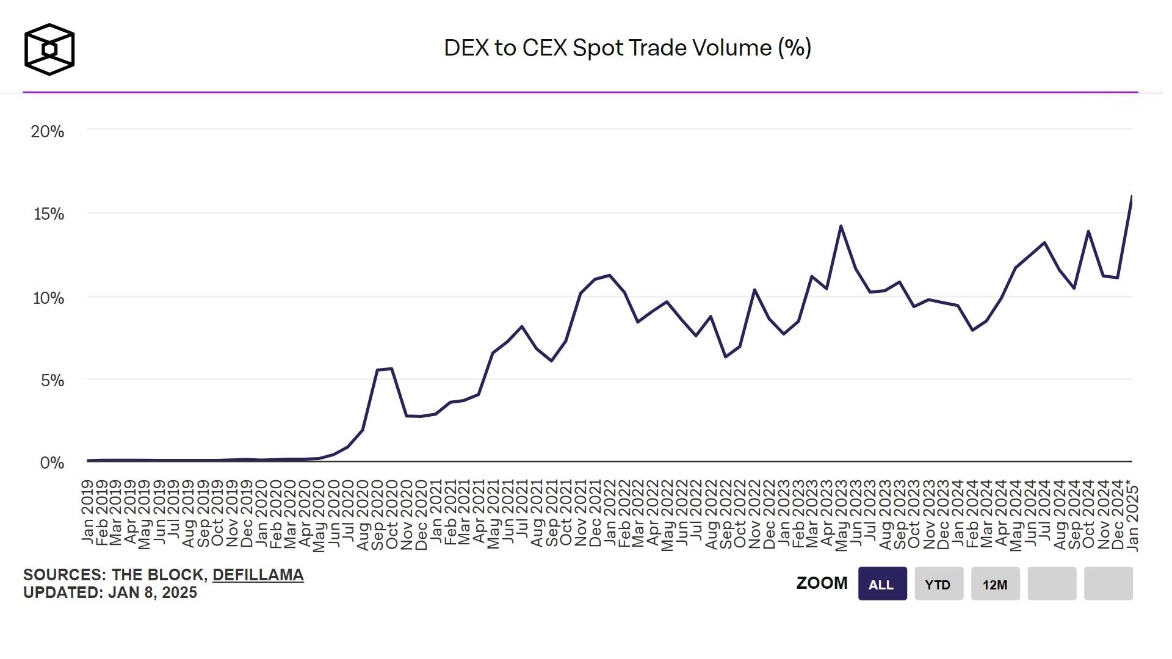

According to the latest data from The Block, the trading ratio between decentralized exchanges (DEXs) and centralized exchanges (CEXs) has reached a record high of 20.21%. This means that for every $1 billion traded on centralized platforms like Binance or OKX, approximately $202 million is now being transacted on decentralized platforms (DEXs).

This marks a significant leap from the previous record of 14.22% set in July 2024, reflecting a clear trend of users increasingly opting for decentralized solutions.

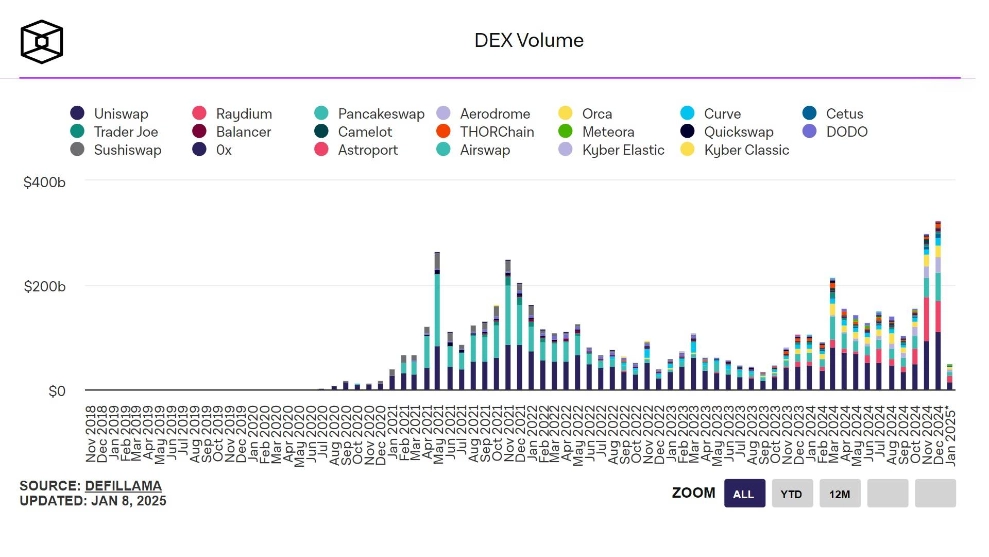

In just the first week of January 2025, DEXs recorded an impressive total trading volume of $48.72 billion. Uniswap led the pack with $14.85 billion, followed by Raydium at $12.95 billion, and PancakeSwap securing third place with $7.88 billion.

In contrast, CEXs are experiencing a sharp decline. Trading volumes have dropped by more than half in just two weeks, falling from $102 billion (on December 23, 2024) to $52 billion. However, since the start of January 2024, CEXs have still generated a total trading volume of $309 billion, with Binance contributing $101.8 billion, followed by Upbit ($33.33 billion) and Bybit ($32.85 billion).

Notably, Solana has overtaken Ethereum to become the blockchain with the highest trading volume over the past month, registering $113.04 billion, which is 43% higher than Ethereum’s $78.9 billion. This milestone is particularly significant given the memecoin trend, which accounted for 24% of investor interest last year, with many memecoins launched on Solana—especially after the debut of pump.fun in April 2024.

The year 2024 also posed numerous challenges for CEXs, with a series of high-profile hacks, including WazirX ($230 million), Indodax ($20 million), BtcTurk ($54 million), and BingX ($43 million). These incidents have eroded user trust, driving more people toward DEXs, which continue to improve in terms of speed, cost, and security. A prime example is Solana’s quantum-resistant Winternitz Vaults feature.

However, CEXs still maintain a competitive edge in the derivatives trading segment—a stronghold that allows them to attract the majority of leveraged traders, a market that DEXs have yet to fully penetrate.