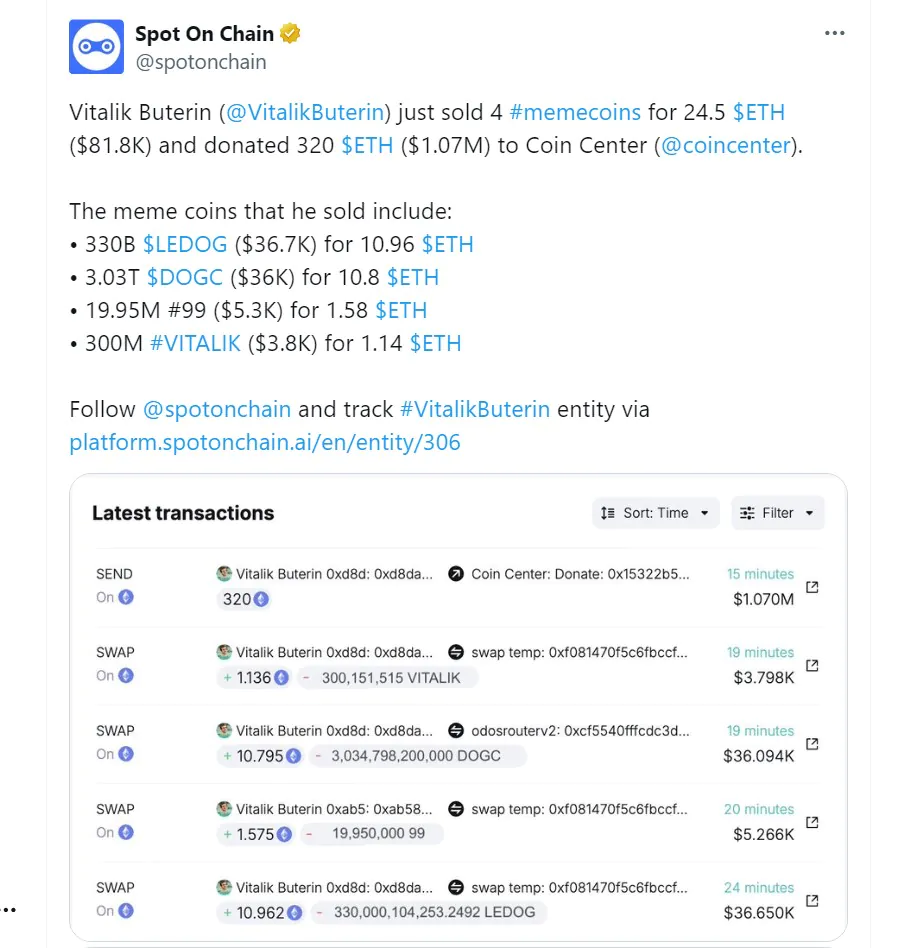

Vitalik Buterin, the founder of Ethereum [ETH], recently made headlines when he sold several memecoins for a total of 24.5 ETH, equivalent to $81,800. Specifically, he sold:

- 330 billion $LEDOG for 10.96 ETH,

- 3.03 trillion $DOGC for 10.8 ETH,

- 19.95 million $99 for 1.58 ETH,

- and 300 million $VITALIK for 1.14 ETH, according to a report from SpotOnChain.

Vitalik then made a large donation, donating 320 ETH ($1.07 million) to the Coin Center organization.

What does this mean for ETH?

Donating to Coin Center can have both positive and negative effects on the ETH price chart.

- On the downside, if Coin Center liquidates the ETH donated to fund operations, it could create selling pressure in the market, especially if the amount is large enough relative to the trading volume.

- On the upside, an influential individual like Buterin’s donation could draw positive attention to Ethereum, thereby creating a good media effect, promoting interest and increasing trading activity.

Currently, this donation does not seem to have a negative impact on the ETH price. Ethereum is still in a strong bullish phase, indicating that the market has absorbed the ETH sales well, and investor sentiment towards ETH remains positive.

The market’s optimism towards Ethereum continues to be reflected in the behavior of “whales” – large investors. According to data from IntoTheBlock, the net inflow of whales has remained positive during this period.

This shows that the capital inflow into ETH far exceeds the outflow. When large investors increase their buying, it usually means an accumulation phase, indicating that they expect ETH prices to rise in the near future.

In addition, Ethereum’s Open Interest (OI) has increased sharply over the past week, reaching an all-time high (ATH). According to data from Coinglass, OI peaked at $21.22 billion before stabilizing at $20.8 billion at the time of writing. This increase shows that investors are opening new positions while holding on to existing ones, a sign of confidence in the market.

Where is Ethereum headed next?

As mentioned, Buterin’s donation to Coin Center has not had a negative impact on the ETH price chart. On the contrary, Ethereum investors continue to maintain optimism as bulls attempt to regain control of the market.

At the time of writing, Ethereum is trading at $3,580, up 10% over the past 24 hours.

This sustained uptrend is strengthening Ethereum’s position to reach new milestones. If the bulls maintain their bullish sentiment, ETH could continue to challenge the $4,000 resistance level.