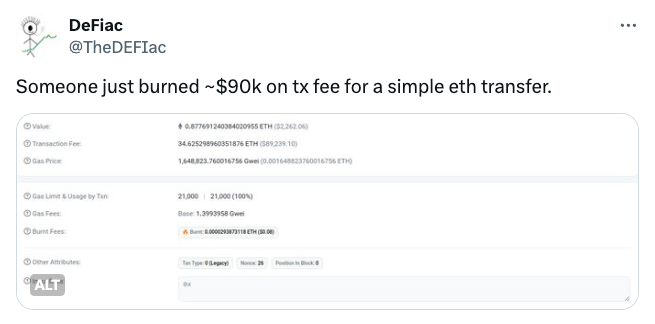

The user expended 34.26 Ether, equivalent to $89,200 at current rates, to send 0.87 ETH, valued at just $2,262, according to data from Etherscan highlighted in an August 11 post on X by the anonymous user DeFiac. At the time of the post, Ethereum network gas fees were hovering at a yearly low between 2 to 4 gwei, meaning an ETH transfer would cost a maximum of $5. In percentage terms, this error led the user to overpay by a staggering 1,783,900%. Such “fat finger” transactions are not uncommon in the cryptocurrency realm.

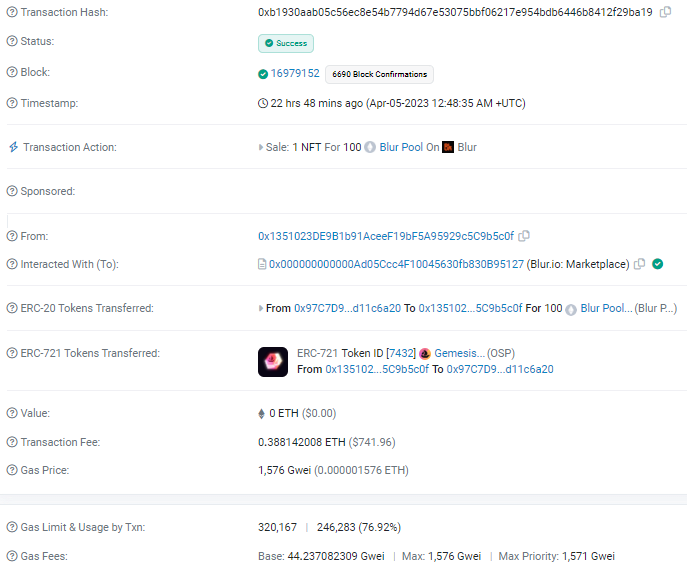

On October 10, 2023, an NFT trader paid an enormous sum of 1,055 ETH — worth $1.6 million at the time — to acquire an NFT priced at just $1,000.

Similarly, on April 6, an OpenSea collector spent 100 ETH, approximately $191,000 then, to purchase a free NFT, which sparked allegations of money laundering.

Mistakes in transferring funds aren’t limited to retail participants. In May 2021, Singapore-based cryptocurrency exchange Crypto.com accidentally sent $7 million to Thevamanogari Manivel, an Australian user of the exchange.

Manivel never reported the incident and instead used the funds to purchase a multimillion-dollar mansion in Melbourne and deposited approximately $4 million into a foreign bank account. She was sentenced to 209 days in jail for “dealing with the proceeds of crime.” It’s not always a fat-finger mistake.

While overpaying gas fees on the Ethereum mainnet may seem accidental, it can also be a sophisticated form of money laundering.

Users need to know which Ethereum validator will verify a specific transaction and ensure it is sent to the correct block. From there, the anonymous user must closely collaborate with that validator to ensure the funds aren’t distributed to an unauthorized entity.

In an October 2023 report, cryptocurrency staking company Northstake revealed that the total number of illegal and high-risk activities across three Ethereum staking protocols and some areas of the mainnet ranged between 0.46% and 1.56%.

Although these figures are relatively low, Northstake noted that they raise concerns among regulated entities looking to engage with liquid staking protocols and decentralized finance on Ethereum in general.