Ethereum (ETH) has experienced a dramatic decline in market share, dropping from over 20% to just under 7%—a level not seen in recent history. Notably, during the 2021 bull run, ETH’s dominance peaked at 22%.

Over the past three years, Ethereum’s market share typically fluctuated between 16% and 20%. However, 2024 marked a turning point, as it suffered a sharp and alarming decline. Overall, ETH has lost approximately 67% of its market share, hitting a five-year low of 7%. This downturn is largely attributed to regulatory uncertainty, particularly around taxation, and a broader negative sentiment surrounding the asset.

During the same period, Bitcoin has significantly outperformed Ethereum, despite ETH’s reputation as the pioneer of smart contracts and decentralized finance (DeFi). The ETH/BTC ratio—a key indicator of Ethereum’s price performance relative to Bitcoin—plummeted to a five-year low of 0.018, reflecting a staggering 77% drop since Ethereum’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS).

In terms of price, ETH has declined by 64%, falling from its all-time high above $4,000 to around $1,500. The bearish outlook is not limited to retail investors; it has also affected institutional interest in Ethereum throughout 2025.

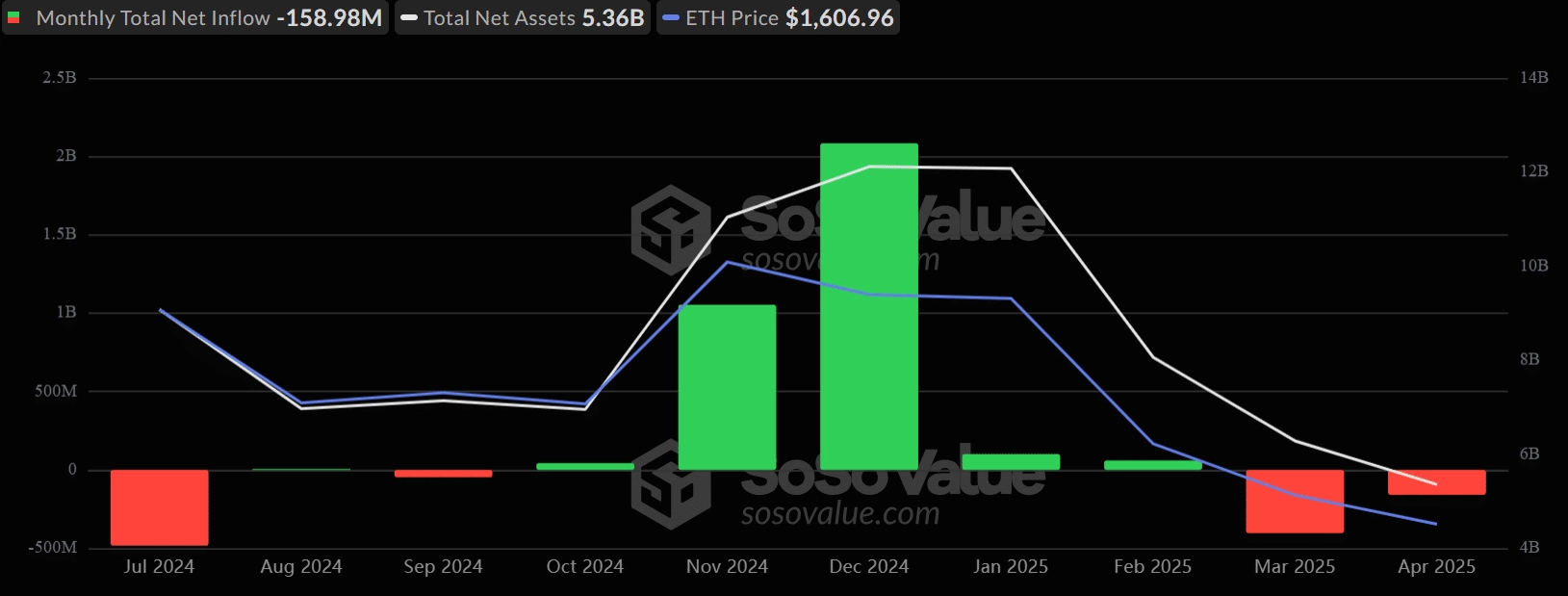

This stands in stark contrast to December 2024, when spot Ethereum ETFs attracted over $2 billion in monthly inflows. In Q1 2025, demand has dropped drastically. According to data from Soso Value, net inflows fell to $100 million or less during the first two months of the year.

More concerning is the fact that nearly $500 million has been withdrawn from Ethereum investment products since March.

Despite the negative sentiment, Ethereum continues to move forward with several major upgrades, including Pectra and Fusaka. These updates are designed to significantly improve transaction speed and reduce costs on both Layer 1 and Layer 2, enhancing Ethereum’s competitiveness against rising challengers like Solana (SOL).

Related: Vitalik Buterin Unveils Ethereum’s Major Upgrade

One potential bright spot on the horizon is the possibility of staking being approved for ETH ETFs, with a key regulatory decision expected in June.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE