A trader who owns three crypto wallets, with addresses 0x76e, 0xc49, and 0xfcc, has lost a total of $2.53 million after dumping 866 million REEF tokens in a panic. Popular analytics platform Spotonchain reported the incident on social media X, revealing that the sudden price drop cost a crypto investor millions of dollars.

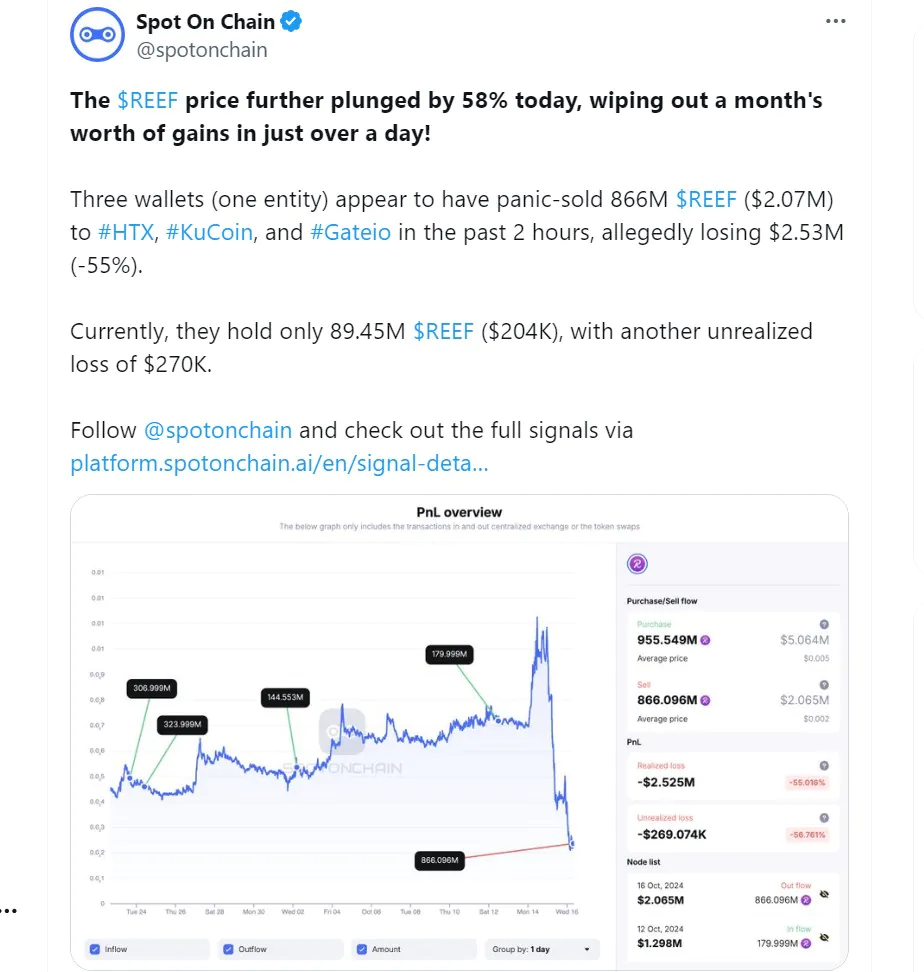

According to Spotonchain, the three crypto wallets all belong to the same person, as one of the wallets transferred 0.1 ETH to the other two. The massive loss began when the trader withdrew 955.549 million REEF tokens, worth $5.06 million, from the Gate.io exchange between September 23 and October 12, 2024. The investor purchased the token at an average price of $0.005 but was forced to sell it at $0.002 after the token’s value dropped by more than 71.8% in just 27 hours.

However, the trader only sold 866 million tokens (worth $2.07 million) on three major cryptocurrency exchanges, HTX, KuCoin, and Gate.io, resulting in a loss of $2.53 million. Notably, he still holds 89.45 million tokens (worth $204k), leaving him with an additional unrealized loss of $270k.

With this crypto trading experience, the trader lost a total of $2.8 million, including the unrealized loss.

How is REEF Token Performing?

REEF is one of the more popular altcoins, currently ranked 570th in terms of market capitalization, reaching $48.9 million, after a 6% drop in the last 24 hours. Furthermore, following this price drop, the 24-hour trading volume has dropped by 65% to $128.18 million. With the sharp decline in both metrics, it is clear that REEF is still struggling on the charts, currently valued at $0.00214, down 8% on the day and 65% on the week.

As a result, the 89.45 million tokens that traders still hold are now worth just $191k. However, REEF facing major losses is not new, as it has struggled to recover since its sharp drop shortly after its launch. In mid-March 2021, REEF reached an all-time high of $0.05841, but then fell to $0.01254 in July. Not stopping there, despite attempting to reach a new peak later that year, the token continued to collapse. Since then, the downtrend has continued, with only minor recoveries in short periods of time.