VanEck’s spot Solana ETF has officially appeared on the Depository Trust and Clearing Corporation (DTCC) website, marking a key milestone in its journey toward potential approval by the U.S. Securities and Exchange Commission (SEC). Bloomberg analysts now estimate the chance of approval at 91%.

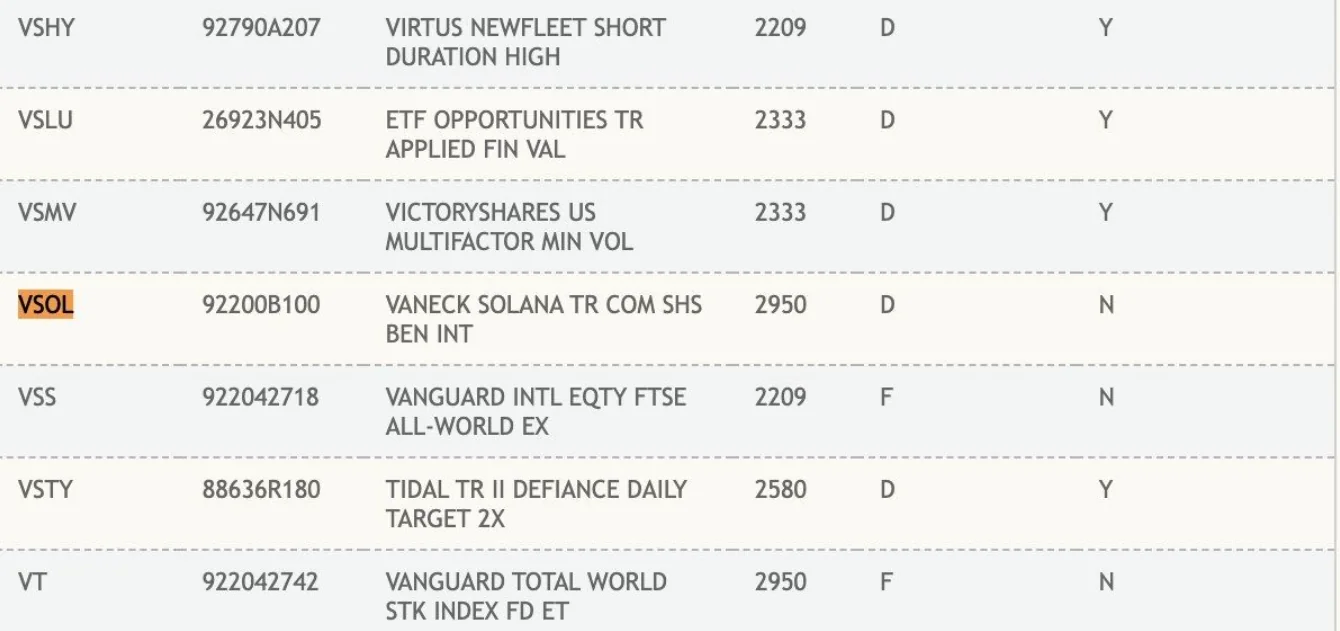

The Solana ETF, listed under the ticker symbol VSOL, is currently in DTCC’s “active and pre-launch” category. While the fund is not yet approved for trading, its presence on the DTCC platform is seen as a positive signal that regulatory review is underway and a decision may be imminent.

The SEC has historically been cautious in approving crypto-based spot ETFs. While Bitcoin and Ethereum ETFs have recently received approval, Solana has yet to receive the same treatment. Thus, VanEck’s listing on DTCC could be a significant step toward broader acceptance of Solana and similar crypto-based ETFs in the U.S. market.

It’s important to note, however, that appearing on the DTCC site does not mean the ETF is approved. The listing is part of the pre-launch process, and DTCC will not process any creations or redemptions until formal approval is granted by the SEC.

According to Bloomberg analysts James Seyffart and Eric Balchunas, the SEC is currently working with ETF issuers to revise their S-1 filings — a crucial part of the regulatory process. While the exact timing remains uncertain, analysts suggest approval could come within the next month, given the progress made and growing interest in Solana.

This optimistic outlook is further supported by the Chicago Mercantile Exchange (CME)’s plan to launch Solana futures, signaling strong market confidence in the asset. Prediction platform Polymarket also shows a 91% chance of SEC approval for a Solana ETF, mirroring Bloomberg’s estimates.

VanEck is not alone in the race. Other major asset managers, including CoinShares, Bitwise, and Franklin Templeton, have submitted proposals for Solana ETFs. Some are facing delays, but there is a clear trend: several firms have updated their filings to include staking options — a sign that the crypto ETF market is rapidly evolving and expanding.