XRP Price Action and Technical Signals

After years of being trapped in a symmetrical triangle pattern since 2018, XRP recently broke out and entered a price discovery phase. In July, the cryptocurrency surged to $3.66 — its highest level in seven years — before slightly retracing to around $3.11.

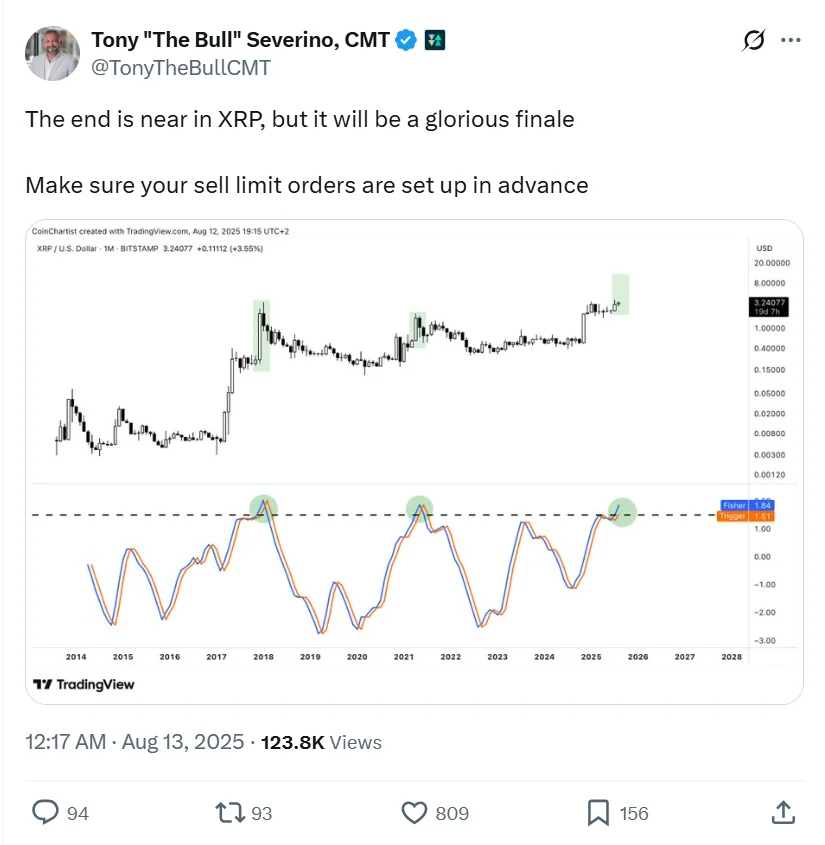

According to Severino, technical indicators such as the Fisher Transform are approaching levels last seen at major peaks in 2017 and 2021. Both of those instances were followed by steep declines, signaling the need for caution. He advises traders to set sell orders in advance to secure profits and reduce risk when momentum starts to fade.

Potential Peak and Historical Parallels

Severino sees similarities between the current rally and XRP’s late-2017 surge, when the token skyrocketed from under $0.01 to over $3 in just nine weeks. He predicts this rally could unfold in a shorter timeframe, with the “final wave” possibly reaching $12.73 within roughly 40 days — implying a potential peak in late August or early September.

Some other analysts are even more bullish, projecting year-end targets between $50 and $99. Nevertheless, Severino emphasizes the importance of measured trading, especially for retail investors.

The Importance of an Exit Strategy

While maintaining an optimistic view, Severino revealed his own target range for taking profits lies between $8 and $13. He is not alone in warning of a potential reversal once a peak is reached.

Analyst Jaydee cautions that while XRP could experience a dramatic surge similar to 2017, only a small fraction of investors are likely to capture significant gains. Many could be left holding positions at a loss if they fail to exit strategically.

EGRAG, another market analyst, echoes these concerns and outlines two sharp correction scenarios:

-

Scenario 1: XRP reaches $27 before plunging 97% to $0.80.

-

Scenario 2: XRP climbs to $9 before falling 85% to $1.30.

He also warns that a drop below $0.30 remains possible based on historical market cycles. While figures like Michael Saylor and Bitwise’s Matt Hougan argue that institutional participation has changed market dynamics, EGRAG maintains that cyclical trends still matter and that deep corrections remain likely.