On June 13, Trump Coin (TRUMP) dropped 5.6% as geopolitical tensions triggered a sell-off across the crypto market. Technical analysis indicates the formation of a bearish pattern, suggesting that the price could plunge another 40% to $5.75, especially with a $500 million token unlock approaching.

Currently, Trump Coin is trading at $9.90 with a daily trading volume of $520 million. According to data from CoinGlass, the recent decline has liquidated $4.31 million in long positions, adding more downward pressure on the price.

Descending Triangle Pattern Signals Steeper Decline

Trump Coin is testing the lower boundary of a descending triangle pattern, where sellers have been steadily overpowering buyers, signaling weakening bullish momentum. The horizontal support at $9.73 has held since late April but is now under threat. A breakdown from this level could send TRUMP down to $5.75, marking a 40% drop.

Trading volume has steadily declined within the triangle, indicating uncertainty from both bulls and bears. The RSI has dropped to 37 and continues to trend downward, reinforcing the bearish outlook.

However, a short-term rebound remains possible if some investors decide to buy the dip at the triangle’s base. The AO histogram shows early signs of a potential reversal, turning green though still below the neutral line. A crossover above zero could trigger a rally back to the upper resistance line.

$500 Million Token Unlock Poses Additional Pressure

According to Tokenomist, 50 million TRUMP tokens—worth nearly $500 million at current prices—are scheduled to be unlocked on July 18. Like most token unlock events, this influx of supply could drive prices lower.

Ahead of the unlock, short interest in Trump Coin has surged as traders bet on further price declines. Notably, even with President Trump’s birthday on June 14—a date that usually brings positive momentum for Trump-affiliated meme tokens—TRUMP has failed to gain any meaningful traction, reflecting widespread caution among investors.

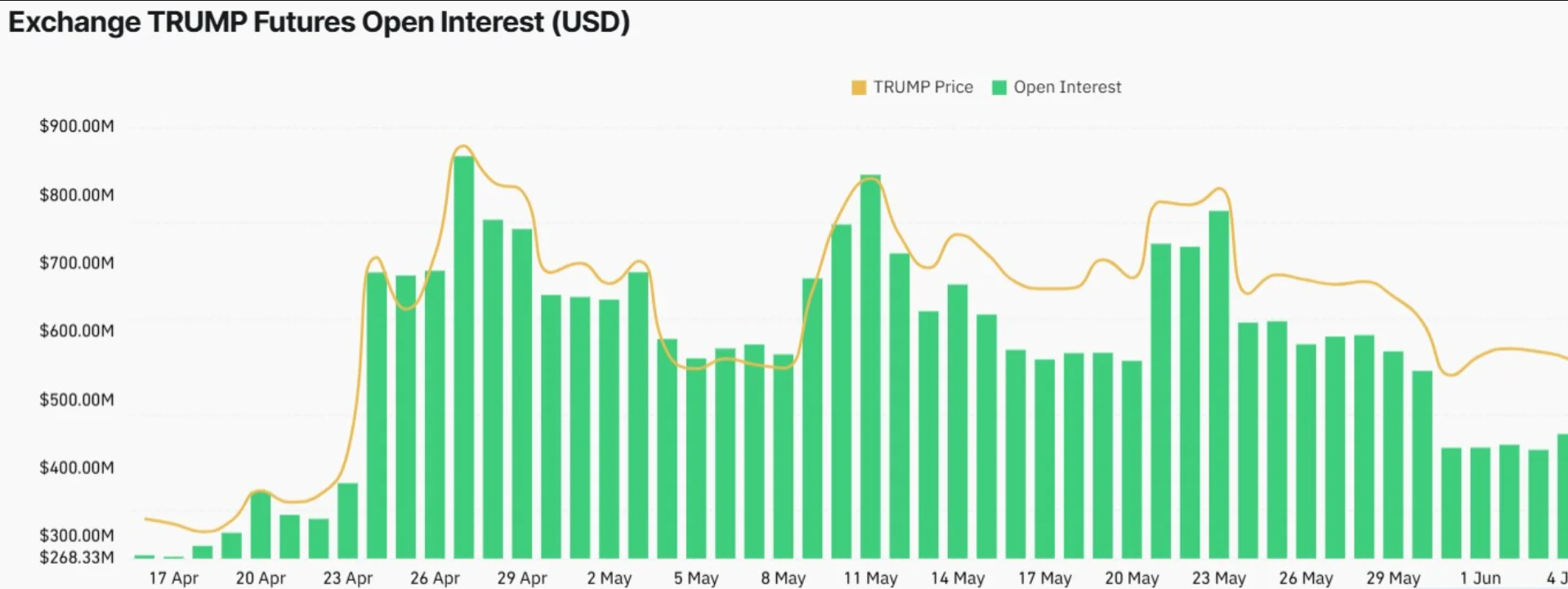

Open Interest Falls to 7-Week Low

Open interest in Trump Coin has fallen to its lowest level in seven weeks, currently standing at $357 million. Data from Coinglass reveals that most new positions are short bets, while the funding rate has plummeted to -22%, indicating strong dominance by short sellers in the derivatives market.

In summary, Trump Coin faces significant downside risk as the descending triangle pattern points to a potential plunge toward $5.75. The upcoming $500 million token unlock and fading buyer interest continue to weigh heavily on the price. Nonetheless, long-term forecasts suggest a potential recovery between 2025 and 2030.