Amid the volatile crypto market at the beginning of the week, the whale’s move has sparked heated discussions. According to on-chain data, the investor made a massive sell-off, dumping more than 130 billion PEPE and diversifying his portfolio by buying more than 200,000 Ethereum-based tokens.

This strategic shift, which came as the price of the meme coin plummeted while the token of the EigenLayer ecosystem grew, has sparked much speculation about the future direction of both assets.

Pepe Coin Whale Restructures Investments, Focuses on EIGEN

According to data from Spot On Chain on November 25, the whale sold 74.07 billion PEPE worth $1.53 million to earn 448.1 ETH as the token price fell. Over the past three days, the whale continued to dump another 130.2 billion PEPE worth $2.71 million, earning 891 ETH.

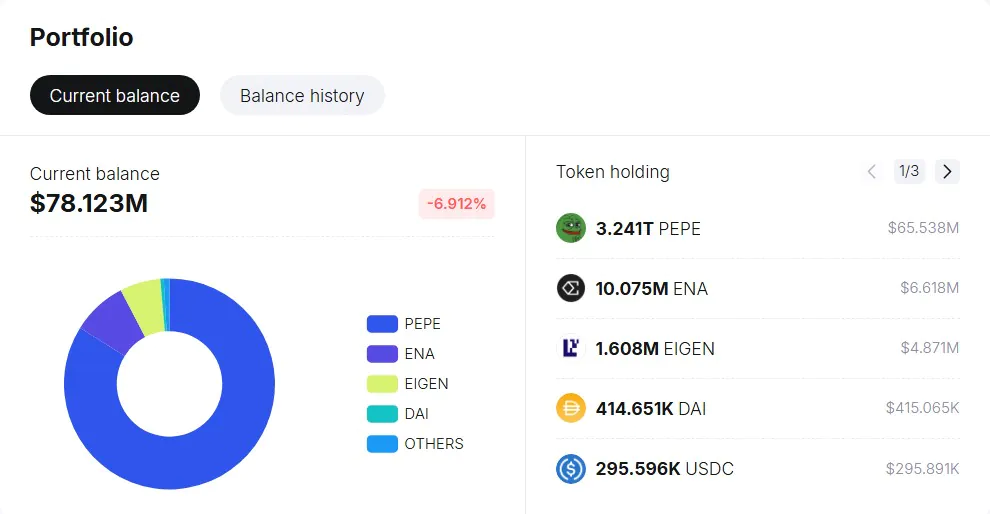

While this massive sell-off has put pressure on the market, it is worth noting that the whale still holds 3.241 trillion PEPE, representing a 12.6x profit of $68.3 million.

However, at the same time, the whale also focused on buying EIGEN, swapping 181.3 ETH to own 217,348 tokens on the Ethereum platform over the past two days. The whale currently holds 1.608 million EigenLayer tokens, worth $4.31 million, for an 11% gain. The swap has fueled optimism around the flagship token of the EigenLayer ecosystem, while market watchers are closely watching the movements of the leading meme coin.

PEPE & EIGEN Prices Trend Opposite

As PEPE’s price fell, coinciding with the Pepe Coin whale’s sell-off, EIGEN’s price rose on strong buying pressure. PEPE’s price is down 2% on the day and 5% on the week, currently trading at $0.00002026. Its 24-hour range is between $0.00001918 and $0.00002086.

In contrast, EIGEN’s price is up nearly 7% on the day and 23% on the week, reaching $3.06. The 24-hour range is between $2.56 and $3.07. Active buying has fueled the bullish sentiment on EigenLayer’s token, while the huge amount of PEPE that whales still hold adds to the curiosity about the meme coin’s price movements in the coming time.