Vitalik Buterin’s Disdain for DeFi

The controversy ignited following the 57th episode of the Steady Lads Podcast—a well-known platform in the crypto space—where three founders, Jordi Alexander, Justin Bram, and Taiki Maeda, along with guest Kain Warwick (founder of Infinex and Synthetix), revealed some surprising insights about Ethereum’s creator, Vitalik Buterin. According to them, Buterin “doesn’t hold a favorable view of DeFi.”

This revelation sparked a heated, ongoing debate among notable figures in the crypto world, including founders and analysts from leading investment funds and crypto platforms, each offering differing perspectives.

One of the most striking reactions came from the account @llamaonthebrink, who expressed shock, disbelief, and disappointment at Buterin’s negative view. They argued that this sentiment contradicts the very purpose of building the Ethereum network, which serves as the foundational infrastructure for most blockchains in the cryptocurrency world.

This person explained that “the majority of ETH’s current value comes from its use as collateral in DeFi,” and they genuinely couldn’t understand “why Vitalik would want to reduce the proliferation of new DeFi protocols.”

Adding to their confusion, they questioned Buterin’s frequent praise of the USDC stablecoin, a type of asset that has the potential to replace ETH as a store of value and undermine the neutrality of the blockchain.

“I still can’t fully believe that Vitalik Buterin dislikes DeFi. I hope to hear his views directly to clarify this. If it turns out to be true, it would be deeply disappointing for all of us who are working tirelessly to protect and enhance the value of ETH.”

In response to these concerns, Ethereum’s founder didn’t disappoint. He promptly replied, suggesting that people had misunderstood his stance on DeFi. He clarified the misconceptions circulating in the community by stating:

Vitalik Buterin clarified that he wants to see the development of useful applications in a sustainable way, without compromising core principles such as permissionless access and decentralization. He pointed out, “I still regularly use DeFi protocols like decentralized exchanges (DEX) on a weekly basis.”

What Vitalik finds problematic, however, are products that create temporary hype, such as the liquidity farming craze of 2021. During this period, users could earn passive returns (APY) as high as hundreds or even thousands of percent simply by depositing their coins into these DeFi protocols—without any clarity on where the profits were coming from. Was the money generated from borrowers, or was it taken from a portion of the protocol’s transaction fees?

Vitalik likened unsustainable DeFi protocols to “an endless loop”: The value of crypto tokens lies in investors being able to use them to earn interest, and that interest is paid out by… other users trading those same tokens.

Regarding his praise for Circle’s stablecoin, USDC, Vitalik explained:

“While USDC may not be as exceptional as the RAI stablecoin (which is backed solely by Ether and uses an algorithm to maintain price stability), it’s undeniable that USDC is highly convenient and widely used.”

Personally, I find it incredibly useful for making international donations, much more convenient than traditional banking. We’re here to make the global economy and society more open and free. The use of stablecoins by people in emerging markets to trade freely is a prime real-world example.”

In response to Vitalik Buterin’s views, “0xstrobe,” a core contributor to the DeFiLlama data aggregation platform, disagreed with the notion that “DeFi is an endless loop.”

The “0xstrobe” account presented counterarguments to Vitalik Buterin’s perspective:

> the yield comes from borrowers, trading fees, etc

Right, so this worries me. Because it feels like an ouroboros: the value of crypto tokens is that you can use them to earn yield which is paid for by… people trading crypto tokens.

Even if the answer is something clear like…

— vitalik.eth (@VitalikButerin) August 25, 2024

The technology behind many DeFi protocols is genuinely useful and valuable for tokenizing other assets on the network, such as centralized stablecoins and real-world assets (RWA). These protocols do more than just reflect the performance of Ethereum.

DeFi yields aren’t always high—and when they are, it may be due to market inefficiencies because there aren’t many sophisticated users trying to maximize those yields. For example, the APY for USDC on Aave is currently 4.51%. (We’re not talking about the 2021 Ponzi-like token printers, which I believe don’t represent DeFi as a whole).

DeFi has made significant strides in sustainability, becoming more evident in recent years. This is demonstrated by the consistent inflows and outflows of capital, as well as the transaction fees on these protocols, which continue to attract substantial funds.

DeFi also holds great potential for bridging the gap with traditional finance (TradFi). For example, borrowing USDC from a lending protocol on Ethereum, transferring it to a centralized exchange (CEX), and then using it to fund a debit card for everyday expenses. In TradFi, such activities would incur substantial fees, and securing a loan would require navigating numerous difficult requirements.

However, “0xstrobe” acknowledged that DeFi alone may not be enough to trigger a 10 to 100-fold growth explosion for crypto in the future.

In the course of this debate, Vitalik Buterin expressed his support for Real World Asset (RWA) platforms, noting that “they help decentralized applications (dApps) mitigate systemic risks associated with relying on a single issuer or asset type.”

Vitalik Buterin, the “father” of Ethereum, highlighted Polymarket as a prime example, noting that it’s more than just a financial platform; it can serve as a social awareness tool. He criticized the notion that “labeling Polymarket as gambling is a significant misunderstanding,” arguing that “the public gains insight into the importance of certain events and the likelihood of various outcomes—insights that are less influenced by editorial bias compared to social media or news websites.”

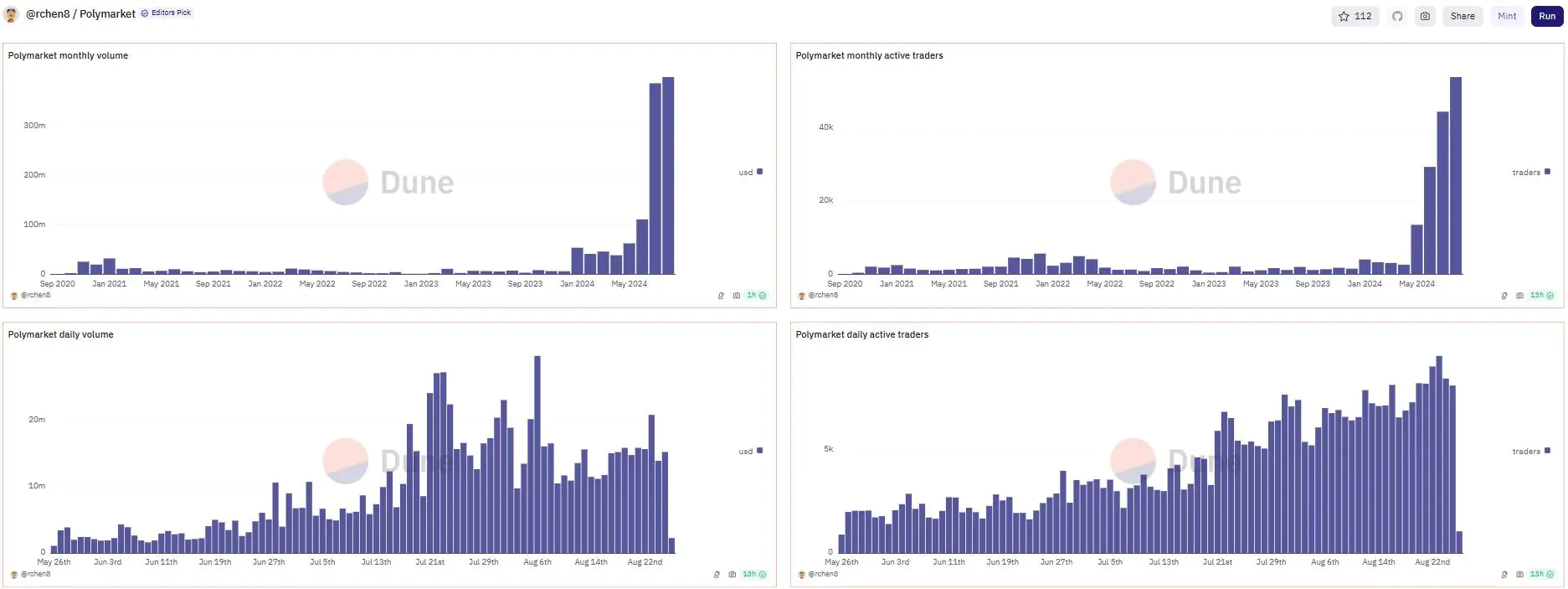

According to data from Dune, Polymarket’s monthly active users reached 54,000 in August, setting a new record for the fourth consecutive month. The platform’s trading volume has consistently exceeded $380 million for two consecutive months, and for the first time in its history, Polymarket’s total holdings surpassed $100 million.

Reactions from other key opinion leaders (KOLs) to Vitalik’s statements

Vitalik Buterin’s remarks sparked a strong reaction from the DeFi community. Influential figures such as Sam Kazemian, founder of Frax Finance, criticized him, stating that “he no longer has expertise when it comes to DeFi or stablecoins at this point… making fundamental mistakes with outdated theories.”

Some critics have pointed out that the stablecoin Vitalik Buterin often promotes, RAI, has a relatively small market capitalization and low trading volume compared to other stablecoins in the DeFi space.

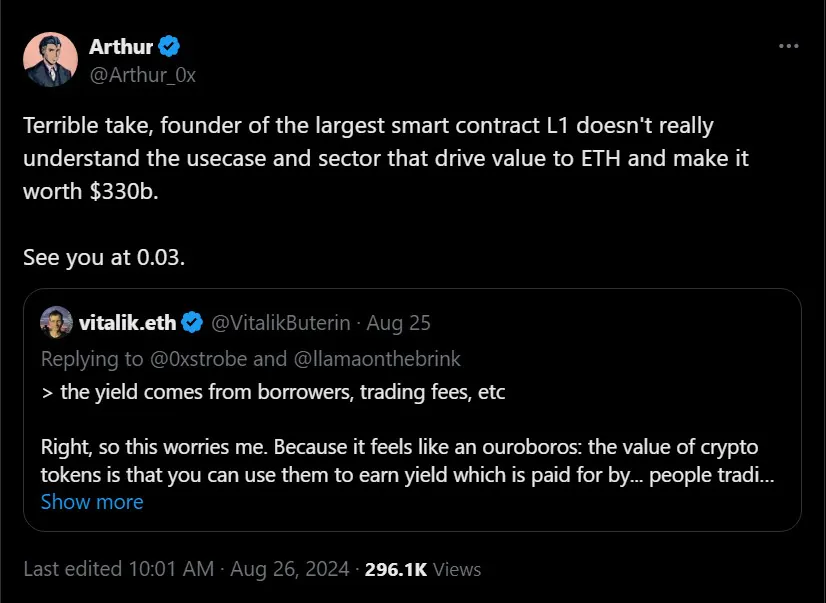

Similarly, Arthur Cheong, the founder and CEO of Defiant Capital, argued that Vitalik Buterin no longer fully understands the current drivers of Ethereum’s value. He noted that it is precisely these use cases that have propelled Ethereum to a market capitalization of $327 billion. This perspective aligns with others in the industry, like Evanss6 and Zaheer Ebtikar, co-founder of Split Capital, who share the view that “Ethereum’s value is 100% DeFi.”

Loi Luu, former co-founder of Kyber Network, while agreeing with Vitalik Buterin that DeFi has led to unsustainable and impractical speculative practices, acknowledged that DeFi has been a key factor in attracting a large number of users to the crypto market. He noted that such issues are common in any emerging market, whether it’s NFTs, memecoins, or DeFi.

What developers need to focus on is continuously upgrading and creating additional utilities within the crypto space, rather than downplaying the importance and role of DeFi in Ethereum. Some people find it particularly perplexing that Vitalik Buterin would question the origins of yields in DeFi, as similar concepts have long existed in traditional finance.

Rhett Shipp, founder of Gravita Protocol, also argued that DeFi plays a crucial role in ETH’s growth because it constitutes the majority of Ethereum’s usage and gas fees, thereby driving its value as ETH is widely used as collateral within the sector.

“Removing DeFi from Ethereum would result in an 80% drop in ETH’s value,” Shipp concluded.