The cryptocurrency project World Liberty Financial (WLF), backed by the family of U.S. President Donald Trump, is closing out 2025 on a weak note, with its WLFI token down more than 40% since it began public trading, despite having benefited significantly from this year’s crypto bull market.

Launched amid high expectations, World Liberty Financial was widely viewed as a symbol of a shift in the Trump administration’s stance toward digital assets. However, real-world performance has fallen short of the project’s scale and the attention it attracted.

A Promising Start, but Limited Returns

World Liberty Financial was first announced in September 2024, while Donald Trump was still campaigning for the U.S. presidency. Led by Donald Trump Jr. and Eric Trump, the project marked a major change in tone toward crypto from the Trump family.

The program got off to a strong start, issuing its WLFI governance token and making sizable purchases of large-cap cryptocurrencies. During the summer and fall 2025 bull run, the Trump family’s crypto holdings reportedly surged into the tens of billions of dollars.

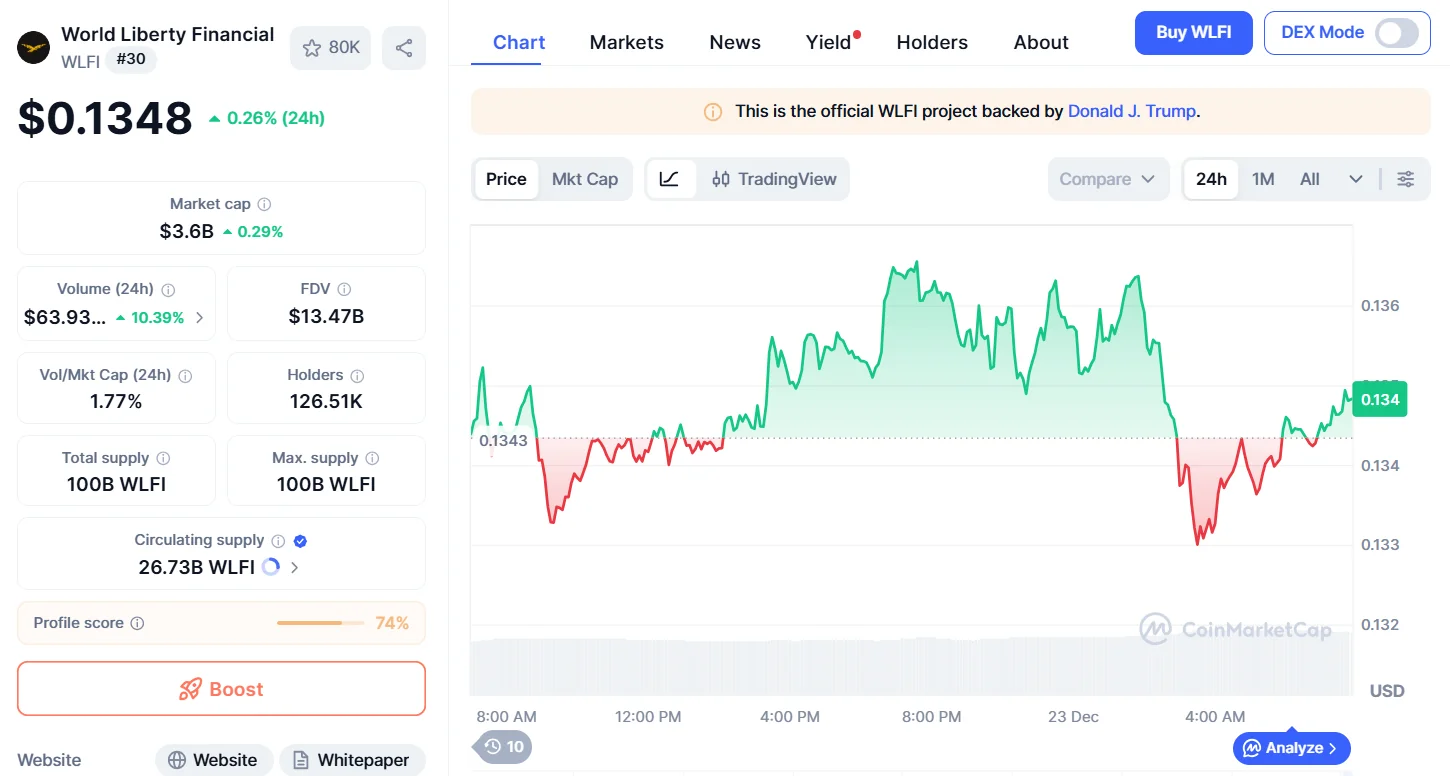

However, since WLFI began trading publicly, the token has fallen by more than 40%, significantly weighing on the project’s overall performance.

Token Sales and Expansion Strategy

WLFI completed its first token sale in October 2024, selling approximately 20 billion tokens at $0.015 each, raising around $300 million. This was followed by a second sale from January to March 2025, during which the project sold 5 billion WLFI tokens at $0.05 each, raising roughly $250 million.

In March 2025, the Trump family launched its own USD1 stablecoin, and by June, the asset was promoted through a partnership with PancakeSwap, a decentralized finance protocol within the Binance ecosystem.

In August, World Liberty Financial entered a $1.5 billion private placement and treasury deal with ALT5 Sigma Corporation, under which ALT5 exchanged 100 million shares of its common stock for WLFI tokens, effectively establishing a crypto treasury model.

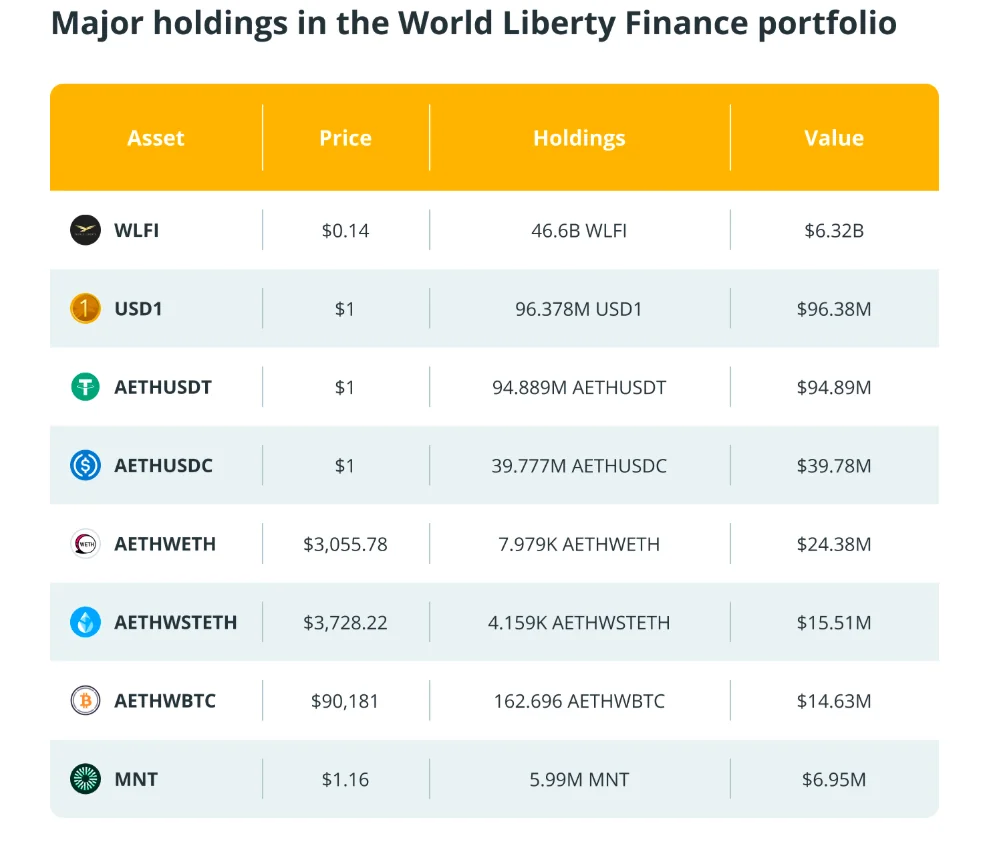

Throughout the 2025 bull cycle, the fund made multiple large-scale crypto acquisitions, investing tens of millions of dollars in assets such as Wrapped Bitcoin (WBTC), Ether, and Move, alongside significant holdings of USD1, several Aave-related tokens, and Mantle.

According to publicly available tracking data, World Liberty Financial’s portfolio value peaked at over $17 billion in September 2025, but by December 11, it had dropped to just under $8 billion, representing a decline of approximately 47%.

Controversy and Conflict-of-Interest Concerns

Historically, U.S. presidents have distanced themselves from business ventures that could pose conflicts of interest. Former President Jimmy Carter, for example, placed his peanut farm into a semi-blind trust while in office.

President Trump has taken a markedly different approach, remaining actively involved in business ventures that could directly benefit from his administration’s political and financial priorities. According to the BBC, as Bitcoin approached its annual high, the Trump family’s contractual ownership of WLFI tokens alone was valued at over $5 billion.

The Trump administration has faced repeated calls for investigations into potential conflicts of interest. As early as April 2025, Senator Elizabeth Warren and Representative Maxine Waters urged the U.S. Securities and Exchange Commission (SEC) to preserve all records related to World Liberty Financial in order to assess whether Trump’s involvement could compromise the agency’s regulatory effectiveness.

In November, Warren renewed her call for a probe following a report by Accountable.US, which alleged that World Liberty Financial had sold tokens to sanctioned individuals linked to Iran, North Korea, and Russia.

The White House denied the allegations, calling them baseless. Press Secretary Karoline Leavitt accused the media of fabricating conflict-of-interest narratives and undermining public trust. World Liberty Financial also stated that it conducted strict Anti-Money Laundering (AML) and Know Your Customer (KYC) checks and rejected millions of dollars from prospective buyers who failed to meet compliance standards.

The Trump Family’s Expanding Crypto Footprint

The Trump family’s crypto involvement extends beyond World Liberty Financial. Trump Media & Technology Group operates the fintech brand Truth.Fi, which in September purchased 684.4 million Cronos (CRO) tokens worth approximately $104.7 million as part of a deal with Crypto.com.

Meanwhile, Donald Trump Jr. and Eric Trump also co-founded the Bitcoin mining venture American Bitcoin, which held 4,784 BTC as of December 10, 2025, according to Solid Intel.

Despite the sharp decline in the value of World Liberty Financial’s portfolio, the project continues to push forward. On December 3, co-founder Zach Witkoff announced plans to launch a suite of real-world assets (RWAs) beginning in January 2026.