undergone a recent dip from the previously recorded figure of over 87 billion on December 22nd. Given the persistent accumulation by influential whales, there is a strong likelihood that this percentage could surpass the 90% threshold, especially given the ongoing accumulation trend.

Weekend Downtrend Grips XRP

The prospect of even a modest uptick in XRP’s price, pushing it into the $0.7 range, could exert a significant impact on these metrics, further bolstering the profitability of existing holdings.

Despite the promising accumulation patterns, XRP found itself entangled in a weekend downtrend. The Relative Strength Index (RSI) for XRP has consistently remained below the neutral line. Despite a recent increase in value, it has struggled to breach this critical threshold.

At the time of assessment, the RSI experienced a further downturn, trading at approximately $0.61 and registering a decline of over 1%. Concurrently, the short moving average (depicted by the yellow line) persisted as a formidable resistance within the same price range.

Related: XRP Token Burn Hits 2-Month High, Whales Execute Large Money Transfer

Despite these evident challenges, there remains a discernible potential for an impending price surge. This optimistic outlook suggests that the strategic accumulation maneuvers by influential whales may soon translate into positive outcomes for XRP’s market performance.