Top researchers Justin Drake and Dankrad Feist left their advisory roles for the EigenLayer restaking platform in September.

In May 2024, the two publicly confirmed their roles at EigenLayer. Each was promised millions of dollars in EIGEN tokens, which would be unlocked over three years. Drake even admitted that the compensation exceeded his personal net worth.

Community backlash

The decision to join EigenLayer has sparked a wave of criticism in the community, raising concerns about conflicts of interest. This is particularly notable because EigenLayer is a top 3 DeFi project by Total Value Locked (TVL) and operates on a different model than Ethereum.

When the controversy erupted, Aya Miyaguchi, CEO of the Ethereum Foundation, pledged to create a clear conflict of interest policy. “It’s clear that relying on culture and personal judgment is not enough,” she stressed. “We are working on finalizing this policy and will update the details soon.”

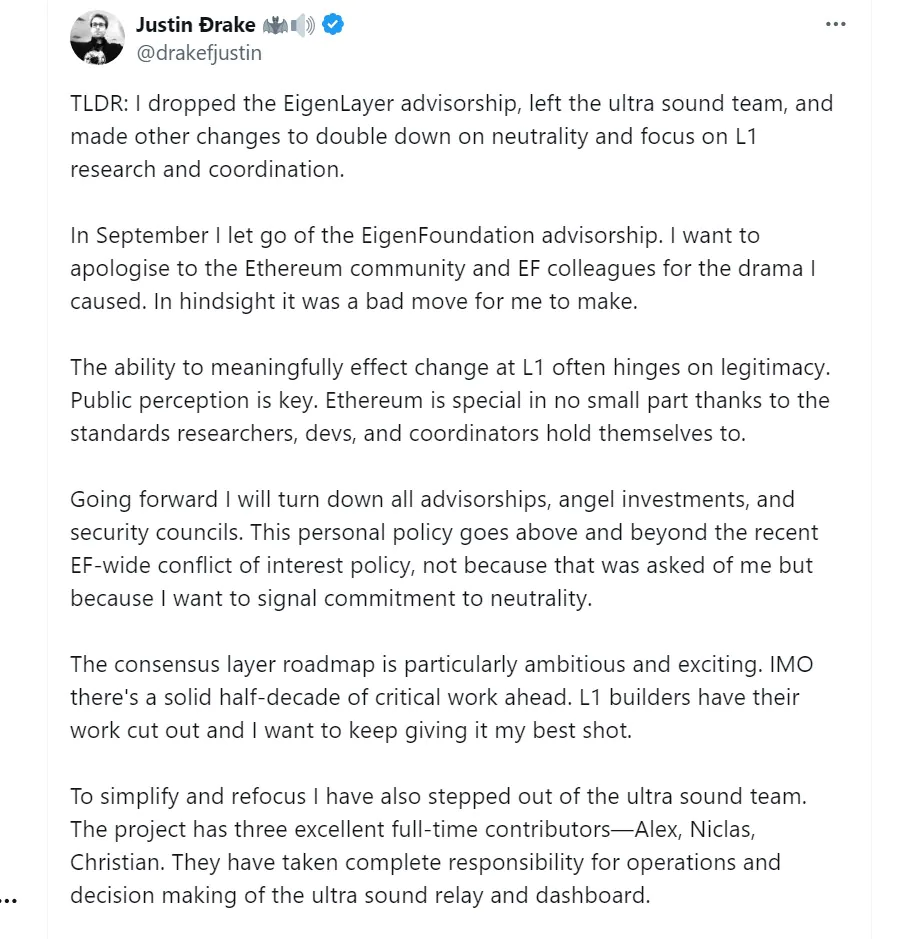

Justin Drake Apologizes

More than five months have passed, and Justin Drake has finally apologized to the Ethereum community and his peers, admitting that accepting an advisory role for EigenLayer was a mistake. The two researchers decided to step down from their advisory roles to focus solely on the parent network, Ethereum.

Drake pledged to remain neutral in the Ethereum community. He said he would decline any advisory positions, angel investments, and security committees. The decision not only complies with the Ethereum Foundation’s conflict of interest policy, but also underscores his commitment to neutrality. He asserts that his advisory role at EigenLayer was terminated before any EIGEN tokens were unlocked.

For his part, Feist maintains that his decision to take on the advisory role was negotiated in good faith, to ensure that EigenLayer was aligned with Ethereum’s vision. However, he understands that the community’s perception of the relationship is different, and that the conflicts of interest it creates would be difficult to reconcile with his responsibilities at Ethereum.

EigenLayer’s EIGEN token price has fallen more than 13% over the week, now halving since the airdrop and listing, with prices hovering around $2.40 per coin.