Ethereum, the world’s second-largest cryptocurrency, is struggling to recover from a string of sharp declines, leaving investors on their toes. However, it seems that the largest investors are starting to withdraw.

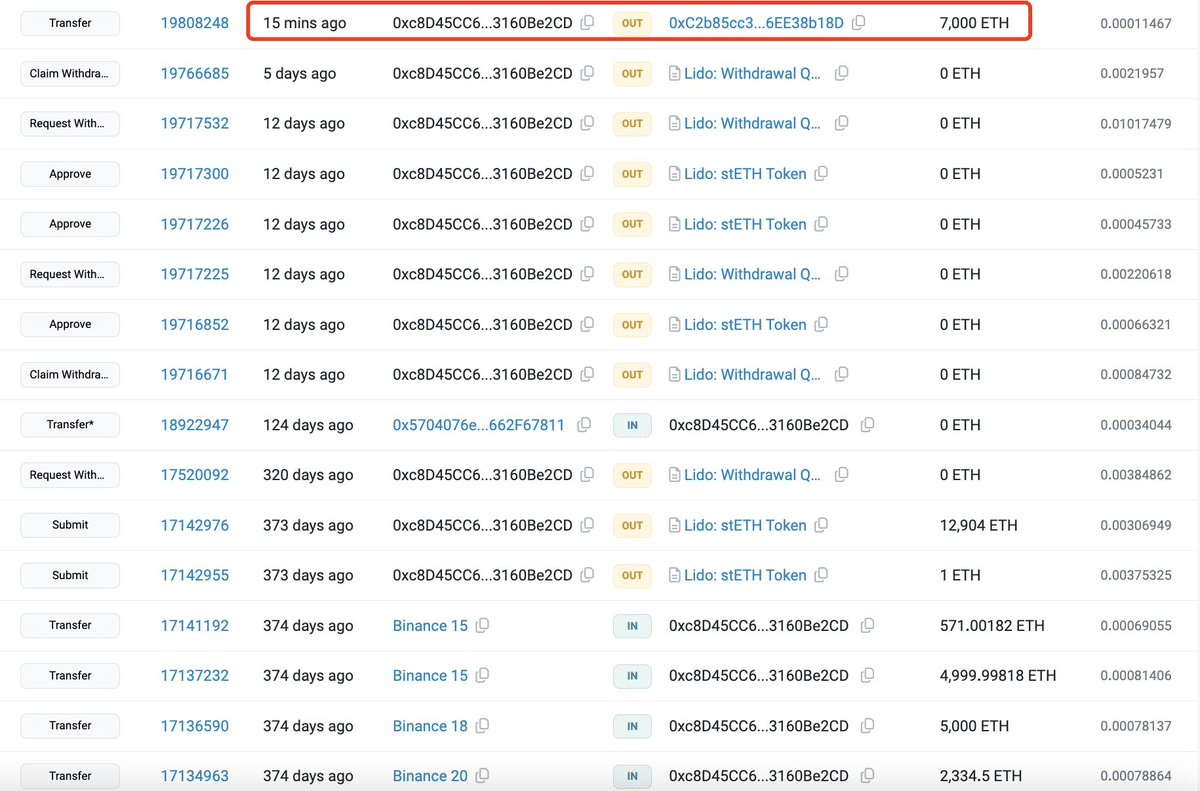

The latest data from Lookonchain shows that an Ethereum “whale”, who bought the coin about a year ago, is now selling for profit. The whale sold 12,906 ETH (equivalent to $24 million at market price at press time) from Binance last year for $1,890 and transferred that amount to Lido.

Source: LookonChain

They then withdrew 7,000 ETH from Lido when the market showed signs of decline on April 30 and transferred that amount to Binance. The profits earned by whales amount to more than 16 million USD.

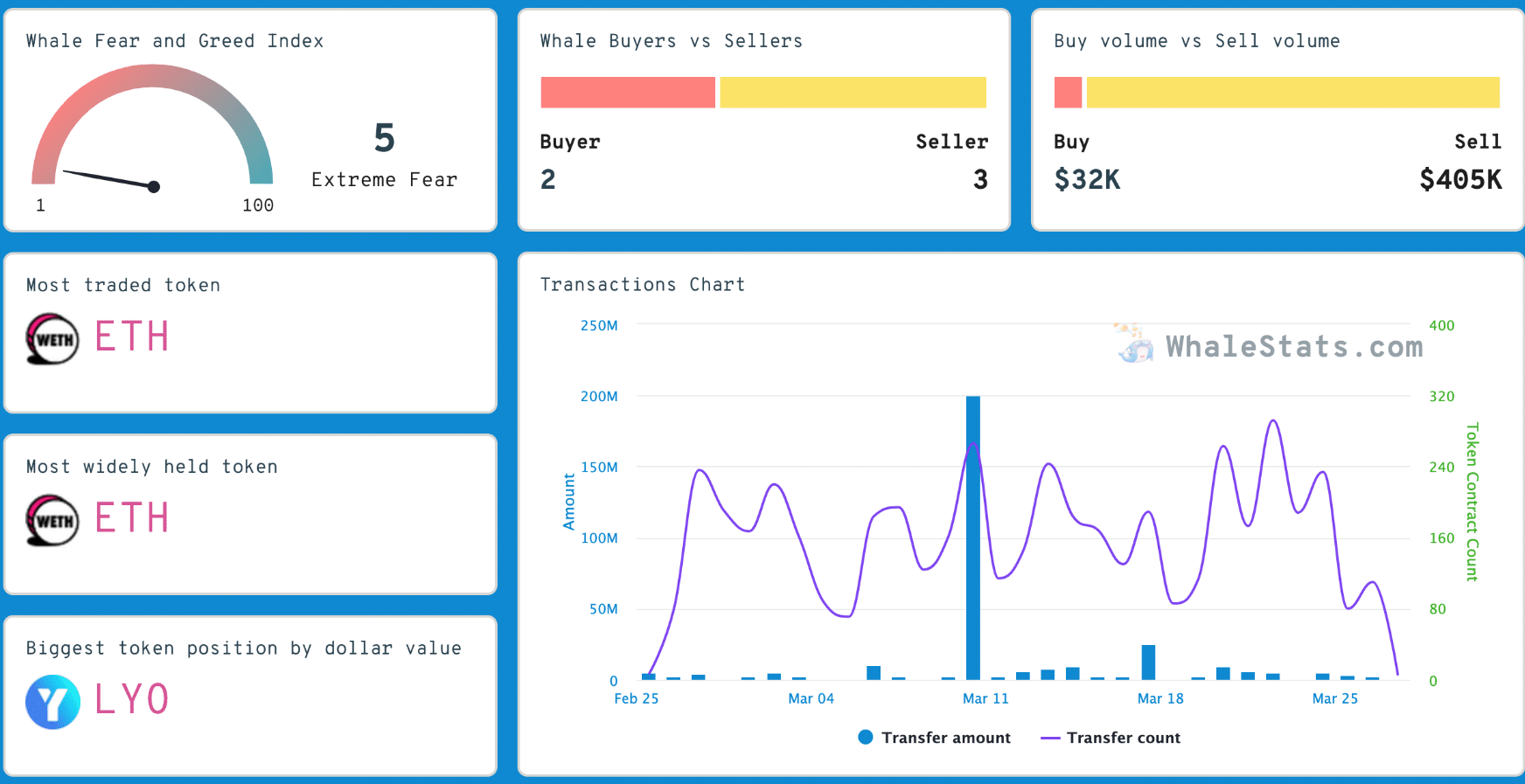

Data from WhaleStats reveals that the fear and greed index of major investors on BSC Chain Ethereum is at extreme fear levels at this time. Ether is still the most traded and held token by whales, but it is clear that they are facing difficulties and waiting for further market fluctuations.

Source: WhaleStats

Ethereum performance in a dangling market

Crypto markets are still in the red due to a correction after Bitcoin hit a new all-time high, indicating the start of a bull run. However, currently, the bears have the upper hand. At this time, Ethereum is priced at $3,208, up 0.02% on the day and 0.8% over the past seven days. Popular crypto analyst Ashcrypto has shared his outlook on Ether price.

According to him, based on historical patterns from 2020 and 2021, Ethereum is predicted to rise again in the third quarter of this year. He expects Ether to reach $4,000, based on his chart analysis.

Source: IntoTheBlock

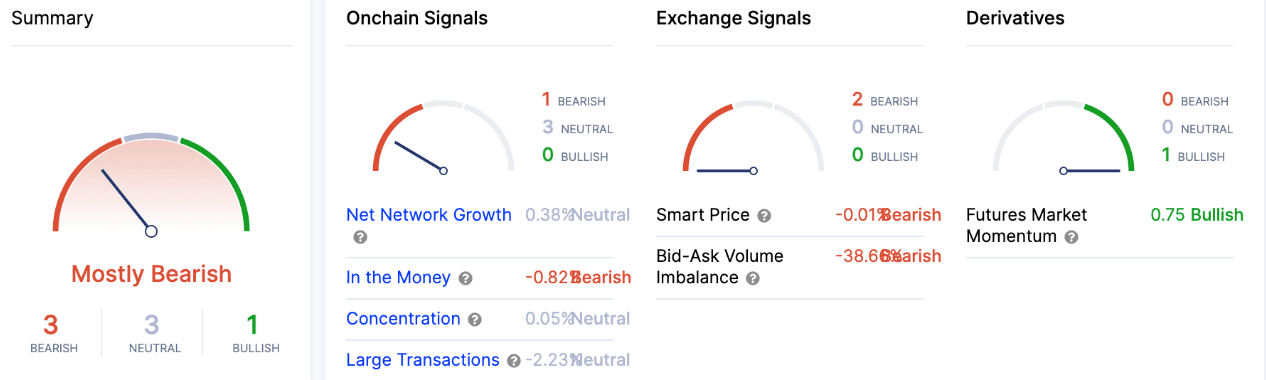

Meanwhile, KEN Crypto, another famous analyst, believes that investors’ sentiment has changed a bit. While it is largely bearish, he emphasized that there is also some bullish sentiment, seen from Ethereum consistently remaining above the 100 Simple Moving Average (SMA). However, regardless of that, Ethereum bulls are facing major resistance, attempting to break through more important highs.

Related: Ethereum Continues to Attract Investors Despite Major Volatility

Further insights from IntoTheBlock reveal a strong connection between Ethereum price and high trading volume, suggesting they have a major influence on Ethereum’s price movements. Notably, this decrease in trading volume in April corresponded with a decrease in Ethereum’s price. Clearly, large investors are influencing the market by increasing selling pressure.