Data from IntoTheBlock shows that Uniswap has seen a surge in large-scale transactions. Specifically, a 200% increase in large-scale transactions over the past 24 hours suggests that the “big players” in the market are making significant moves.

However, it is unclear whether these whales are accumulating Uniswap tokens in preparation for a price increase or are ready to unload.

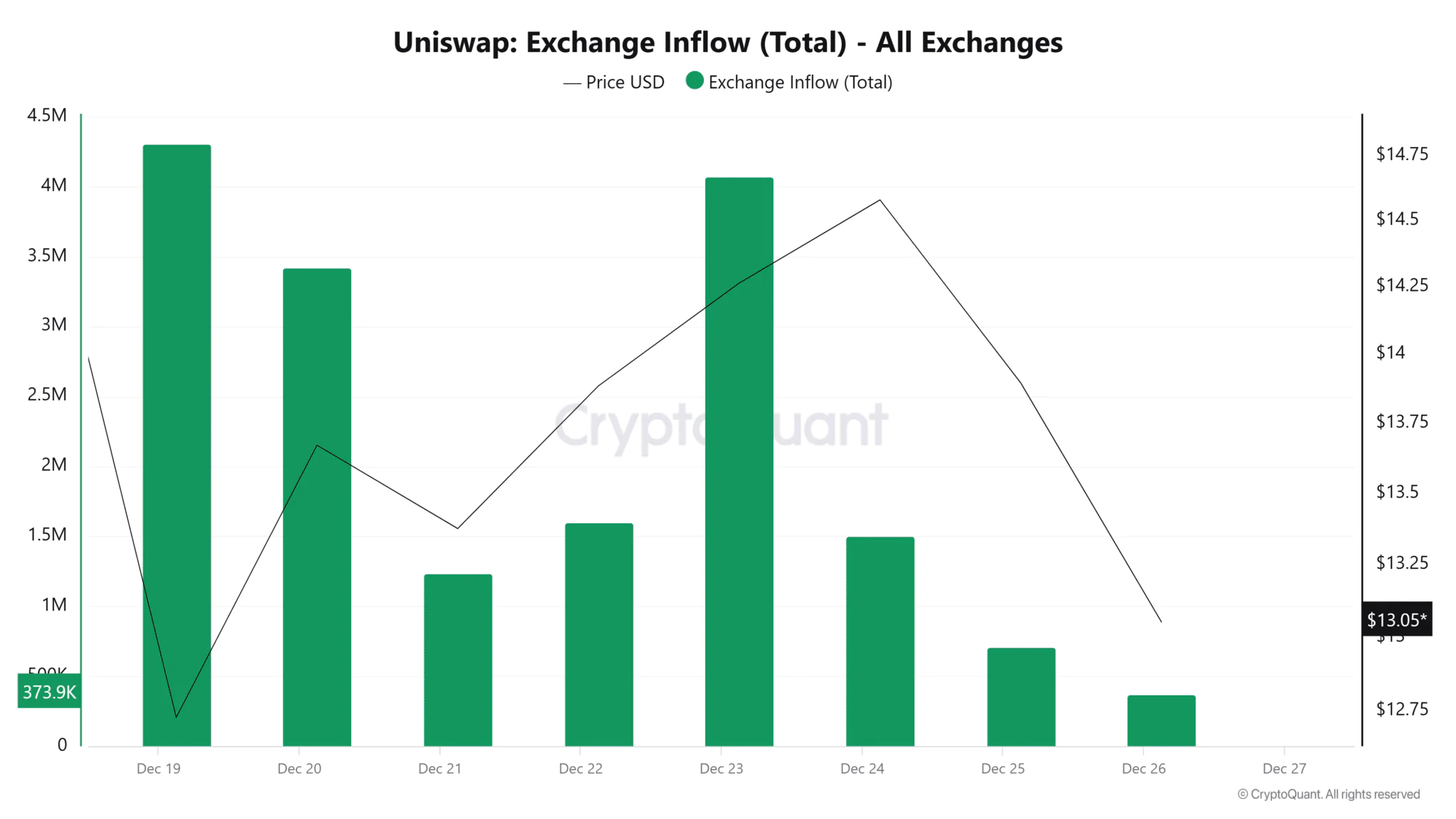

Declining Exchange Inflows Add to the Mystery

While whale activity is on the rise, exchange inflows have cooled. According to data from CryptoQuant, the amount of tokens transferred to exchanges over the past three days has dropped sharply.

Typically, this downward trend is a sign that traders are holding onto their assets rather than preparing to sell. However, the decline in inflows could also reflect waning retail investor interest.

Uniswap Price Plunges Despite Market Activity

Complicating matters, Uniswap has dropped by 9% in less than 48 hours. This sharp drop suggests that bears are in control.

However, looking at longer time frames, Uniswap’s price action is still bullish. This suggests that the altcoin may just be in a short-term correction before a stronger rally.

Technically, the price could drop to test the key support level of $12 – a former resistance level that turned into support during the recent rally.

A look at liquidation data from Coinglass could provide the expected answer. Around 818,000 UNI could be liquidated if the price continues to fall towards $12.

The altcoin is likely to drop further towards $12 before a potential rally, thanks to increased buying pressure from whales.