A federal court in Manhattan has frozen approximately $57.65 million in the stablecoin USDC, allegedly tied to the controversial Libra cryptocurrency scandal.

According to attorney Max Burwick — who represents the plaintiffs in a class-action lawsuit — the freeze order was issued on May 28 after the Southern District of New York (SDNY) court approved a temporary asset freeze. A hearing is scheduled for June 9 to decide whether the assets will remain frozen as the case proceeds.

The lawsuit accuses crypto venture firm Kelsier Ventures and its three co-founding brothers — Gideon, Thomas, and Hayden Davis — of creating the Libra (LIBRA) token and misleading investors to siphon over $100 million from one-sided liquidity pools. Blockchain infrastructure companies KIP Protocol and its CEO Julian Peh, as well as Meteora and co-founder Benjamin Chow, are also named as defendants.

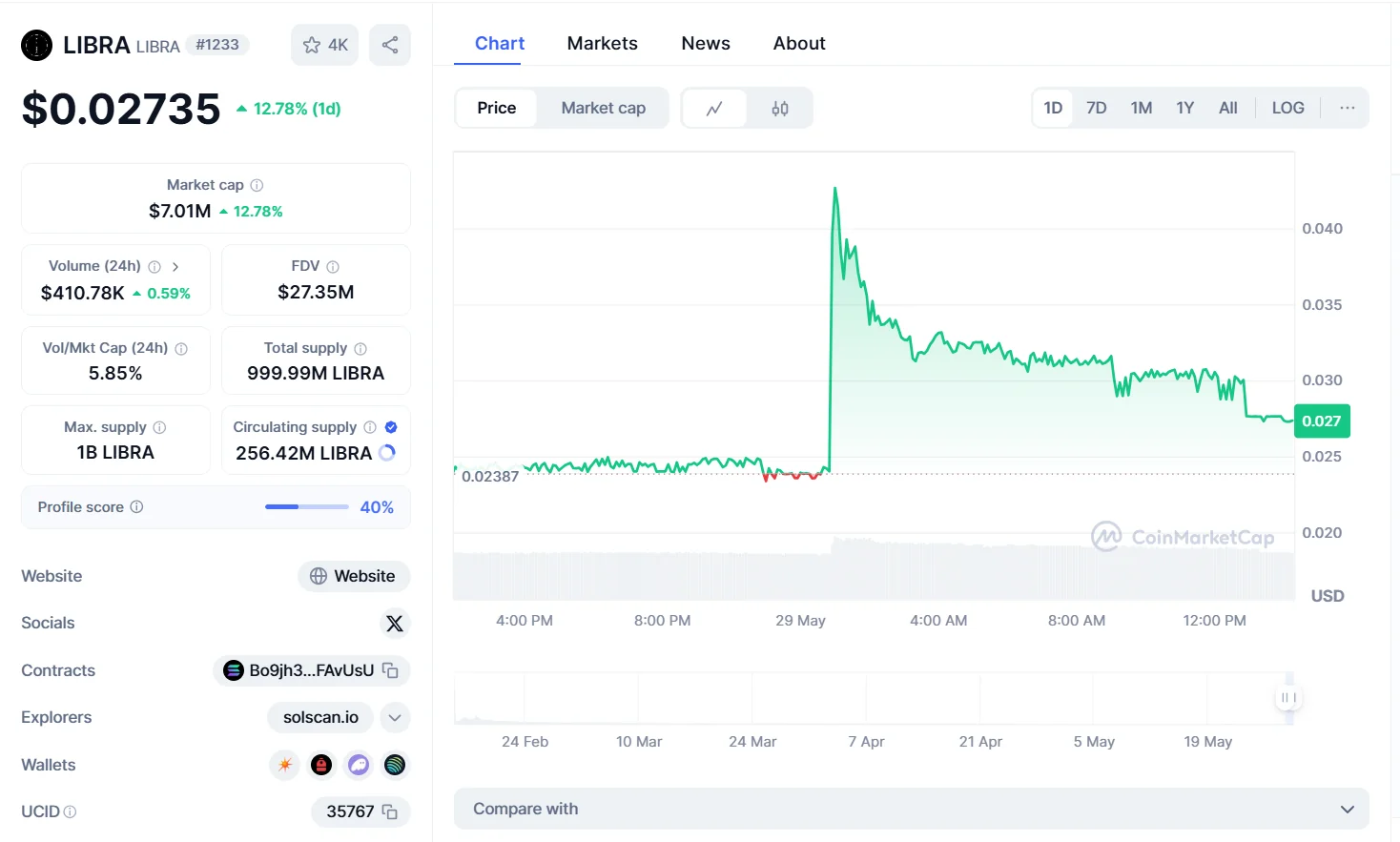

LIBRA briefly reached a $4 billion market cap on February 14, following a social media post by Argentine President Javier Milei, before crashing 94% within hours. The incident sparked a political scandal in Argentina, with opposition parties calling for Milei’s impeachment, though the movement saw little traction.

Polling firm Zuban Córdoba reported that the scandal negatively affected public perception of Milei and confidence in his administration. Nevertheless, on May 19, Milei signed a decree disbanding the special task force assigned to investigate the Libra case, without taking action against himself or any other officials. Critics claim the investigation was never conducted seriously and allege political cover-up.

On May 28, two Solana wallets holding a combined $57.65 million in USDC were frozen, according to Solscan data. One wallet contained $44.59 million, while the other held just over $13 million. Both were frozen by the Multisig Freeze Authority.

The case underscores growing concerns about transparency in the crypto space and highlights potential political interference in cross-border financial investigations.