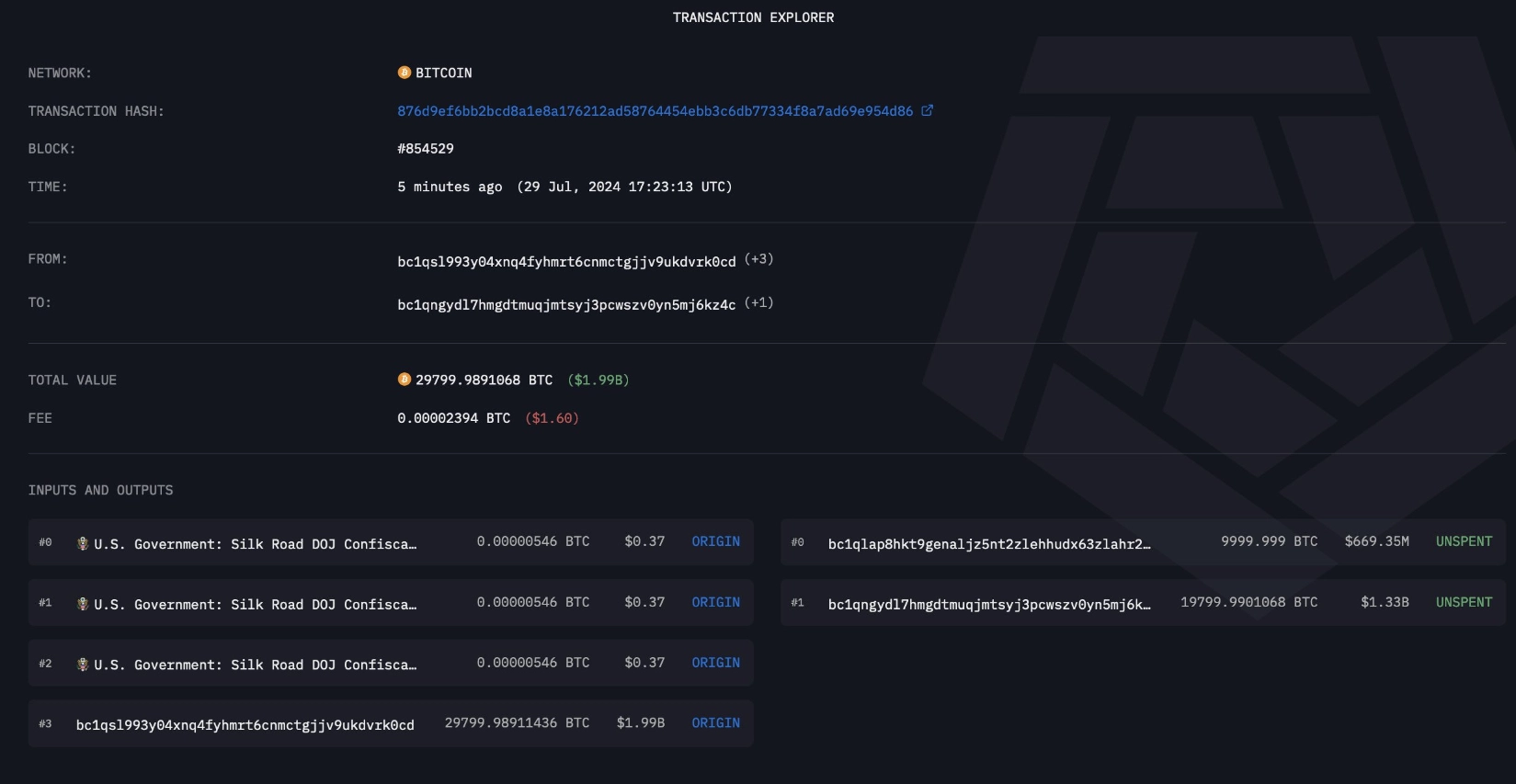

On the evening of July 29 (UTC), on-chain data aggregated from Arkham revealed that the U.S. government unexpectedly transferred nearly 29,800 Bitcoins, valued at approximately $2.02 billion, to an unknown address for reasons yet to be clarified.

These Bitcoins are part of the assets seized by U.S. authorities from the Silk Road darknet marketplace.

The motive behind this latest Bitcoin transfer by the U.S. government remains unclear. The last time the U.S. government’s Bitcoin wallets moved funds was on July 23, with a transaction value of only $3.96 million. At the end of June, U.S. authorities transferred $243 million to a Coinbase wallet address. In April, the U.S. moved $2.1 billion worth of Bitcoin seized from Silk Road.

According to Arkham’s data, the U.S. still holds nearly 183,500 BTC, valued at approximately $12.3 billion, along with smaller amounts of other cryptocurrencies. The U.S. government remains the largest holder of crypto assets, primarily due to seizures from criminal activities.

Related: What Price Targets Does the Community Expect for Bitcoin, Ethereum, and Solana?

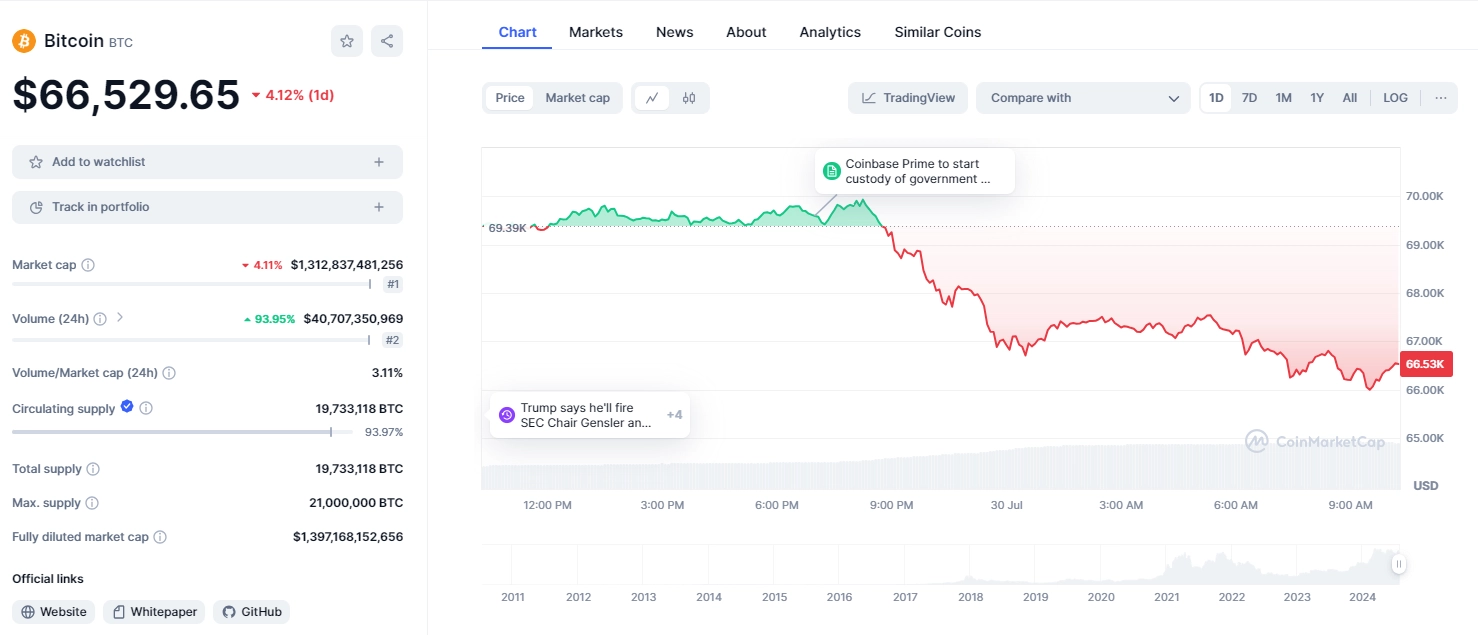

Bitcoin Price Fluctuation

It is uncertain whether this information caused an immediate negative reaction in Bitcoin’s value, which dropped by $4,000 from $70,000 to $66,000. Currently, BTC is trading around the $66,500 mark.