Bitcoin withdrawals are becoming very noticeable. Bitcoin prices climbed to a new record surpassing $73,700 last week, but have since dropped 12%. Amid these fluctuations, a notable trend has emerged: large investors are starting to withdraw Bitcoin from exchanges at an unprecedented rate.

Whale movements

According to experts and blockchain data, this action is not just a normal reaction to price fluctuations but also a deliberate strategy by large investors to prepare for the next price increase. The creation of 13 new whales, each holding over 1,000 BTC, is a testament to their increased confidence in the long-term value of Bitcoin.

Transaction data combined with on-chain analytics provides a clear view of Bitcoin’s current market dynamics. As prices hit new highs, profit-taking activities appear to have taken place.

However, it’s worth noting that while the price has dropped, the amount of BTC on exchanges has dropped significantly since mid-January, with a significant drop of 21,401 BTC in the last week alone. This trend is highlighted, especially as the withdrawal of $750 million worth of Bitcoin on March 15 marked the largest outflow day of the year since May 2023.

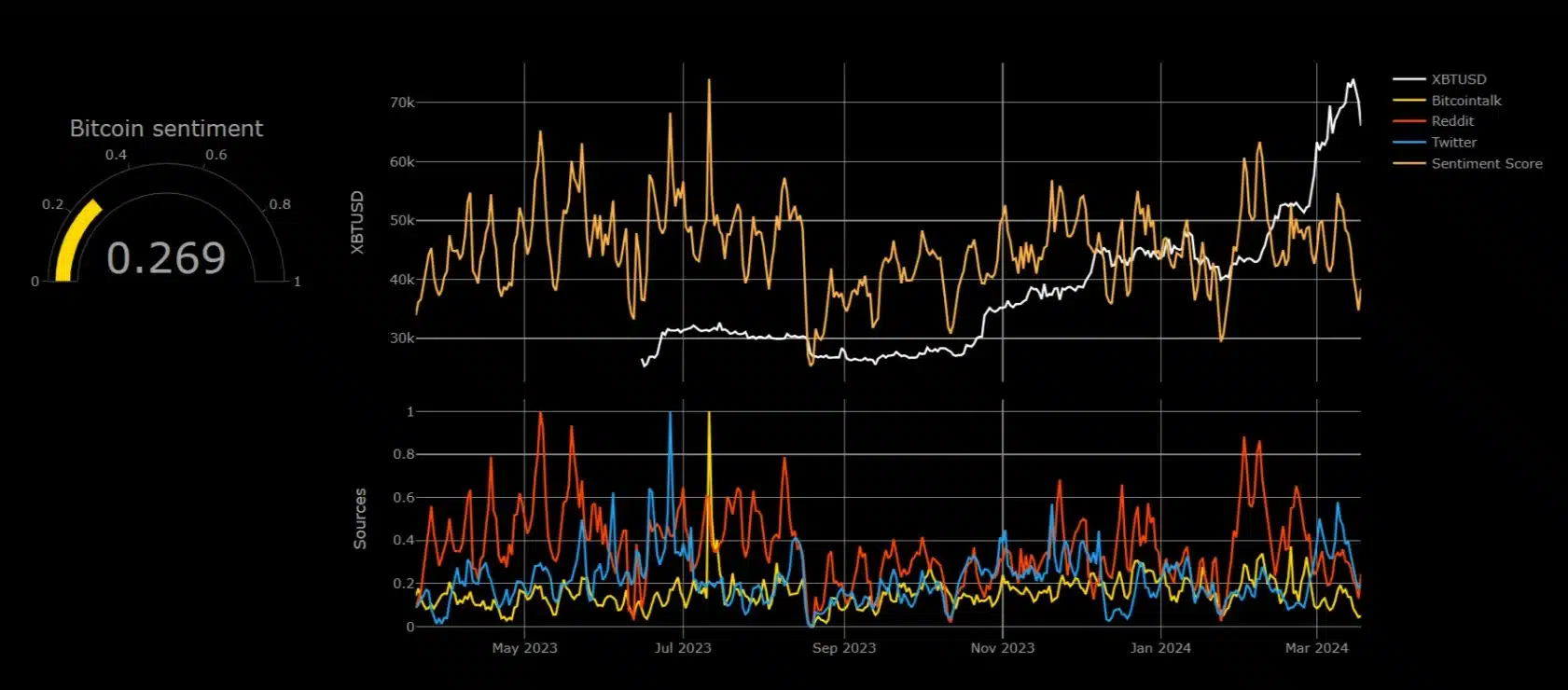

Implications for Bitcoin’s market sentiment

The implications for Bitcoin’s market sentiment are very important. The large number of Bitcoins withdrawn from the market and the appearance of new whales in the Bitcoin ecosystem reflect the deep optimism of investors about the future prospects of this currency. Although the market is going through a period of correction, with Bitcoin price falling to around $68,201, the sentiment of major investors appears to be unaffected.

The current phase is seen as a bullish move for the next recovery, not a sign of weakness. The strategic actions of major investors, including the withdrawal of large amounts of Bitcoin from exchanges, show that they are preparing for a further uptrend, contrary to previous negative sentiment from December 2023.

What’s next for Bitcoin?

Often, the actions of Bitcoin whales are predictive of the cryptocurrency’s future direction. With recent accumulation and withdrawal activities, it is possible that the market is waiting for a new price increase. Bitcoin’s recovery and major investor positioning strategies underscore the cryptocurrency’s long-term appeal and widespread belief in its ability to grow in value. With the market experiencing volatile fluctuations, the rise in price of Bitcoin whales could be a signal for the next bullish phase.

Related: Short-Term Bitcoin Investors Have Reaped Profits

Conclude

Significant Bitcoin withdrawals by whales amid price volatility have highlighted a broader trend of accumulation by large investors. This demonstrates strong belief in Bitcoin’s ability to increase in price.

As the market absorbs recent events and prepares for the future, the actions of these whales provide valuable insight into underlying confidence in Bitcoin’s long-term direction. With the emergence of new whales and large amounts of Bitcoin moving out of exchanges, this period appears to mark an interesting development in the market dynamics of cryptocurrencies.