Crypto Market Recap for the Past Week

In the last week of March, Bitcoin showed signs of recovery after a dip from its peak of 73K to around 60K. Currently, Bitcoin is hovering around the 70K mark after closing both the weekly and monthly candles of March. With the rebound to 70K, Bitcoin’s potential to break its all-time high is highly likely as institutional funds and whales continue to accumulate Bitcoin.

Following Bitcoin is Ethereum, the brainchild of Vitalik, which has also seen a slight recovery from 3150 to 3600. Although returning to its peak at 4000 is still a distant target, positive signals from Bitcoin suggest that reaching the 4000 mark is entirely plausible.

This week also saw the emergence of several trends such as RWA, DePin, and BRC-20, alongside the growth of existing trends like Memecoin and AI.

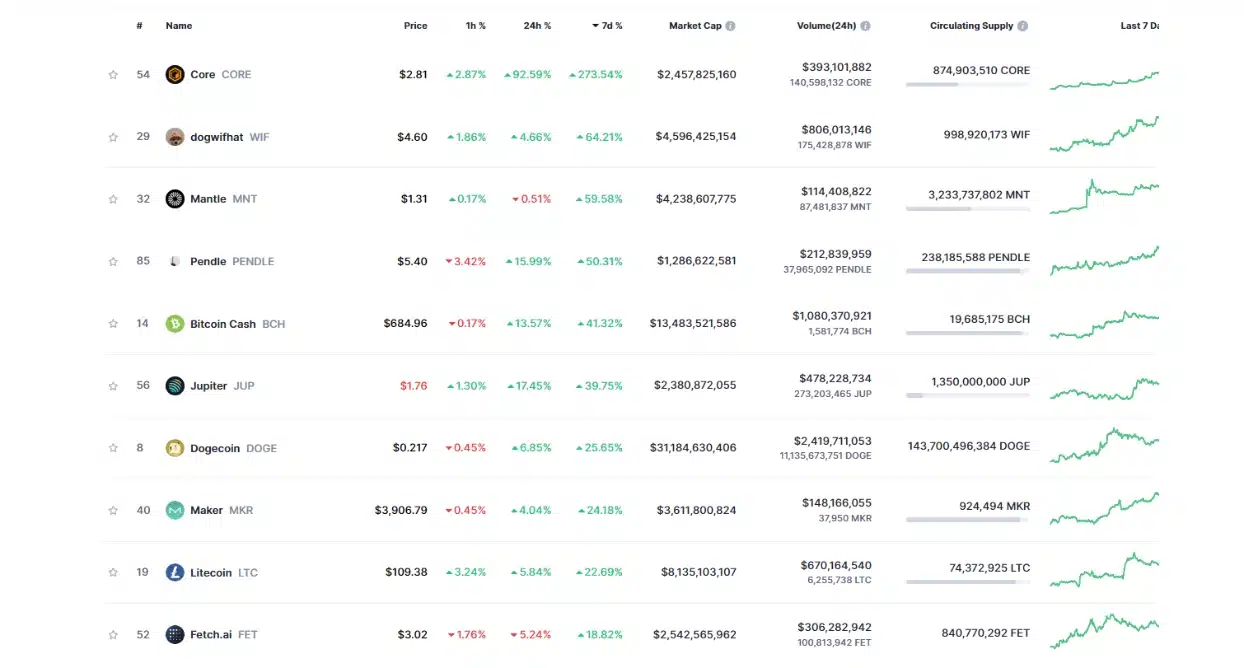

Top 10 Coins with the Highest Gains This Week

Source: Coinmarketcap

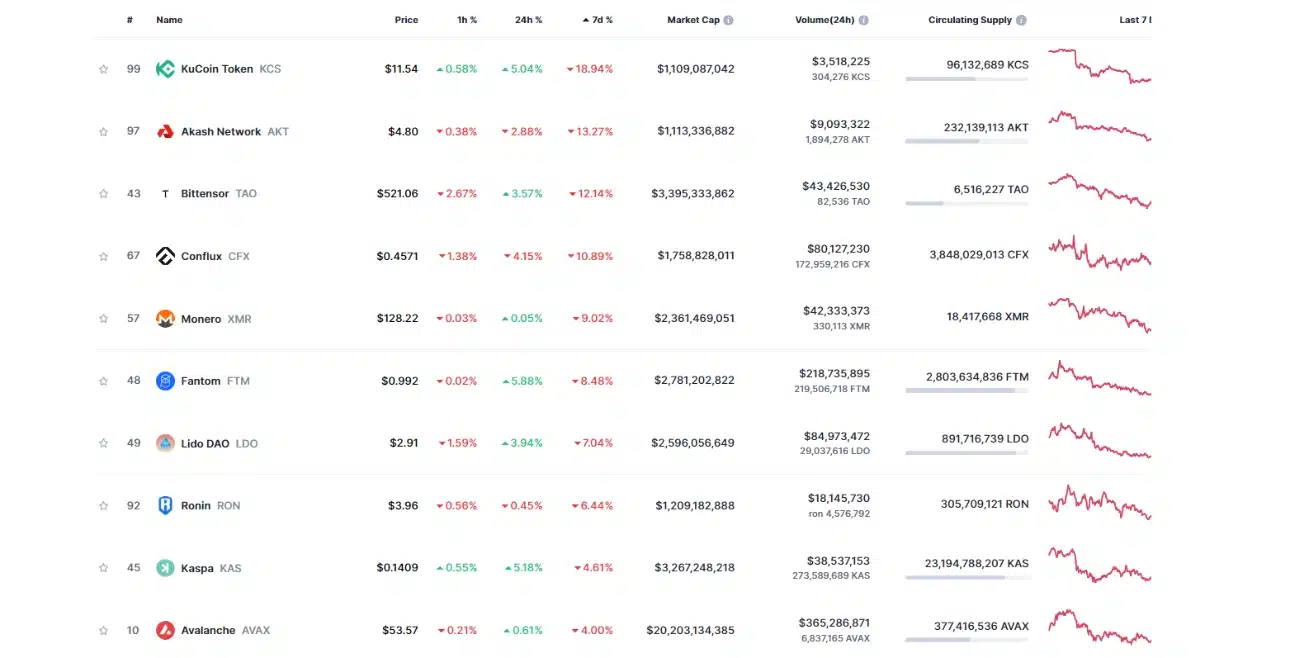

Top 10 Coins with the Highest Losses This Week

Source: Coinmarketcap

Key Highlights:

- Sam Bankman-Fried Sentenced to 25 Years in Prison for 7 Charges

- Escalation of Tensions Between Nigeria and Binance

Macro Events this Week

This week will witness several crucial economic events that could cause significant market fluctuations.

- Firstly, on Wednesday (03/04/2024), investors will await the ADP Non-Farm Employment Change. A result higher than forecasted will be seen as a positive signal, further strengthening the US economy and potentially boosting the USD.

- The biggest highlight of the day will be in the late evening with a significant speech by Fed Chairman Jerome Powell. Powell’s remarks are always anticipated to provide insights into future monetary policy, significantly impacting global financial markets.

- Moving on to Thursday (04/04/2024), the Initial Jobless Claims figure will be released. A larger-than-expected increase would be viewed as a negative sign for the labor market, potentially putting pressure on the USD.

- Finally, the Non-Farm Payrolls for March will be announced on Friday (05/04/2024). This is an important indicator reflecting changes in employment compared to the previous month. A more positive result than forecasted could drive up the USD, while a lower-than-expected figure could have the opposite effect.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

Nice job

Good

Good but after some time

Good morning beautiful ❤️

Nice work

Required some time

Patience

Nice job