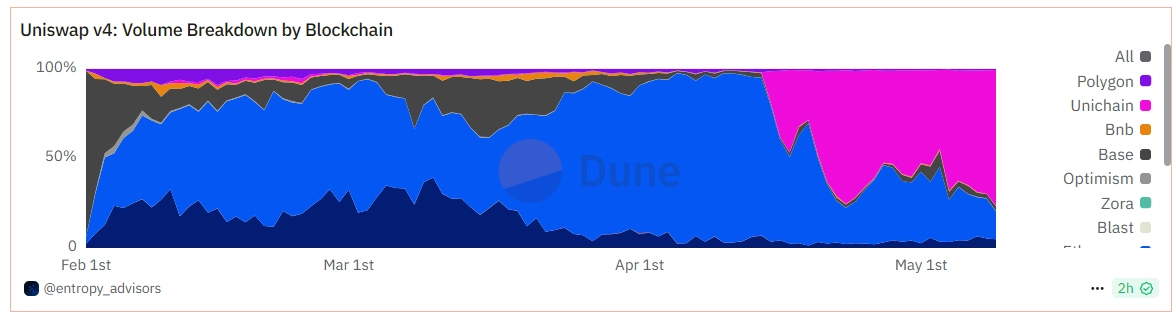

Unichain, the Layer 2 blockchain developed by Uniswap, has officially surpassed Ethereum to become the dominant platform for Uniswap v4, now accounting for 75% of the protocol’s total trading volume, according to data from Dune Analytics compiled by Entropy Advisors. Meanwhile, Ethereum’s share has dropped to under 20%.

This trend began accelerating in mid-April 2025, fueled by Unichain’s rapid development and strategically designed incentive programs. However, Ethereum still maintains its lead in transaction volume on Uniswap v3, which remains more popular among users.

Launched in January 2025, Uniswap v4 is the latest version of the leading decentralized exchange (DEX), introducing game-changing features like customizable hooks, flexible fees, gas optimizations, and native ETH integration. Unichain was purpose-built to power v4 and does not support v3 within its core ecosystem.

Unichain’s traction on v4 is largely driven by a $45 million liquidity incentive program, which has significantly boosted both active wallet counts and total value locked (TVL). According to DeFiLlama, Unichain is now the third-largest Layer 2 network, with a TVL of $800 million.

Built on the Optimism Superchain, Unichain offers up to 95% lower transaction fees compared to Ethereum Layer 1. With 1-second block times and plans for 250ms sub-blocks in the future, Unichain aims to deliver near-instant trading experiences.

Related: Ethereum Market Plummets: Drops to Record Low

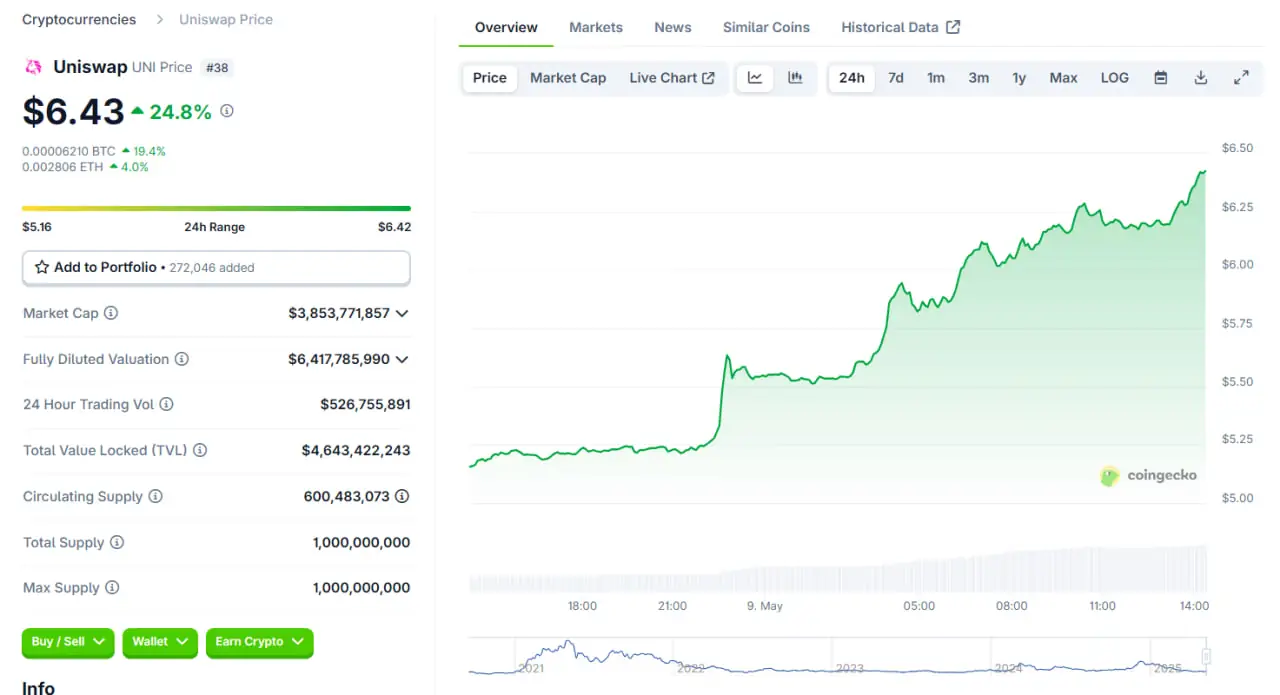

The UNI token has also surged more than 20% in the past 24 hours, making it one of the top-performing large-cap altcoins on the market.