Truth Social, the social media platform backed by former U.S. President Donald Trump, has officially entered the cryptocurrency investment space. On June 5, the company registered a new entity in Nevada called the Truth Social Bitcoin and Ethereum ETF, laying the groundwork for the launch of its first exchange-traded fund (ETF) focused on Bitcoin and Ethereum.

The registration in Nevada marks a significant legal step, clearly signaling Truth Social’s intention to participate in the digital asset investment market. Although the official offering documents have yet to be filed with the U.S. Securities and Exchange Commission (SEC), the move demonstrates a strong commitment to launching a crypto ETF in the near future.

The ETF will target both Bitcoin (BTC) and Ethereum (ETH), the two largest cryptocurrencies by market capitalization. While it remains unclear whether the fund will be spot-based, futures-based, or a mix of both, combining the two approaches is a possibility.

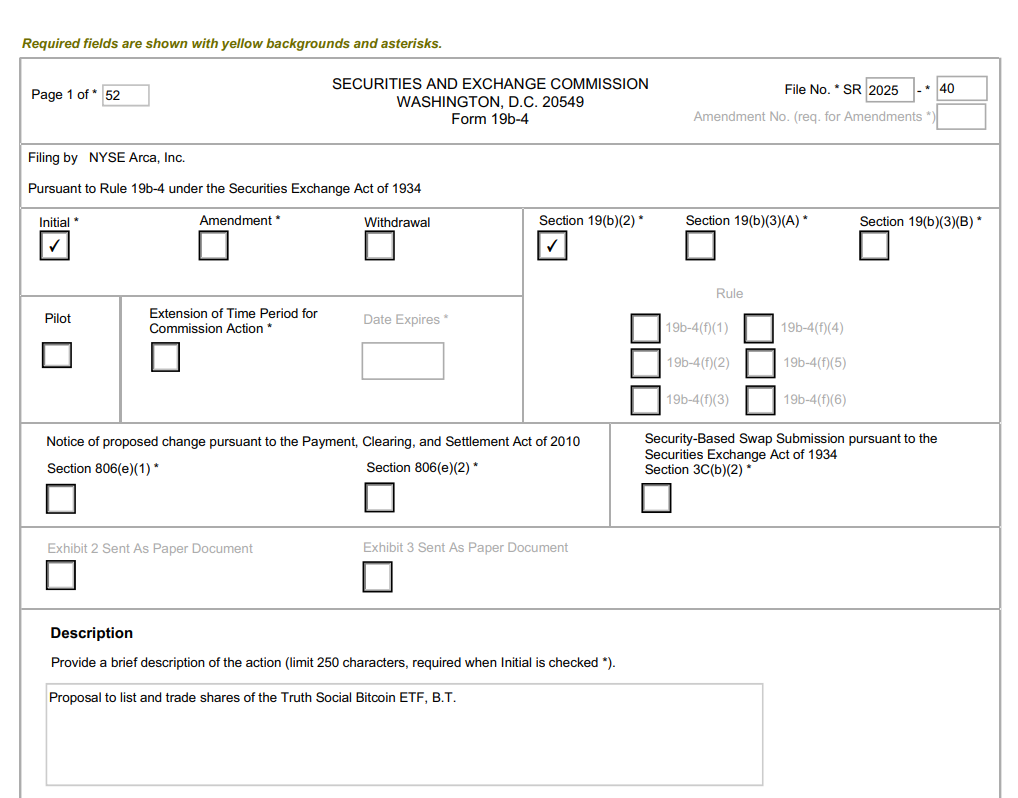

Notably, Truth Social is not going it alone. The company is receiving support from Yorkville America Digital, a digital asset management firm. On June 3, Yorkville filed a Form 19b-4 with the SEC, proposing the listing and trading of shares of the new Bitcoin ETF. This filing is a key step in the approval process, as it requests a rule change through the SEC’s self-regulatory organization (SRO). Yorkville also submitted a Form S-1—an important document in the ETF launch process—though the order of filing was reversed in this case.

If approved, the Truth Social Bitcoin and Ethereum ETF will enter a competitive market currently dominated by major financial institutions such as BlackRock, Grayscale, Fidelity, and Franklin Templeton—all of which have launched Bitcoin ETFs. Among them, BlackRock’s iShares Bitcoin Trust (IBIT) has become a market leader, managing nearly $70 billion in assets since its debut.

To ensure security and transparency, Truth Social’s ETF will be custodied by Foris DAX Trust Company, which also serves as the custodian for Crypto.com. This partnership reflects Truth Social’s commitment to building trust and credibility with prospective investors.